The bank’s return on equity held firm at 20.4 percent, underscoring its ability to generate solid shareholder value even as expenses rose.

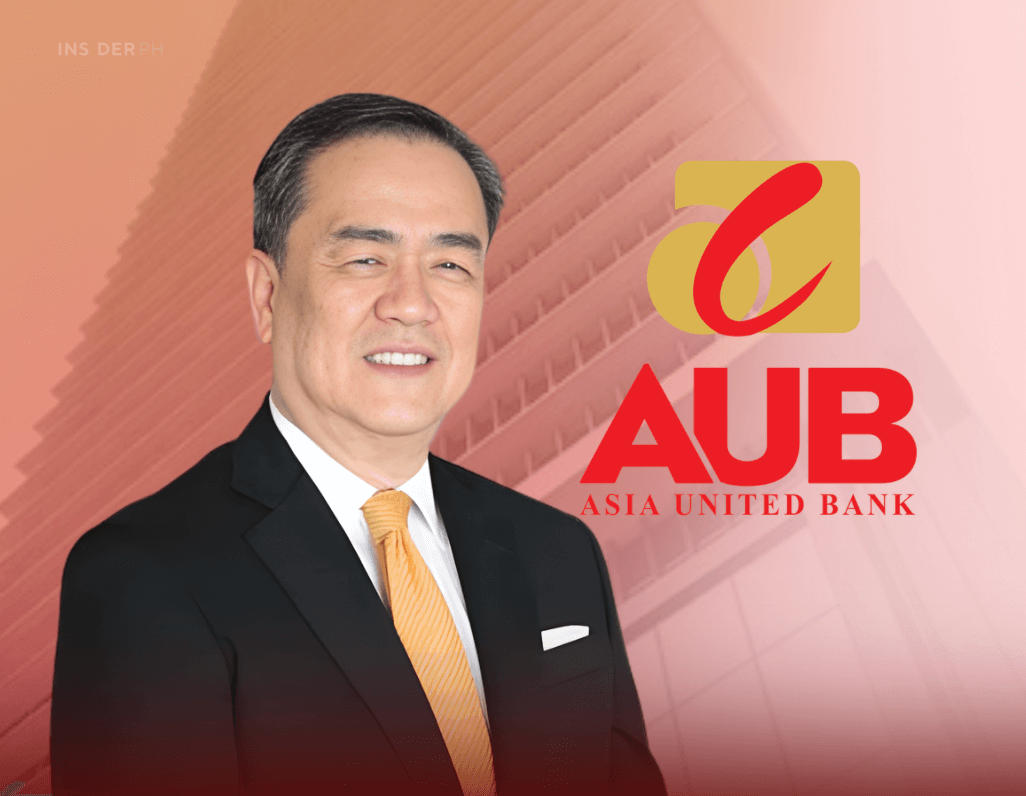

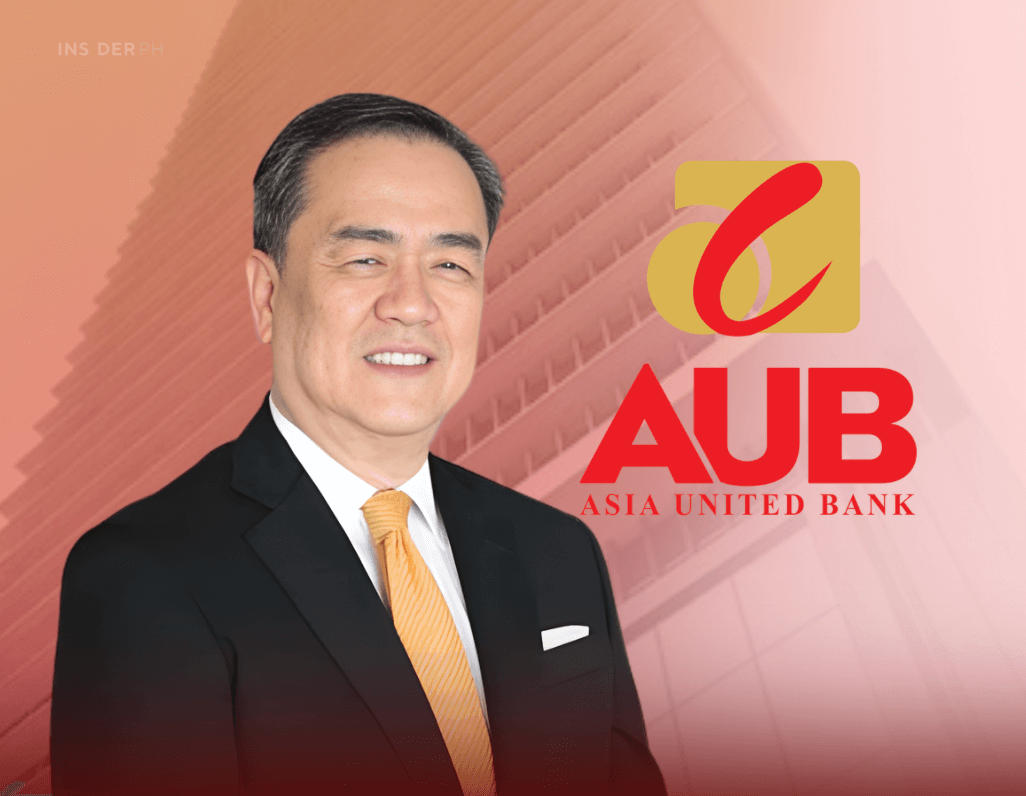

Management’s view

“Sustaining our profitability is no mean feat, considering the heightened risks in our operating environment, both domestically and globally. But we managed to post double-digit growth rates in our core businesses,” said AUB president Manuel Gomez.

Nearly 30 percent jump in loans

Operating income jumped 10 percent to P17.2 billion on the back of rising loan volumes and higher fee-based earnings from AUB PayMate, HelloMoney, and credit cards.

Non-interest income surged 18 percent to P3.7 billion, fueled by stronger trading and foreign exchange gains, while its cost-to-income ratio stayed low at 32.2 percent.

The bank’s loan portfolio grew 29 percent year-on-year to P256.9 billion, while deposits rose 19 percent to P336.2 billion, supported by a robust 78 percent share of low-cost current and savings accounts.

Conservation provisioning policy

Non-performing loans dropped to 0.36 percent from 0.53 percent, even as provisions rose 141 percent to back rapid lending growth.

With total assets up 19 percent to P417.1 billion, AUB remains well-capitalized with a Common Equity Tier 1 ratio of 18.75 percent and a capital adequacy ratio of 19.5 percent.

Gomez said the lender is eyeing more digital partnerships to “offer payment solutions such as AUB PayMate and revolutionize cross-border transactions through HelloMoney.”

—Edited by Miguel R. Camus