After adjusting for non-recurring items — including a net foreign exchange loss at the parent company, insurance proceeds, and cost reimbursements to certain power subsidiaries — net income attributable to equity holders of the parent company stood at ₱959 million, up 9 percent from the same period in 2024.

“Vivant recorded another double-digit growth in CCNI for the first half of 2025. The performance of Vivant Energy Corp., spurred by its participation in the reserve market, primarily drove our earnings for the semester, despite the lower WESM prices in the first half of the year,” said Vivant president and CEO Arlo G. Sarmiento.

Sarmiento credited the “team’s collective effort” for the strong returns.

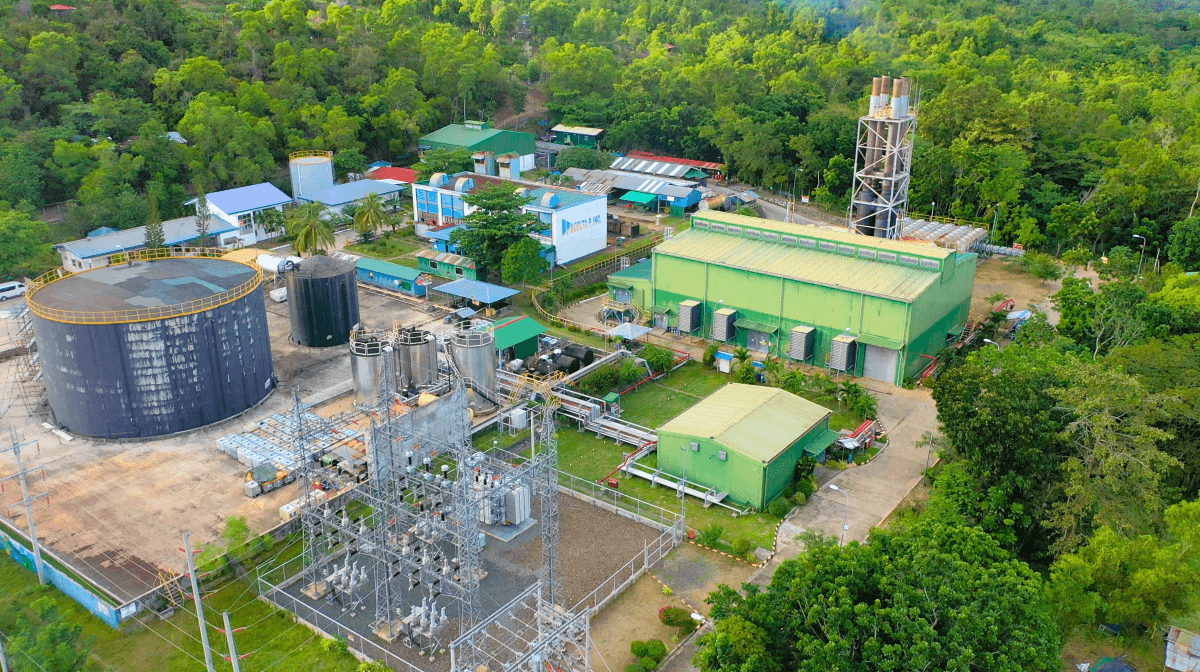

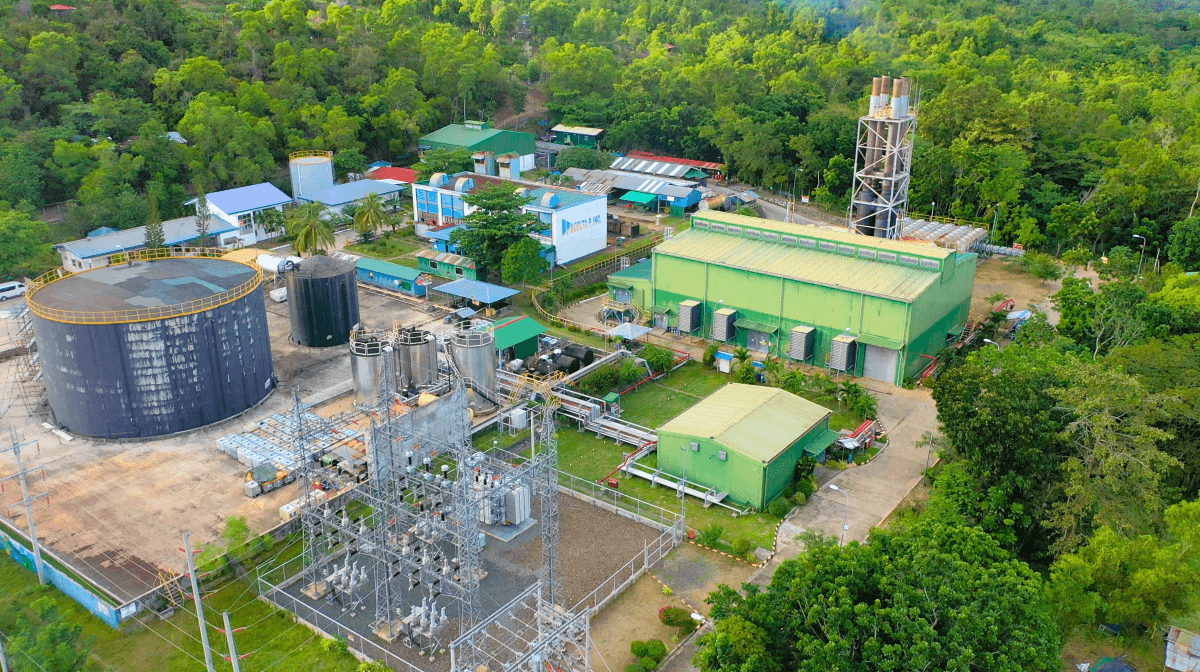

Energy business leads earnings

The company’s energy segment contributed ₱1.4 billion to total income. Power generation accounted for 63 percent, or ₱908 million, followed by the distribution utility (DU) business with ₱589 million. The retail energy segment recorded a ₱62-million loss due to lower average selling prices from retail electricity supply sales.

While overall volumes from Vivant’s conventional plants dropped 21 percent to 1,972 gigawatt-hours, the power generation business posted a 25-percent increase in net income.

The gain came from healthy margins in the Reserve Market (RM), with four plants — Cebu Energy Development Corp., Therma Visayas Inc., 1590 Energy Corp., and Meridian Power Inc. — participating.

RM nominations from these facilities rose more than sixfold year-on-year, benefiting from a full six months of operations in 2025 compared to only one month in 2024 when the market was suspended temporarily.

Income from VECO, the distribution utility, was flat at ₱589 million. A 3-percent rise in overall energy sales volumes was offset by higher operating and finance costs, as well as a one-time Energy Regulatory Commission-mandated refund to customers for unutilized regulatory costs.

