Revenues rose 16 percent year-on-year to P37.3 billion, fueled by an 18 percent increase in net interest income to P29.7 billion, while return on equity stood at 11.6 percent.

Management’s view

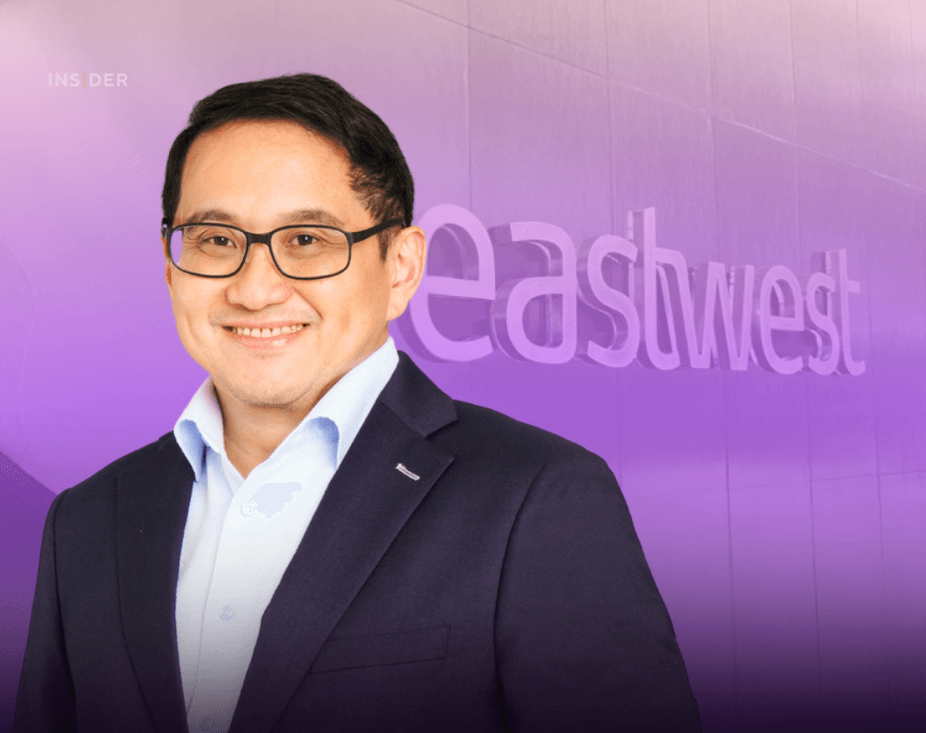

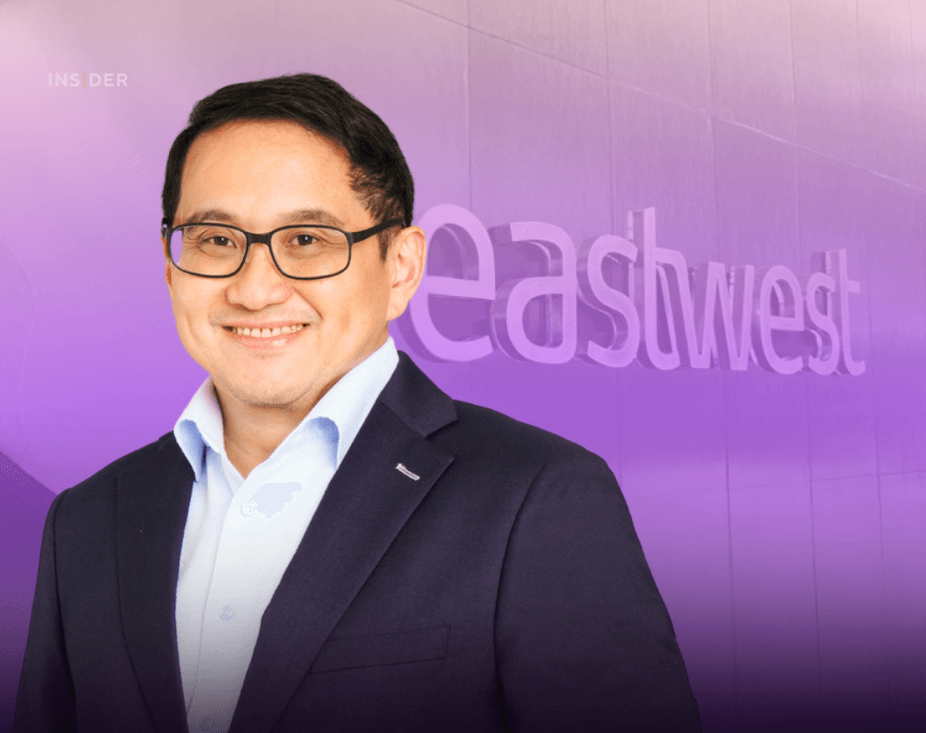

“Our core consumer banking business is thriving, aligning perfectly with the evolving needs of our customers. Our strategic funding initiatives are likewise effectively supporting our growth plans and fortifying our funding structure,” said EastWest CEO Jerry G. Ngo.

“These critical components have significantly contributed to our steady revenue generation. At the same time, we continue to manage risks actively and ensure that provisions are adequate. Combined with our operational efficiencies, these have resulted in robust and sustainable profitability,” he added.

What’s driving the numbers?

• Consumer loans rose 17 percent and now account for 85 percent of EastWest’s total loan portfolio.

• Fee income jumped 27 percent to P5.3 billion, highlighting strong non-interest revenue growth.

• Operating expenses increased just 7 percent to P19.2 billion, improving efficiency and cost-to-income ratio to 51.4 percent.

• Total assets grew 11 percent to P552.9 billion, driven by a 12 percent rise in deposits to P415.8 billion.

• Priority banking assets under management surpassed P100 billion, underscoring expanding wealth operations.

Strong balance sheet

Capital ratios remained well above regulatory standards, with a capital adequacy ratio of 13.6 percent and a common equity tier 1 ratio of 12.7 percent, positioning EastWest for further growth.

On the digital front, EastWest launched new EasyWay features for personal loan and credit card applications, digital CASA opening for peso and foreign currency accounts, and InstaPay QR transfers.

It also rolled out the EastWest BizAccess Visa Debit Card for SMEs to simplify cash management.

—Edited by Miguel R. Camus