Revenues jumped 23 percent year-on-year to P31.6 billion, while net interest income rose 12 percent to P24.3 billion, pushing the net interest margin to 4.56 percent.

Non-interest income surged 81 percent to P7.2 billion, boosted by trading gains and recurring fees. Adjusted for a one-time bancassurance fee in 2024, core fee income rose 23 percent. Expenses climbed 25 percent as the bank invested in technology and manpower.

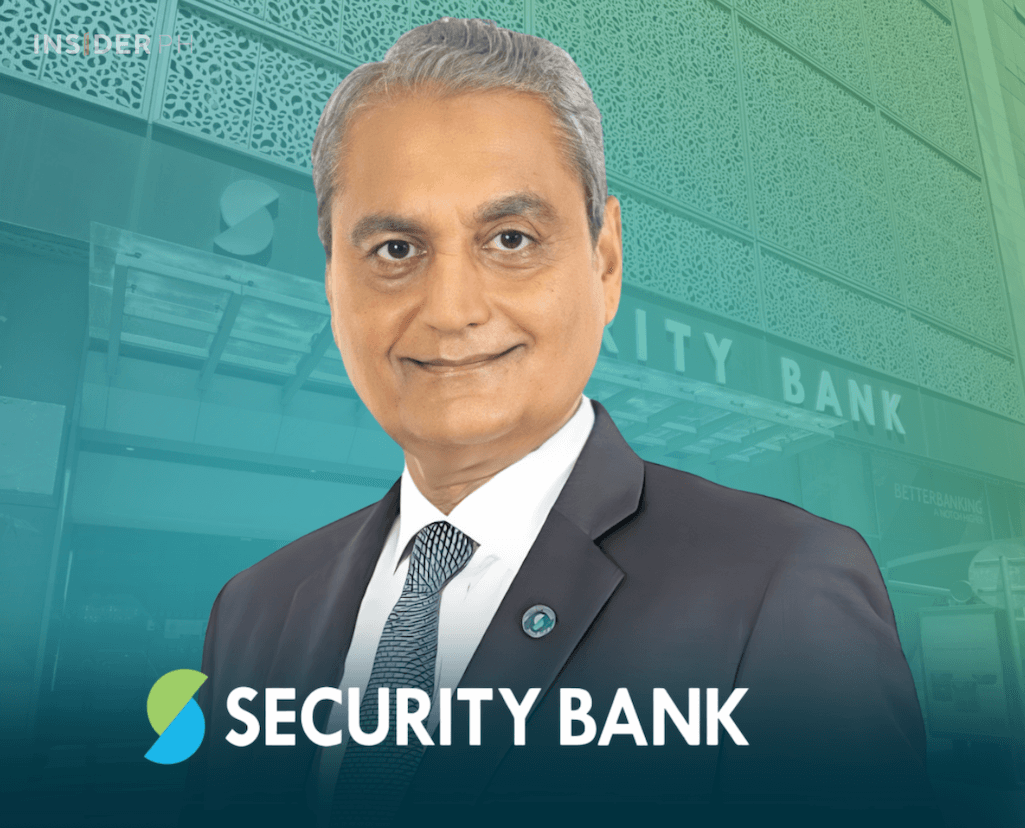

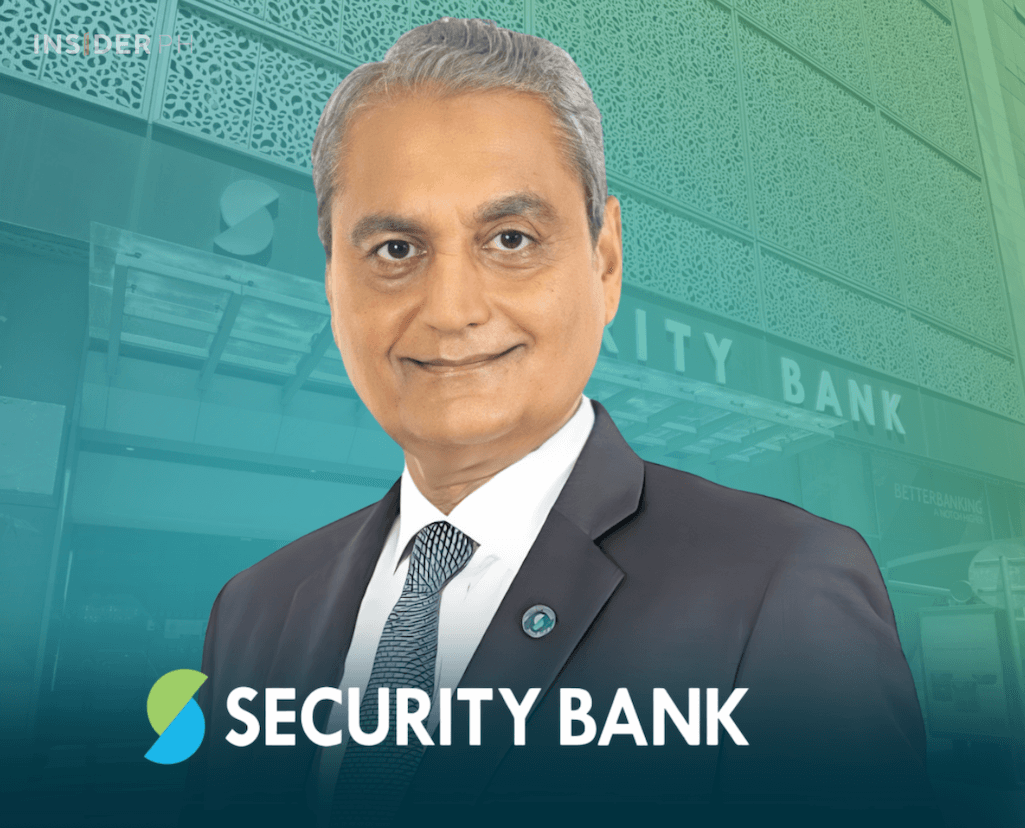

Management’s view

“We delivered another strong quarter with broad-based growth across retail, micro, small and medium enterprises (MSME), and wholesale,” said Sanjiv Vohra, Security Bank president and CEO.

“Revenues rose 5 percent quarter-on-quarter against just a 1 percent rise in expenses, underscoring the stronger efficiency and profitability we are building. Strategic investments in tech and talent are elevating customer experience, strengthening security, and driving long-term growth,” he added.

Loans and deposits power growth

Total loans rose 16 percent to P667 billion, with retail and MSME lending up 32 percent. Auto loans jumped 54 percent, credit cards climbed 43 percent, and MSME loans gained 46 percent. Deposits surged 32 percent to P889 billion, with low-cost current and savings account (CASA) deposits making up 49 percent of the total.

Margins widen, Q2 profits climb

Second quarter net income hit P3.0 billion, up 8 percent year-on-year and quarter-on-quarter. Revenues reached P16.1 billion, led by a 14 percent rise in net interest income to P12.4 billion.

Margins widened to 4.67 percent, and pre-provision operating profit rose 10 percent sequentially to P6.7 billion.

Balance sheet, capital stay healthy

Assets grew 22 percent to P1.15 trillion, while shareholders’ capital rose to P147.7 billion. Common Equity Tier 1 stood at 12.3 percent and Total Capital Adequacy Ratio at 13.2 percent. Liquidity Coverage Ratio was 194 percent and Net Stable Funding Ratio at 140 percent as of June 30.

—Edited by Miguel R. Camus