The deal is part of the company’s $3 billion Euro Medium-Term Note program that was established last year with parent SM Investments Corp.

The notes carry a 4.75 percent coupon, the lowest for a Philippine issuer since Sept. 2020.

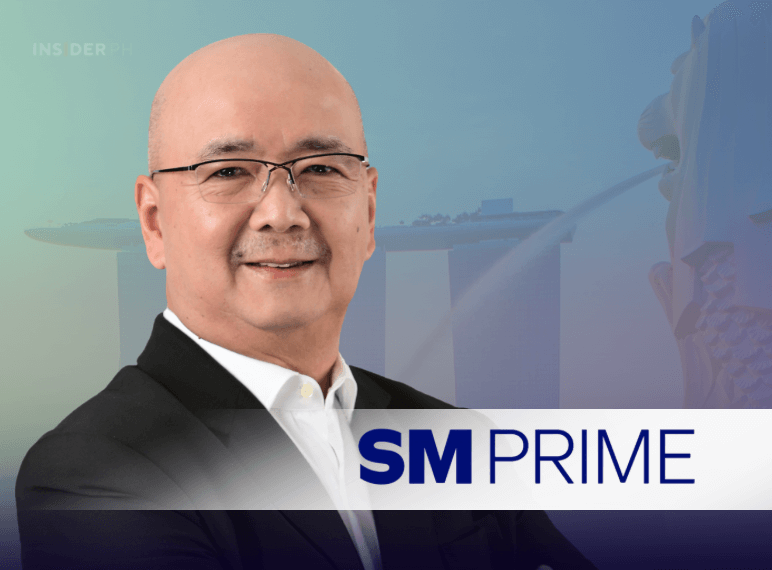

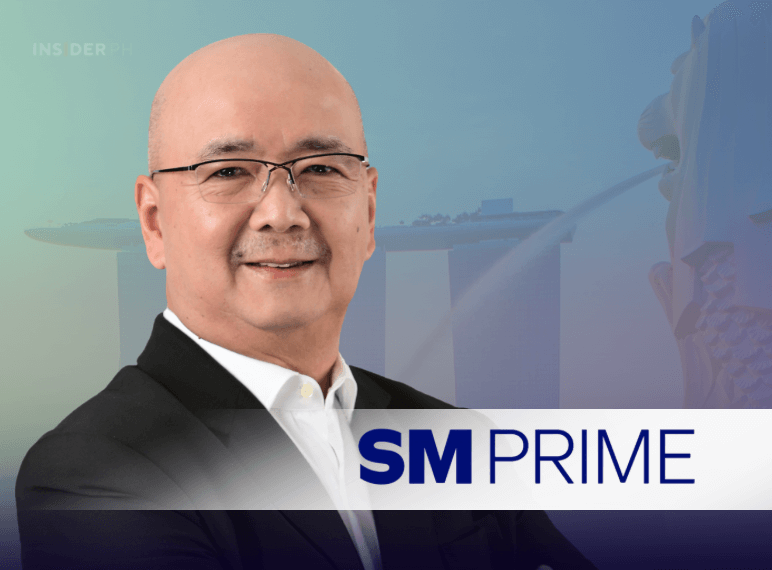

Management’s view

“Through this latest drawdown, we are able to tap the market at an opportune time to support our future projects and strategic initiatives,” said Jeffrey C. Lim, president of SM Prime.

“The continued interest from global investors underscores their sustained confidence in our long-term growth prospects,” he added.

Major banks support offer

The bonds were issued through SM Prime’s wholly owned unit SMPHI SG Holdings Pte. Ltd. and are guaranteed by the parent.

HSBC, J.P. Morgan, Standard Chartered Bank, and UBS acted as joint lead managers and bookrunners, with BDO Capital and Chinabank Capital as joint domestic managers.

By geography, 91 percent of the bonds went to Asia and 9 percent to Europe, the Middle East and Africa, while by investor type, 80 percent were taken up by fund managers, 12 percent by banks, 4 percent by private banks, 3 percent by financial institutions, and 1 percent by insurers.

CFO: Funds to sustain growth

SM Prime said the net proceeds from the issue will be allocated for general corporate purposes.

“SM Prime posted record revenues of PHP140 billion in 2024, and we aim to build on this momentum,” said SM Prime chief finance officer John Nai Peng C. Ong.

“This issuance will support our commitment to sustainable growth and continued contribution to the nation’s progress,” he added.

Together with the $500 million tapped by SM Investments last year, the offshore debt program's balance now stands at $2.15 billion.

—Edited by Miguel R. Camus