Davao-based tycoon Dennis A. Uy’s PH Resorts Group Holdings saw its shares plummet nearly 30 percent after a third prospective white knight walked away from a deal to purchase its stalled casino resort in Cebu.

PH Resorts and Japan’s Universal Entertainment, operator of Okada Manila, announced on Tuesday the termination of investment discussions, casting uncertainty over the project’s future.

After a brief trading halt, shares of the company fell over 29 percent before a modest rebound to P0.58 per share, finishing with a decline of 19.44 percent from the previous session.

3rd buyer to walk away

PH Resorts and Universal did not provide any reason; with the latter stating it was unable to share details due to confidentiality provisions.

A source told InsiderPH talks collapsed due to a disagreement over the selling price of the project.

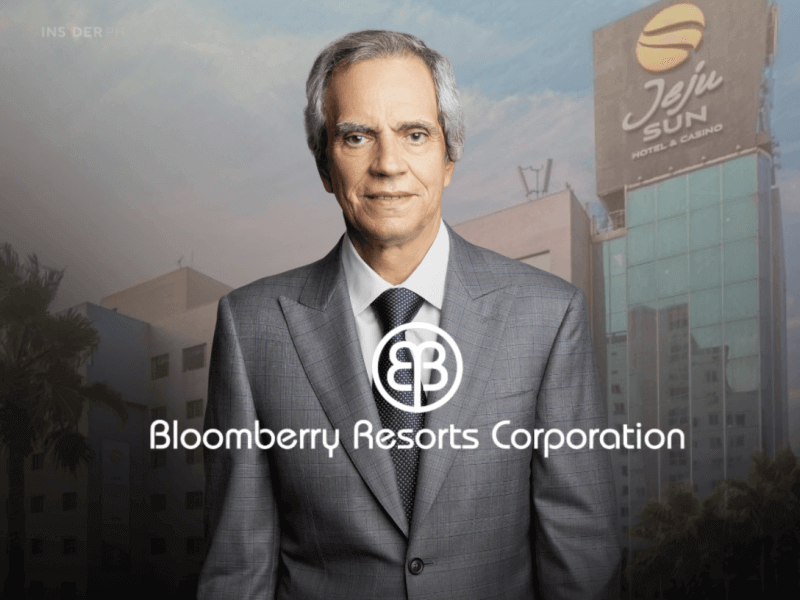

Previous negotiations with tycoon Enrique Razon Jr. and Cebu’s AppleOne Group also fell through.

Earlier denial of InsiderPH report

This publication’s Insider Info column was the first to report the Okada Group’s potential exit from the deal due to a disagreement on the terms despite making a non-refundable down payment of P327 million.

PH Resorts denied the report last June 24, saying the parties were still working to complete the transaction by July this year.

The company earlier sold the Emerald Bay project land to Chinabank to settle debts to the Sy-led China Banking Corp.

It still has rights over the project after entering into a leaseback deal with Chinabank.

Miguel R. Camus has been a reporter covering various domestic business topics since 2009.