Second quarter profit also dropped 33 percent to P4.1 billion from P6.1 billion year-on-year, dragged by a 42 percent plunge in average spot electricity prices and softer global coal benchmarks.

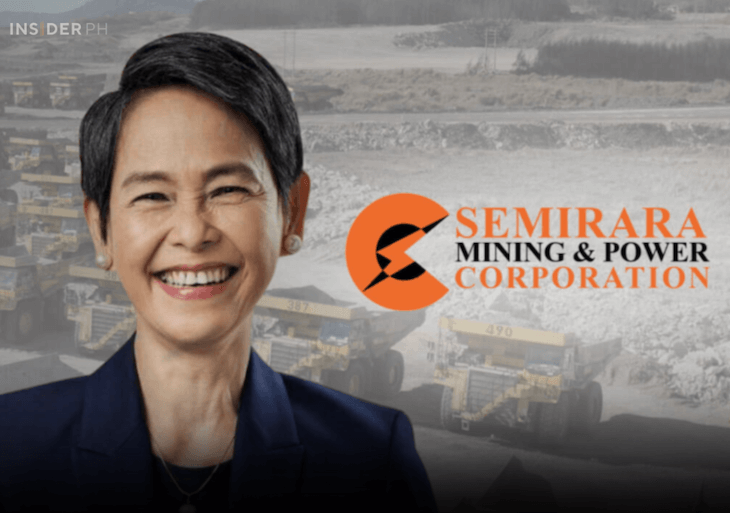

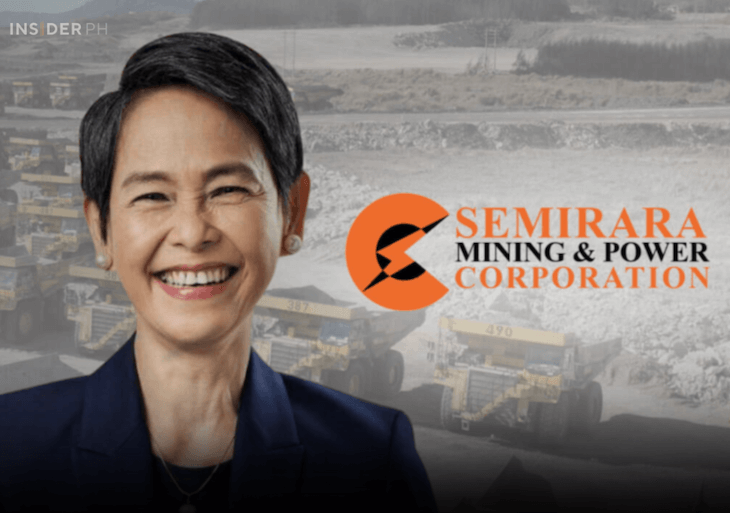

Semirara is owned by the family conglomerate DMCI Holdings.

Management’s view

“While energy prices eased, we ramped up coal production and boosted power generation. By keeping our costs under control and operating more efficiently, we were able to cushion the impact of weaker prices,” said SMPC president, chief operating officer and chief sustainability officer Maria Cristina C. Gotianun.

Quarter-on-quarter, net income eased just 6 percent, as improved power segment results helped offset coal weakness.

Production rises, prices fall

Coal production rose 8 percent to 5.6 million metric tons (MMT), while shipments held steady at 4.6 MMT. However, the average selling price declined 20 percent to P2,223 per metric ton, due to lower market prices and a greater share of low-grade output.

Power sales jumped 17 percent to 1,435 GWh, but the average electricity price slipped 19 percent to P4.51 per kWh, with 56 percent of output sold to the spot market.

“Looking ahead, we expect prices to remain relatively stable. Our focus is on ramping up coal production toward our 18 million metric ton target and optimizing our generation mix to maximize contracted capacity,” Gotianun said.

—Edited by Miguel R. Camus