AUB’s net income rose 12 percent to P12.7 billion, driven mainly by a larger commercial lending portfolio as total loans expanded 13 percent to P276 billion.

The stronger loan base lifted net interest income 10 percent to P18.4 billion, underscoring lending as the bank’s primary earnings engine.

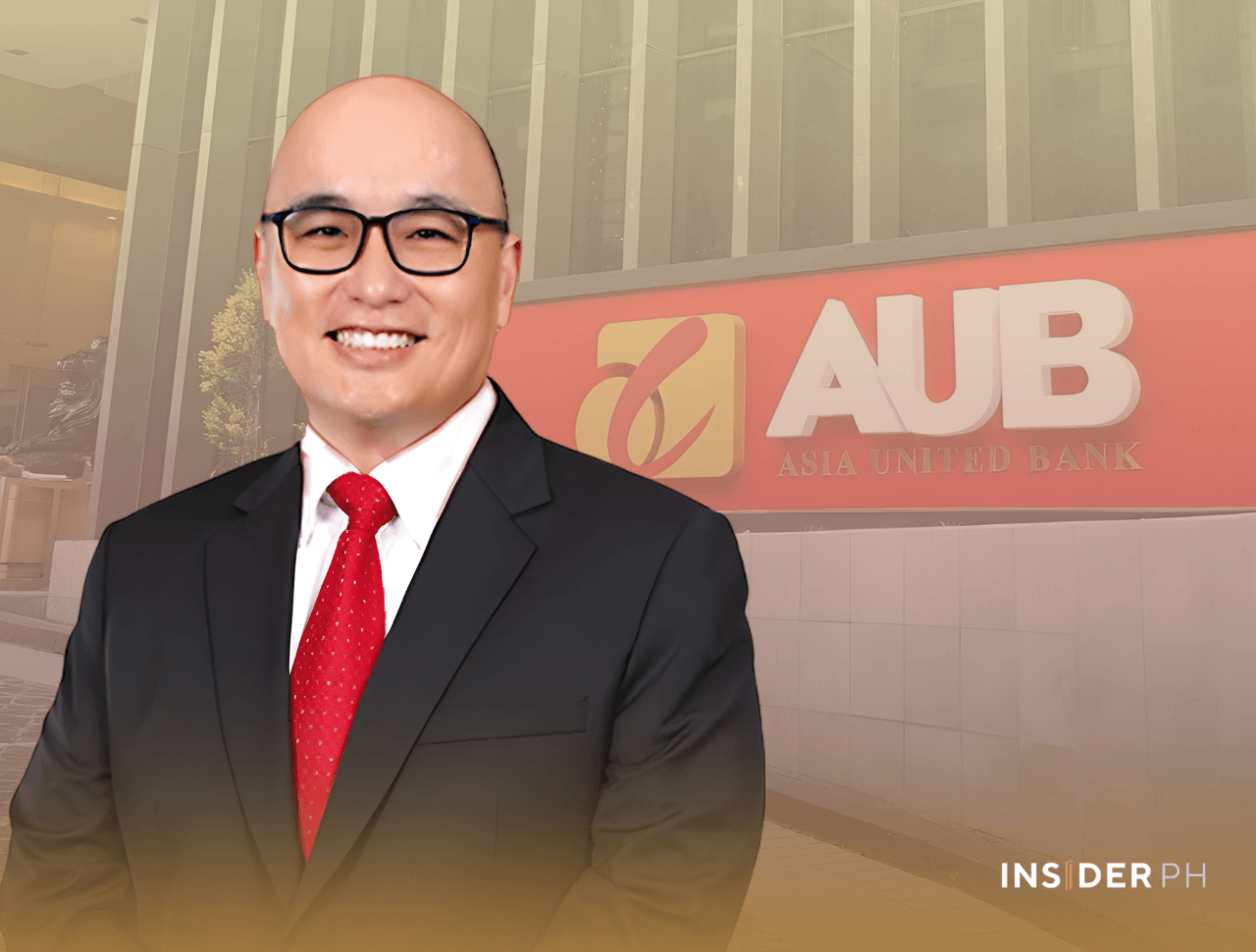

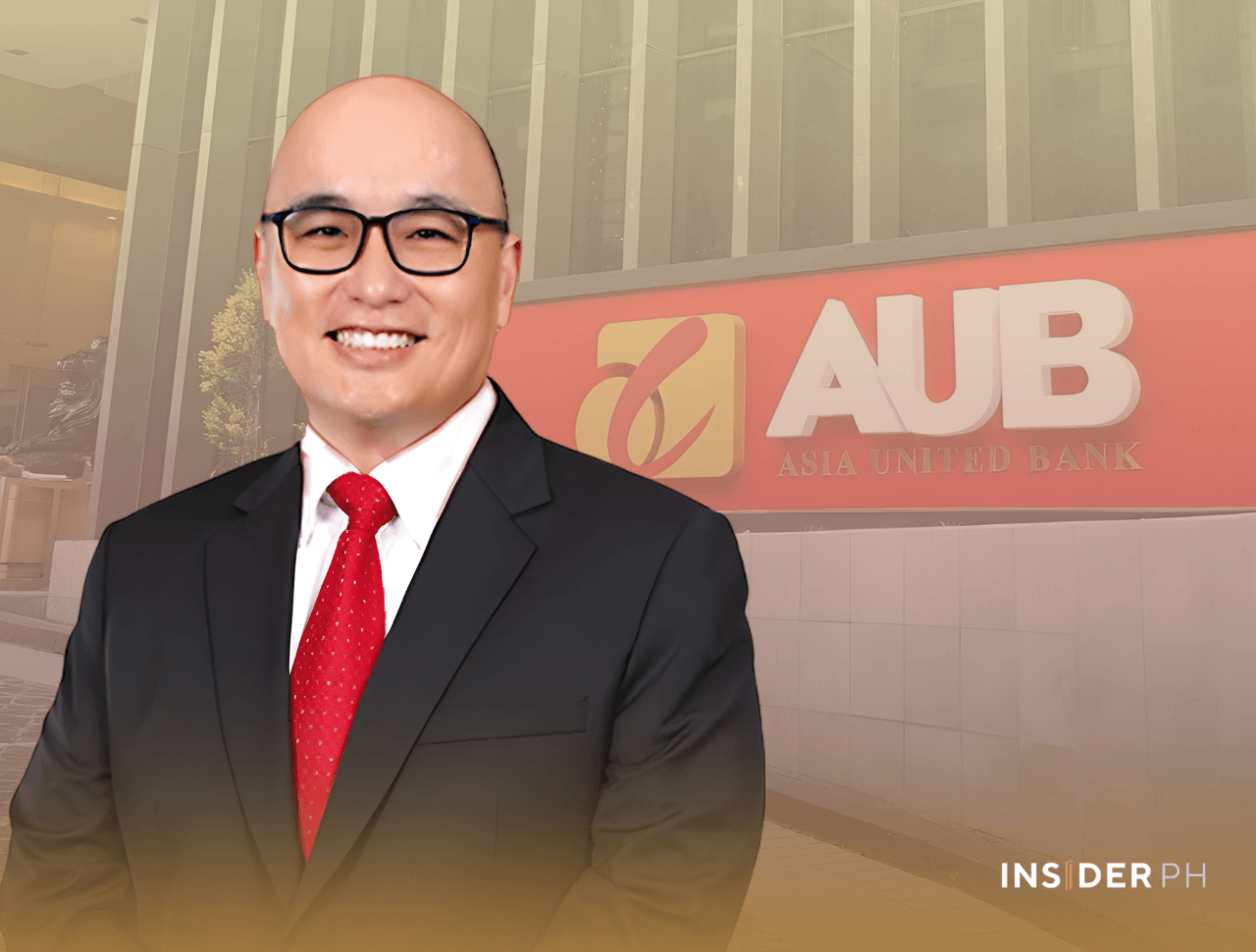

Management’s view

“Even as we continue to post record growth, we remain cautiously optimistic as the entire banking industry faces more intense competition from fintechs, AI adoption, and more complex cyber threats,” said Manuel A. Gomez, president of AUB.

“In addition, there are still mounting cost pressures and continuing geopolitical instability. However, growth opportunities abound for AUB, particularly in digital partnerships. It is through this that we can stay ahead of the curve by revolutionizing cross-border digital payment solutions through our HelloMoney, among others,” he added.

Commercial lending drives record profit

A 25 percent surge in low-cost current and savings account deposits to P279 billion kept margins steady at 4.8 percent despite funding pressures, while return on equity held at 20 percent and return on assets at 3.1 percent.

Asset quality remained strong with a 0.38 percent non-performing loans ratio and 115 percent coverage, allowing earnings to scale without credit strain.

Total assets grew 13 percent to P435 billion with capital ratios well above regulatory minimums, supporting continued balance sheet expansion.

With lending still driving earnings, AUB is widening HelloMoney’s acceptance to nearly 60 markets including mainland China, extending its reach in cross-border digital payments.

—Edited by Miguel R. Camus