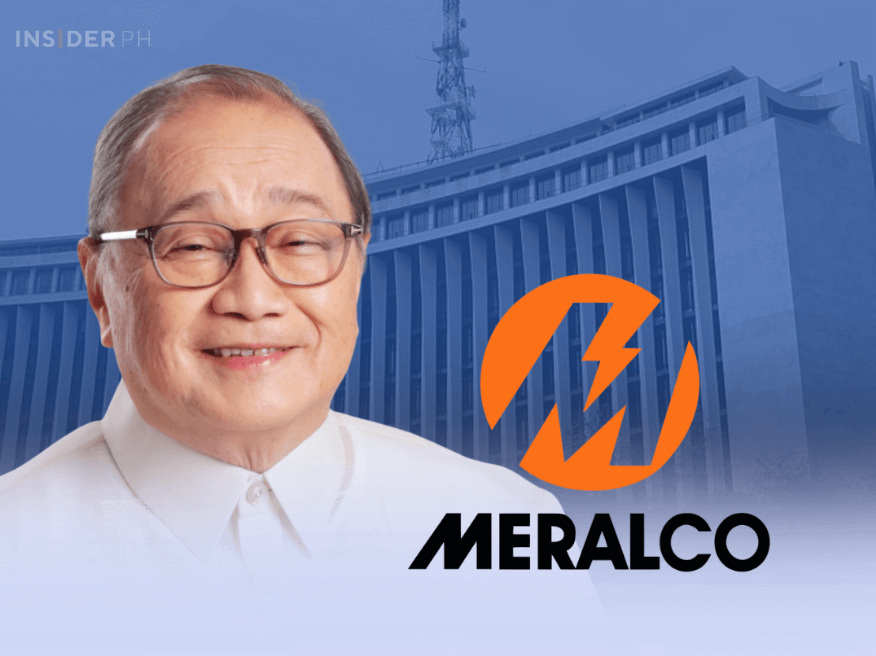

“We’re guiding full-year profitability at around P50 billion,” Meralco chair and CEO Manuel V. Pangilinan said during a media briefing on Monday.

He said the core distribution business will keep growing but at a slower pace than in 2024, with recovery expected in the latter half of the year.

As another major growth driver, Pangilinan said the biggest share will come from power generation.

“The biggest driver of CCNI [consolidated core net income] for the full year will be the generation business,” he said.

“There will be more generation capacities that could come on stream starting 2026, principally Terra Solar,” he added, referring to the first phase of the massive solar and battery facility in Nueva Ecija and Bulacan.

First-half 2025 results

Meralco announced on Monday that first-half 2025 consolidated core net income (CCNI) rose to P25.5 billion, up 10 percent from P23.2 billion last year, driven by strong power generation gains and higher electricity rates despite rising costs.

The distribution utility business delivered P13.7 billion, 54 percent of CCNI.

The power generation arm contributed P9.4 billion, 37 percent of CCNI, lifted by new plants and higher availability.

Retail electricity supply and other non-electric operations added P2.4 billion.

Average retail rates rose 11 percent to P11.41 per kWh, pushed up by higher LNG costs, peso depreciation, and approved recoveries for gas plants.

Meralco offset some of the increases with fee refunds and a 6 percent cut in its distribution charge.

—Edited by Miguel R. Camus