The debt-ridden firm has been in talks with construction firm EEI Corp., owned by the Yuchengcos and the family of House Speaker Martin Romualdez, for potential entry into the $300 million casino project, but a final deal has yet to be signed.

Faced with the prospect of losing the land, it revealed another option: buying back the land from China Bank.

“As of April 30, 2025, the group and EEI have ongoing discussions to determine and finalize the terms of the agreements,” PHR said in its latest annual report.

“As of the same date, the group is also working on a possible repurchase option following its expiration on March 31, 2025,” it added.

A deal insider noted, however, that even the land repurchase option had expired. This means PHR can still reacquire the land but it would have to do so facing other possible bidders in a competitive challenge.

What happened before?

In October 2023, Dennis Uy’s PHR restructured a P3.1-billion loan with China Bank by selling and leasing back its Mactan land. This allowed it to secure a critical lifeline while it finds a new investor for the casino project.

As part of that deal, PHR also secured an option to repurchase the land once its finances stabilize.

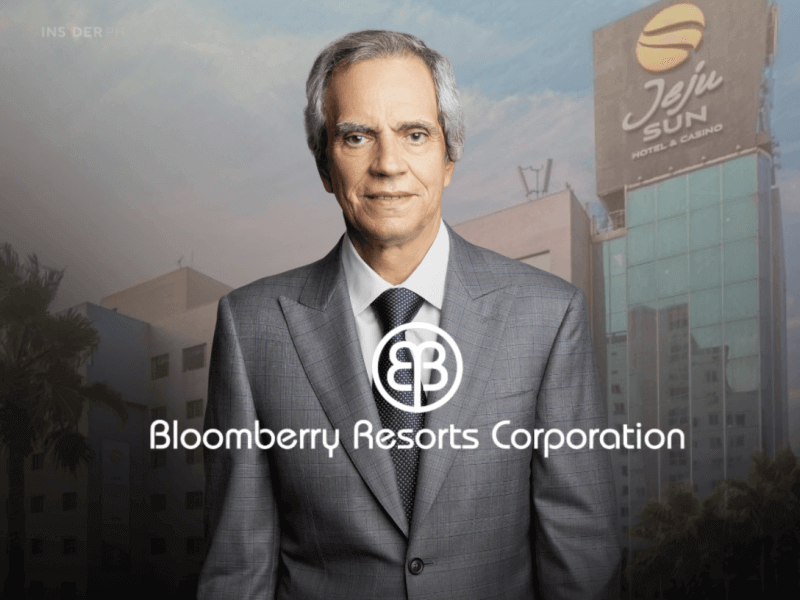

At the time, it was in talks with Cebu-based AppleOne Properties for a potential investment, after tycoon Enrique Razon Jr.'s Bloomberry pulled out earlier that year.

Those deals did not materialize, and later discussions with the Okada Group also fell through.

Dennis Uy gets P300-M advances from EEI

PHR has been in negotiations with EEI since last December.

During this period, Uy’s group received P300 million in advances, which were then used by the firm to pay interest and lease fees to Chinabank.

Does receiving these advances mean an EEI deal is likely?

It’s a strong show of interest backed by money, but it still doesn’t guarantee a deal.

During its talks with Okada, they gave a nonrefundable down payment of P327 million to PH Resorts. Still, the casino group walked away after further studying the project.

Bloomberry also gave a P1 billion deposit, which was refundable and has yet to be fully returned by PHR.

Why PHR needs a white knight

The company recorded a net loss of P1.8 billion, which was a substantial improvement from the previous year’s loss of P4.2 billion after a significant cut in debt payments, operating costs and a tax benefit, its latest financial report showed.

Interest payments still took a heavy toll at P870.8 million in 2024 or more than five times PHR’s revenue of P38.3 million.

Cash assets plunged to P18.76 million in 2024, down over 88 percent from about P165 million in 2023.

Miguel R. Camus has been a reporter covering various domestic business topics since 2009.