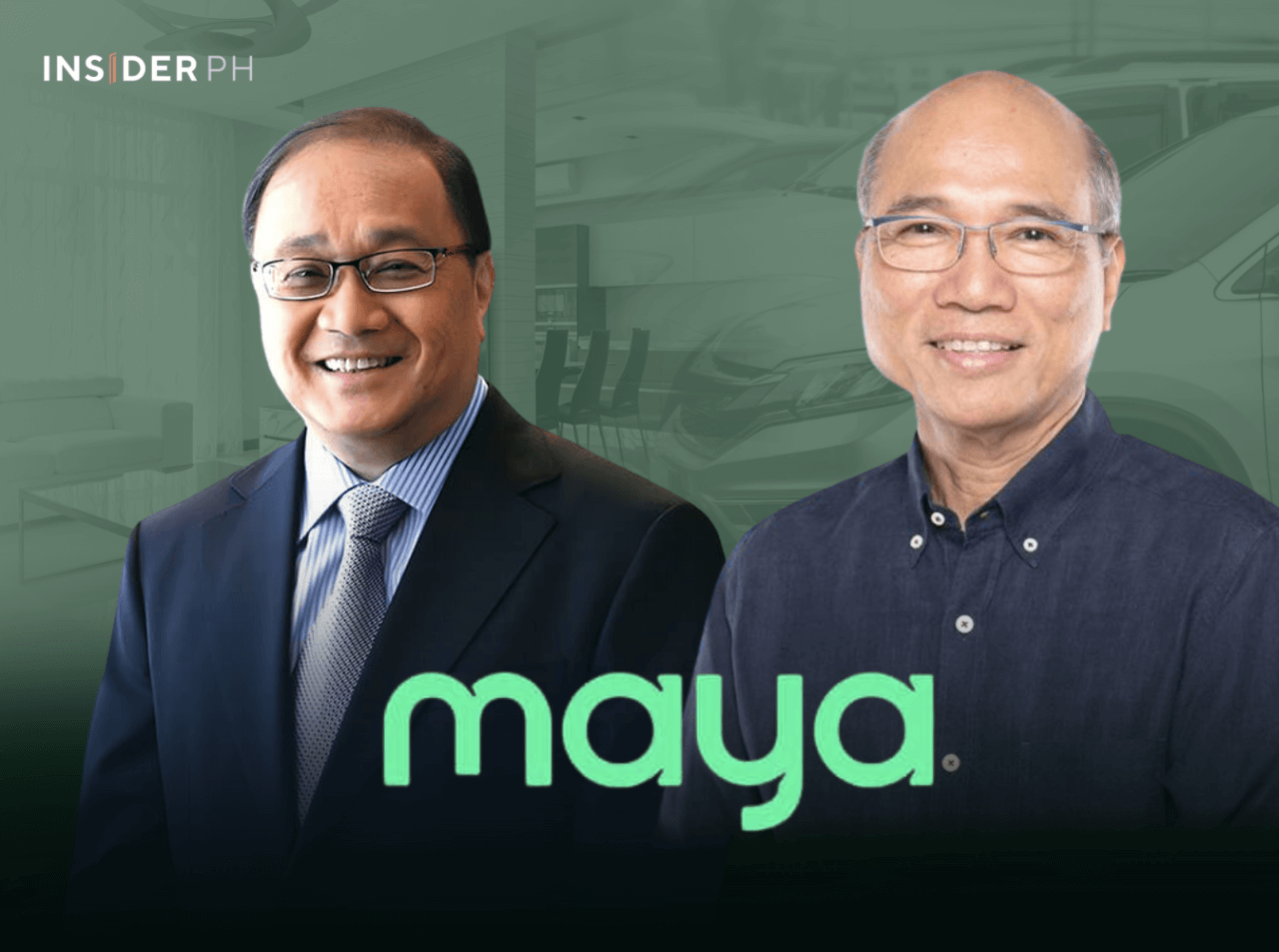

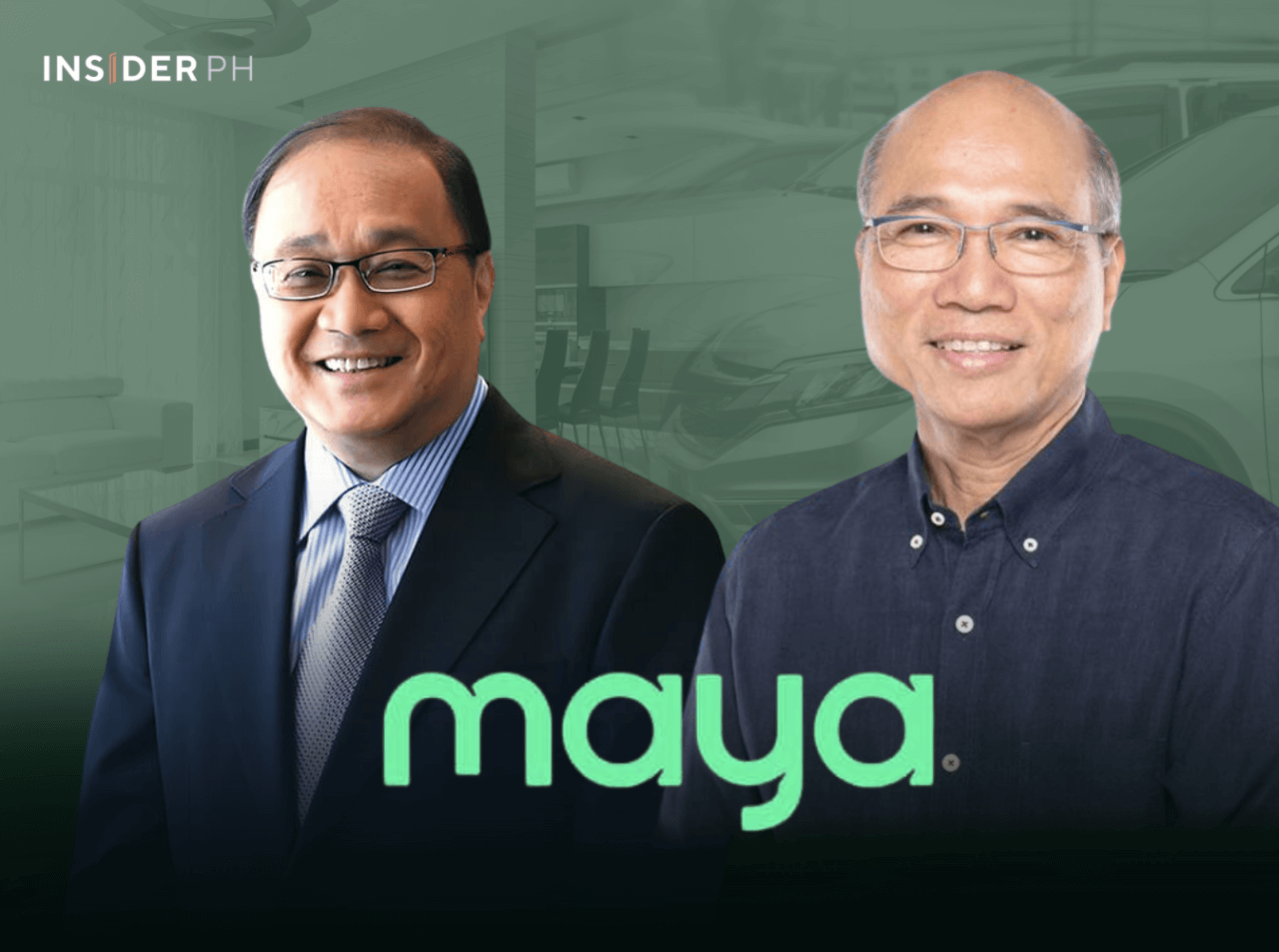

Maya, which combines a payments wallet and a digital bank, is launching new products to sustain its growth momentum after achieving its first profitable year in 2025.

New products were discussed in a recent investor presentation by the First Pacific Group, which controls about 38 percent of the fintech firm.

Apart from consumer loans, Maya is lining up earned wage access or salary loans, which lets workers access a portion of pay they have already earned before payday.

Fractional shares, linked accounts

It also plans to add insurance, bonds, and fractional investing for buying stocks.

Maya, which also offers loans to small business owners, is rolling out supply chain financing, opening up yet another growth segment.

It will also roll out linked accounts for bank clients, improving access and convenience.

Growth mandate for 2026

Orlando Vea, who founded Maya over a decade ago, said the company is confident about growing this year.

“It’s still loans [driving] the growth,” he said in a recent interview.

Maya Bank had outstanding loans of P27 billion last September—a nearly 59 percent increase from the end of 2024. Loan deposits hit P56.7 billion during this period, up 44 percent.

The digital lender also recorded a robust net interest margin of 18.9 percent in September 2025 vs 13.9 percent in 2024.

In the first nine months of 2025, the firm booked a profit of P1.6 billion.

IPO plans?

With Maya turning profitable, the firm might also revive plans to go public to tap public markets for ramp-up expansion.

Vea said there was no timetable for a public lisitng but they stand ready should the opportunity arise.

“We’re push button ready,” he said.

Miguel R. Camus has been a reporter covering various domestic business topics since 2009.