Tuesday, 10 March 2026

26 Feb 2026

9:01AM

Nickel Asia reorganizes geothermal unit, declares P1.95-B cash dividend

The Zamora family-led Nickel Asia Corp. is setting up a dedicated geothermal holding company to consolidate and advance its existing geothermal energy interests within its renewable portfolio.

25 Feb 2026

2:50PM

Power generation boom drives Meralco 2025 profit jump despite softer demand

Tycoon Manuel V. Pangilinan-backed Manila Electric Co. (Meralco) grew core net income 12 percent to P50.57 billion in 2025 as a surge in power generation sales lifted earnings despite softer electricity demand.

24 Feb 2026

3:20PM

Top Semirara executive snaps up 400,000 shares after selloff

By: Miguel R. Camus

Semirara Mining and Power Corp. (SCC) president and COO Maria Cristina Gotianun bought more than 400,000 SCC shares, providing critical support after the stock plunged as much as 36 percent on concerns over the potential loss of its key coal contract.

19 Feb 2026

10:14AM

Top Line targets Cebu’s motorcycle market after Total acquisition

The Lim family-backed Top Line Business Development Corp. (TOP) said the first phase of its acquired fuel retail network in Northern Cebu can sell up to 1 million liters per month after completing renovations on eight stations.

26 Jan 2026

2:30PM

Alternergy secures early approvals for all green energy projects

The certificates of award, received early in January, formally confirm Alternergy’s auction wins after the company completed and submitted all post-auction requirements, including system impact studies and performance bonds, ahead of the original December 2025 deadline.

19 Jan 2026

5:01PM

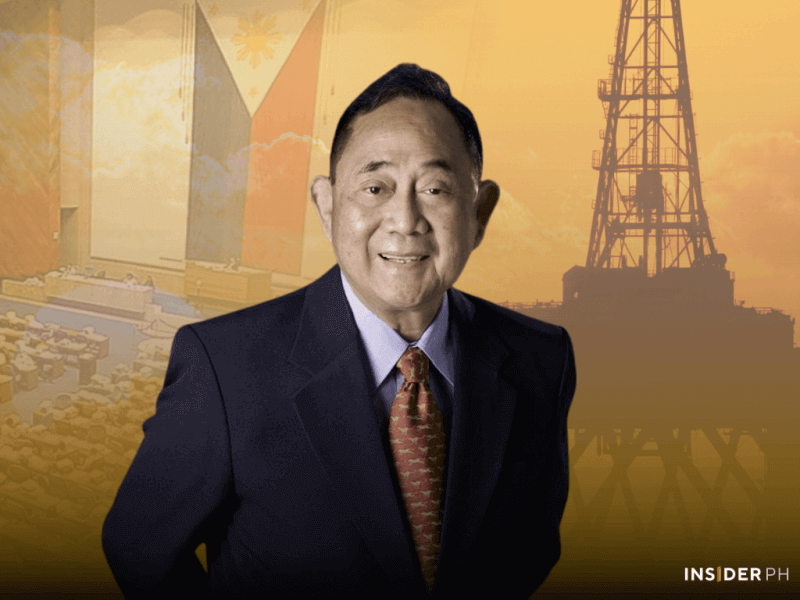

Malampaya East discovery revives push for Philippine energy security

Prime Energy said the successful drilling of the Malampaya East-1 reservoir marks a breakthrough for Philippine energy independence, after confirming a significant new natural gas discovery offshore Palawan. The find, announced by President Marcos, is the first natural gas discovery in Philippine territory in over 10 years and reinforces Malampaya’s role as the country’s only indigenous gas source.

9 Jan 2026

1:15PM

D&L-backed EvoEnergi pioneers retail power aggregation for Boracay hotels

A D&L Group-backed energy provider is breaking new ground in the Philippine hospitality sector by helping a cluster of Boracay hotels pool their electricity demand to cut costs and gain pricing control.

5 Jan 2026

5:42PM

BOI approvals hit P1.56 trillion in 2025 as investor confidence holds

The Philippines sustained strong investor confidence in 2025 as the Board of Investments (BOI) approved P1.56 trillion worth of projects, breaching the P1.5-trillion mark for the second straight year and marking the agency’s second-highest approval level in its 58-year history.

19 Nov 2025

9:49AM

Aboitiz, ING Hubs boost energy access for Bulacan schools

Aboitiz Foundation and ING Hubs Philippines have formalized a partnership to energize four last-mile public schools in Doña Remedios Trinidad, Bulacan—an effort expected to widen access to digital learning for students in isolated communities.