The 12.4-hectare beachfront site—valued at P13.65 billion, including improvements and the unfinished hotel and casino structure—was removed from the company’s books after the buyback option expired last Mach 31, its latest financial report showed.

The $300-million Emerald Bay on Mactan Island, Cebu was once Uy’s most ambitious gaming project.

Losses surge 1,260%

PH Resorts reported a 1,260 percent surge in net loss to P6.7 billion during the first six months of 2025, mainly due to the accounting hit it took after losing control of its Cebu casino site.

During this period, net operating revenues also dropped 12.7 percent to P17.4 million from P19.9 million.

PH Resorts, which operates the boutique Donatela Resort & Sanctuary in Panglao, Bohol, ended the first half with a capital deficiency of P5.83 billion.

PH Resorts drops repurchase plan?

In 2023, Chinabank took over the property under a financial restructuring agreement that allowed PH Resorts to settle mounting peso loans and interest.

PH Resorts continued to lease the site while retaining the option to repurchase it for P5.74 billion. That option expired on March 31, 2025, and after failing to secure a strategic investor, PH Resorts did not proceed with the buyback.

In earlier filings, PH Resorts suggested it was still in talks to reacquire the property, but its second-quarter 2025 report dropped any mention of a repurchase plan.

The expiration of the buyback option triggered the derecognition of P13.65 billion in assets and P8.6 billion in related liabilities and transaction costs from the company’s balance sheet.

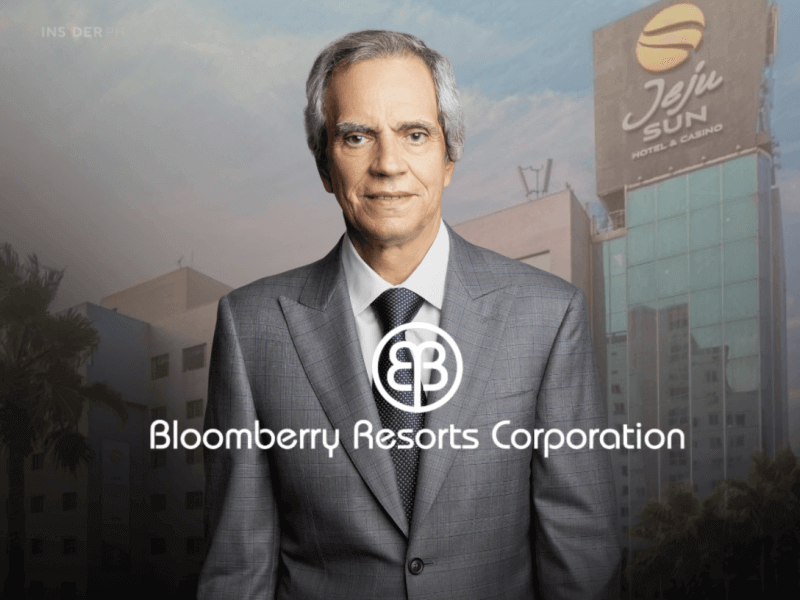

Sy wants to sell

In an interview with reporters last May, Chinabank chair and business tycoon Hans Sy said Uy’s PH Resorts Group Holdings (PHR) was given enough time to reacquire the prime beachfront property, located minutes from the Mactan-Cebu International Airport.

“We always do things with a heart. We gave him [Dennis Uy] a chance,” Sy told reporters.

“It’s expired and we’re not renewing anymore,” Sy added.

What’s next?

With its most valuable asset beyond reach, PH Resorts is under pressure to overhaul its business strategy.

Eyes are now on updates from Yuchengco-backed contractor EEI Corp., seen as a potential white knight after it advanced P300 million to parent firm Udenna in January 2025 for the casino property.

Meanwhile, the company’s shares shed 1.56 percent to P0.189 each, valuing the company at about P1.4 billion.

Miguel R. Camus has been a reporter covering various domestic business topics since 2009.