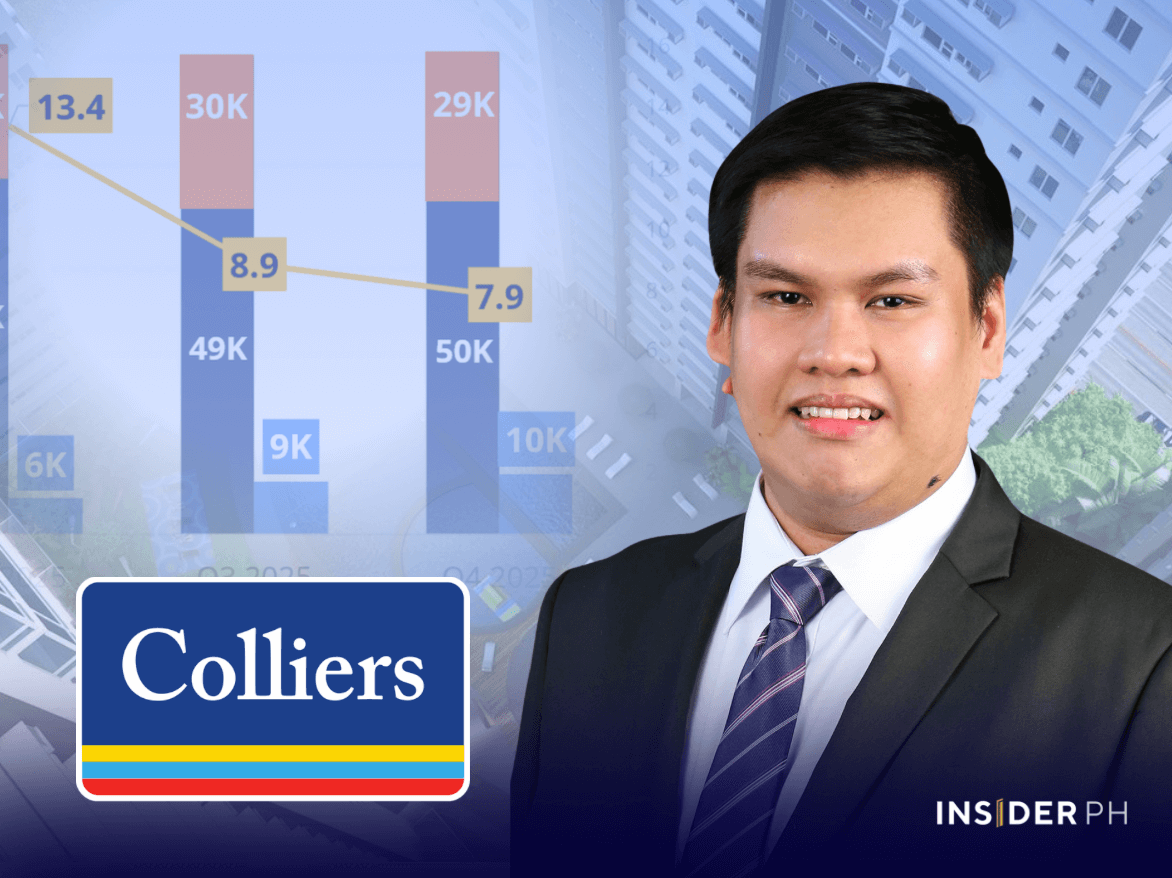

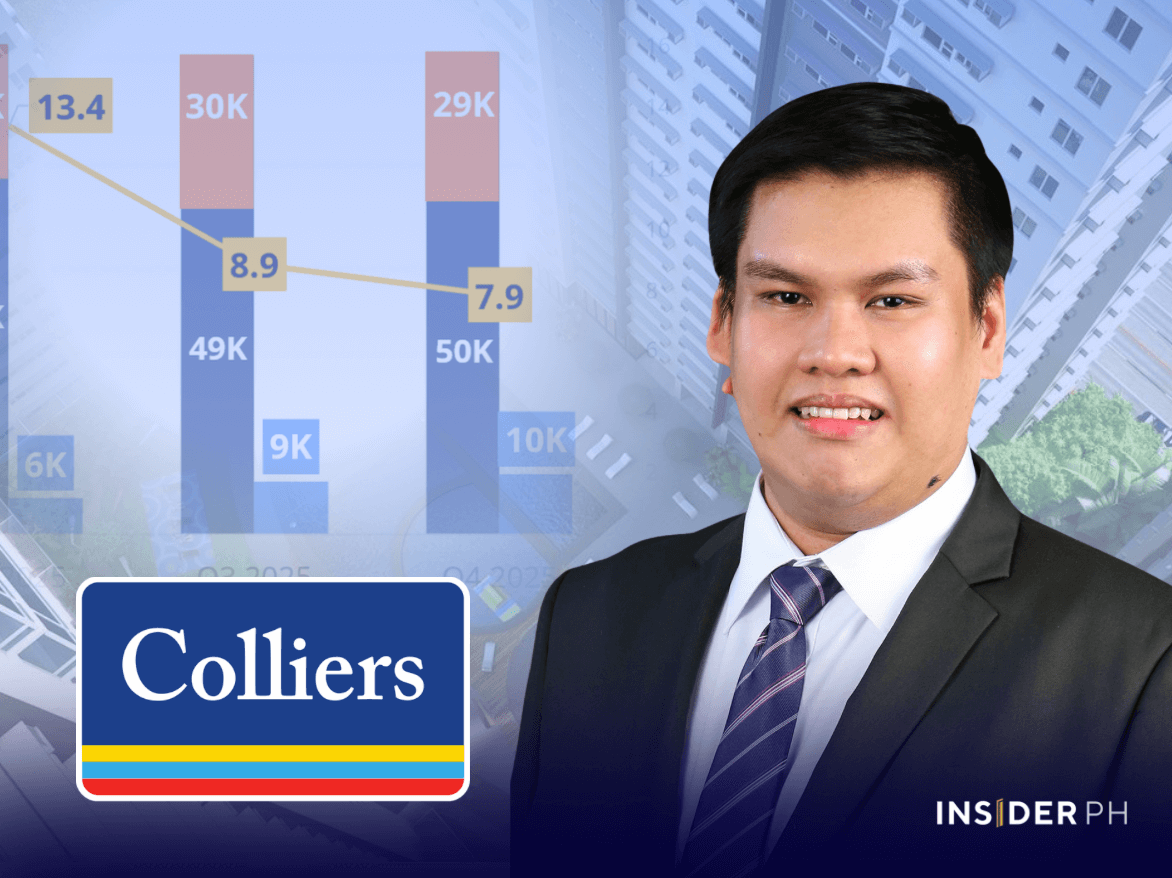

After hitting 13.4 years of inventory life in the second quarter of 2025, unsold inventory eased to 7.9 years in the fourth quarter of 2025, marking a second straight quarterly decline, the property consultancy group said in its recent year-end report.

During this same period, take-up rose from a low of 6,000 units to 10,000 units, a significant improvement, although still about half of the levels seen in early 2024.

Even at 7.9 years, supply pressures continue to weigh on the market.

Data from Colliers Philippines also showed that Quezon City, Manila, Pasay–Parañaque, and Pasig together still account for the bulk of ready-for-occupancy (RFO) stock, reflecting slower absorption in these outer-core districts.

At the same time, pre-selling supply remains concentrated in growth areas like Taguig and Pasay, where developers are still launching projects despite softer overall sales conditions.

By location, districts such as Quezon City, Manila, Pasay–Parañaque, and Pasig continue to carry the bulk of unsold RFO units.

In contrast, Makati Central Business District and Rockwell remain tight markets with very little unsold stock, but prices above P300,000 per square meter keep transaction volumes thin, according to Colliers Philippines.

—Edited by Miguel R. Camus