Insider Spotlight

The surge highlights a broader reallocation of wealth among high-net-worth Filipinos, who are favoring fixed-income style deposit products amid market volatility and heightened focus on capital preservation.

The big picture

The bank said about 85 percent of its depositors are affluent clients placing funds in time deposits, highlighting how structured deposit products have become the preferred choice for wealthier savers seeking certainty over riskier investments.

Salmon Bank attributed much of the momentum to its “Bank on Eight” promotional offering, which provides an 8-percent interest rate per annum for time deposit placements of at least P1 million, with tenors ranging from one to five years. The promo runs from Dec. 1, 2025 until June 1, 2026, positioning it among the most competitive deposit rates in the Philippine market.

What they’re saying

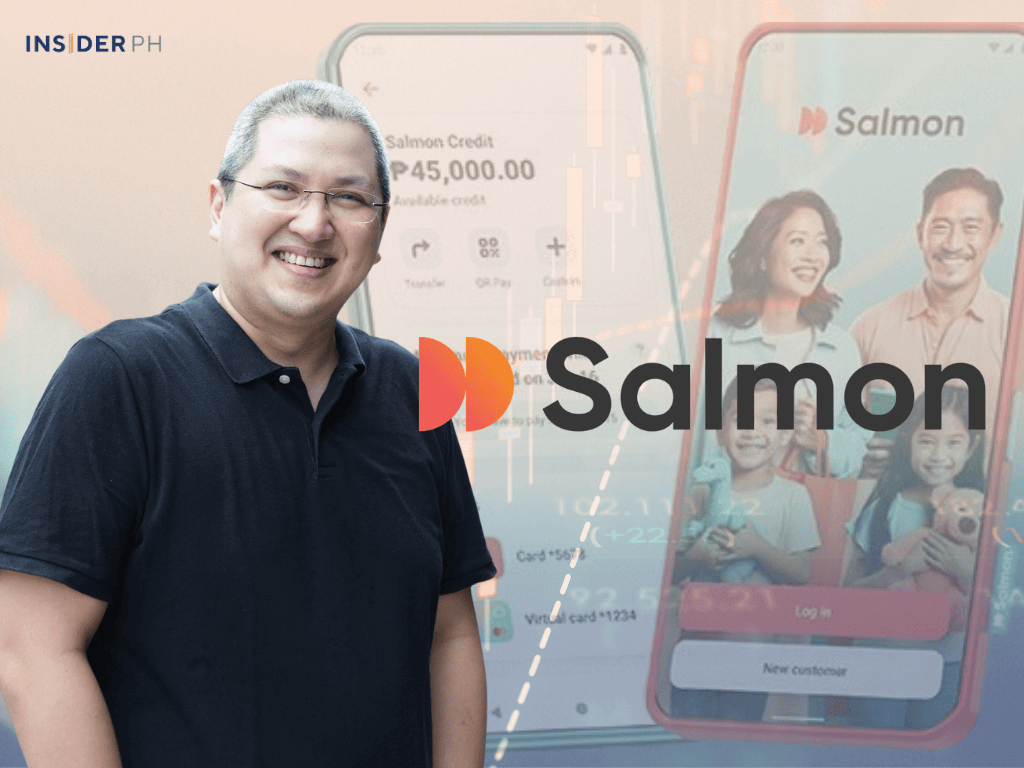

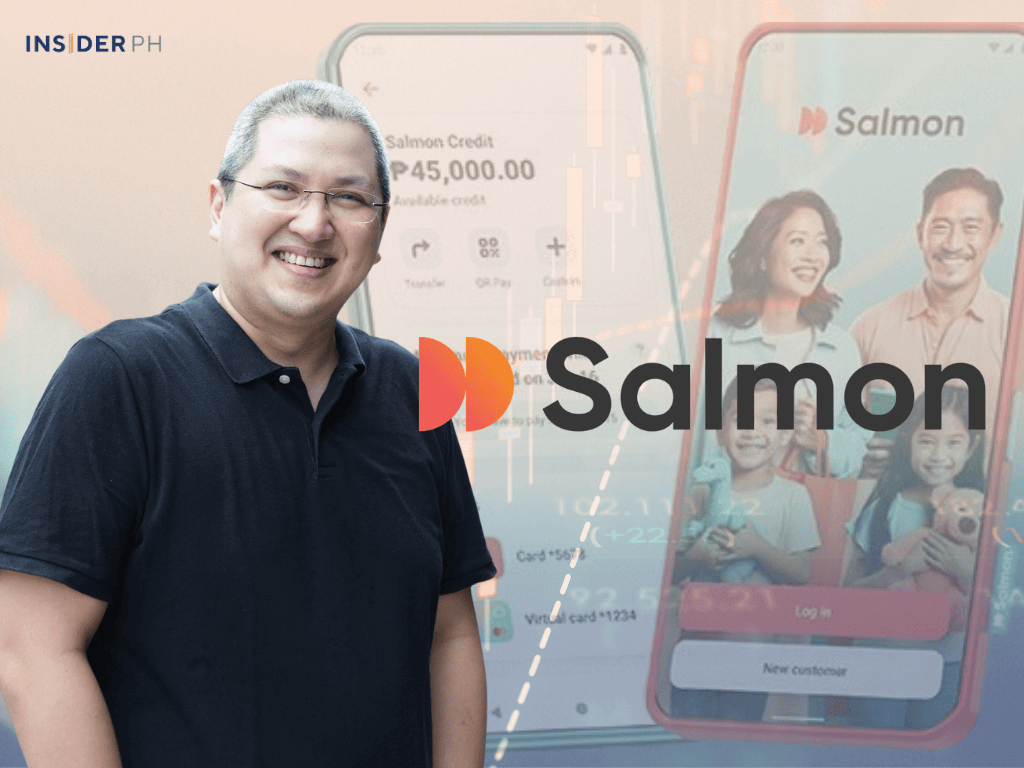

“The recent growth in our deposit client base highlights the rising interest among affluent Filipinos toward time deposits. With competitive rates like ours, they now serve as an attractive way to grow one’s wealth,” Raffy Montemayor, co-founder of Salmon and chair of Salmon Bank (Rural Bank), said in a press statement.

“The response to our ‘Bank on Eight’ offer, in particular, shows that clients now highly value products that combine strong returns with predictability and security,” he added.

Zoom in

Beyond high-value placements, Salmon Bank also offers interest rates of up to 6 percent per annum for deposits below P1 million, broadening its appeal to mass-affluent clients who are beginning to explore higher-yield savings options.

Accounts can be opened digitally via the Salmon App, available on Google Play Store and Apple App Store, or through the bank’s physical branch in Bacoor, Cavite, reflecting a hybrid strategy that blends digital convenience with branch-based trust.

By the numbers

Deposits are insured by the Philippine Deposit Insurance Corp. up to P1 million per depositor, while the bank operates under the regulation of the Bangko Sentral ng Pilipinas.

What’s next

With backing from global investors including the International Finance Corp. and Abu Dhabi sovereign wealth fund ADQ/Lunate, Salmon Group is positioning its rural bank arm to capture a larger share of the country’s growing affluent and mass-affluent deposit market as competition for high-yield savings intensifies. —Vanessa Hidalgo | Ed: Corrie S. Narisma