Water business swings to profit

Vivant’s water business posted a ₱93-million profit in the first half, reversing a ₱10-million loss a year earlier. The improvement was largely due to finance income from the concession of 100-percent-owned IMCC, which operates a 20-million-liter-per-day seawater desalination plant.

In April 2025, Vivant Hydrocore Holdings Inc. signed a 25-year joint venture agreement with the Metropolitan Cebu Water District to supply Metro Cebu with desalinated water from IMCC.

Meanwhile, Vivant’s 45-percent-owned Faith Lived Out Visions 2 Ventures Holdings Inc. (FLOWS) saw income grow 13 percent to ₱5 million, boosted by better sewage operations at Puerto Princesa Water Reclamation and Learning Center Inc. Revenue from the wastewater business increased on higher volumes and an upward rate adjustment under its service contract.

Revenues decline, costs rise

Consolidated revenues slipped 3 percent to ₱5.4 billion from ₱5.6 billion a year earlier, dragged down by lower power sales due to reduced generation volumes. The decline was partially offset by finance income recognition from the bulk water concession.

Operating expenses climbed 33 percent to ₱860 million, reflecting higher headcount, increased professional fees tied to business expansion, and greater depreciation and amortization from asset acquisitions made in late 2024.

Financial position

Vivant reported consolidated assets of ₱32 billion at the end of June, with equity attributable to the parent at ₱20.4 billion. Total interest-bearing debt stood at ₱7 billion.

The company’s current ratio was 2.02 times, down from 2.40 times at year-end 2024. Its debt-to-equity ratio improved slightly to 0.46 times from 0.49 times at the end of last year. —Ed: Corrie S. Narisma