PH Resorts had already lost control of the 12.4-hectare Mactan Island property in Cebu, which was the site of the stalled Emerald Bay casino project, when it failed to repurchase the land from creditor China Banking Corp. by the deadline last March.

Earlier this week, the state-run Philippine Amusement and Gaming Corp. had formally canceled its provisional license to operate a casino at the site.

EEI, one of the country’s largest contractors, entered into investment talks with PH Resorts in December last year as part of its diversification into real estate development.

What EEI is saying

In a statement to InsiderPH on Friday, EEI said it had “initiated the refund process for the P300 million advance in accordance with the relevant agreement”.

“No target timeline yet but we are hoping to close it early next year,” it added.

In January this year, EEI paid the P300 million advance to Uy’s Udenna Group.

The funds were then channeled to LapuLapu Leisure Inc., the PH Resorts subsidiary responsible for developing the Emerald Bay project.

Fourth white knight walks away

EEI, whose major shareholders include the Yuchengco family, was the latest in a series of white knights looking to invest in the Emerald Bay project.

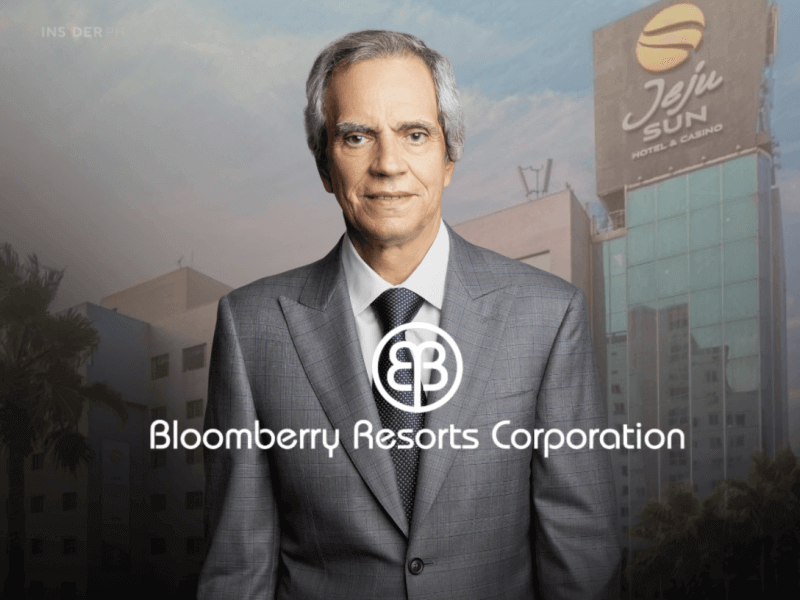

Before this, PH Resorts was in talks with billionaire Enrique Razon Jr.’s Bloomberry Resorts Corp., the Manigsaca family’s AppleOne Properties, and the Okada Group behind the Okada Manila integrated resort.

Razon advanced P1 billion to PH Resorts and was paid back last July—nearly three years after the deal fell through.

The Okada Group also paid P327.6 million to PH Resorts, although this amount was not refundable, meaning the company kept the cash.

Can PH Resorts pay back EEI?

Based on its latest financial results, the firm lacks the resources to pay back EEI without asset sales or financial support from Uy.

The firm posted a net loss of about P6.9 billion in the first nine months of 2025, while available cash stood at about P5.9 million.

Debt pressures remain heavy, with interest expenses of around P324.9 million, although this is significantly lower than debt payments of about P605 million during the same period in 2024.

PH Resorts has other assets

The company also owns and operates the Donatela Resort & Sanctuary, a boutique-style, upscale hotel in Tawala, Panglao Island, Bohol.

However, the property is linked to a Landbank loan worth P1.45 billion with interest. PH Resorts said there are ongoing talks with AppleOne to help restructure the repayment of the debt.

Another PH Resorts subsidiary owns over 3,000 square meters in Azuela Cove in Davao, a major masterplanned community being developed by Ayala Land and the Alcantara family.

Miguel R. Camus has been a reporter covering various domestic business topics since 2009.