Net interest income hit P60 billion, with steady growth across all business lines.

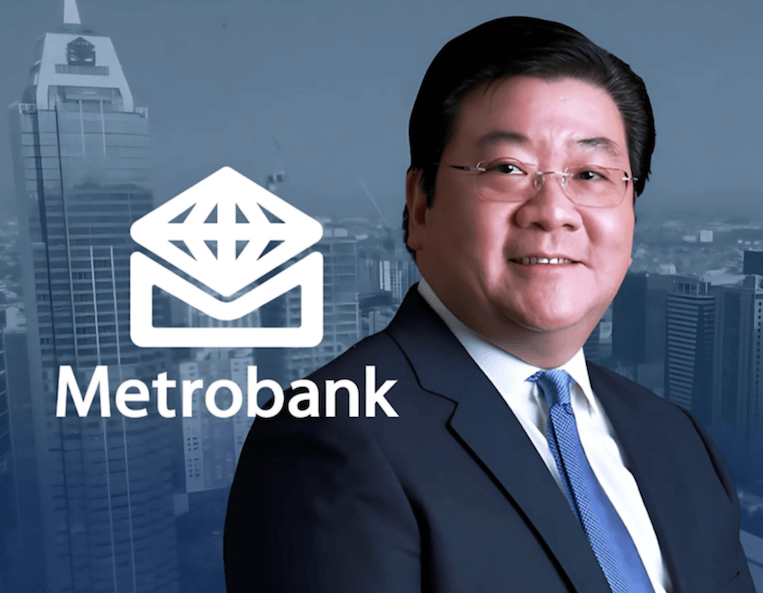

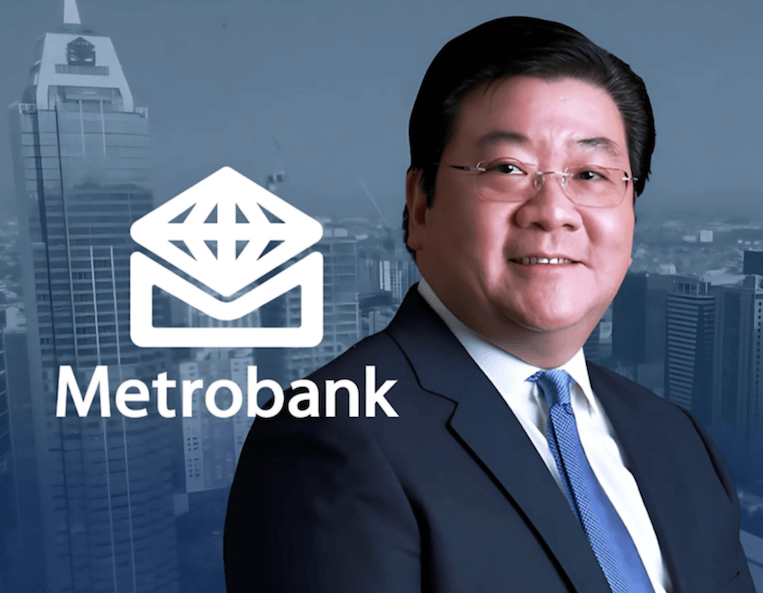

Management’s view

“Our first half performance reflects the continuing strength of our core businesses,” said Metrobank President Fabian S. Dee.

“As we enter the second half of the year, we remain focused on building on our fundamentals and implementing prudent strategies, which will allow us to continue helping our clients grow further as well as achieve our medium-term goals,” he added.

Loans, non-interest income climb

Total loans expanded by 13.2 percent, fueled by robust consumer lending, which jumped 15.3 percent, led by credit cards and auto loans.

Non-interest income surged 46.2 percent to P17.6 billion, with strong contributions from trading, foreign exchange, and fees.

Pre-provision operating profit rose 16.3 percent to P39.1 billion, showing the bank’s earnings strength before accounting for risks.

Strong buffers, better asset quality

Operating expenses rose just 5.9 percent, lowering Metrobank’s cost-to-income ratio to 50.0 percent from 52.3 percent.

Asset quality also improved, with non-performing loans (NPL) easing to 1.5 percent, well below the industry’s 3.5 percent as of May 2025. The bank set aside P5.8 billion in provisions, keeping its NPL cover at a healthy 153.9 percent.

—Edited by Miguel R. Camus