The Ayala Group’s Globe Telecom Inc. navigated a volatile year for the telco sector with steady operational gains, supported by its digital unit Mynt, the operator of GCash, even as core net income slipped amid rising costs.

What’s driving the numbers

• Core net income fell 12 percent to P15.5 billion as higher costs and weaker affiliate earnings offset growth.

• Consolidated revenues slipped to P121.7 billion, but Q3 sales rose 3 percent quarter-on-quarter to P41.5 billion.

• Mobile data drove performance, hitting a record P74 billion, up 2 percent.

• Fiber subscribers jumped 44 percent to 2.1 million, with GFiber Prepaid users surging 3.7 times to 700,000.

• EBITDA held steady at P64.2 billion with a 52.8 percent margin, supported by tighter cost control.

Management’s view

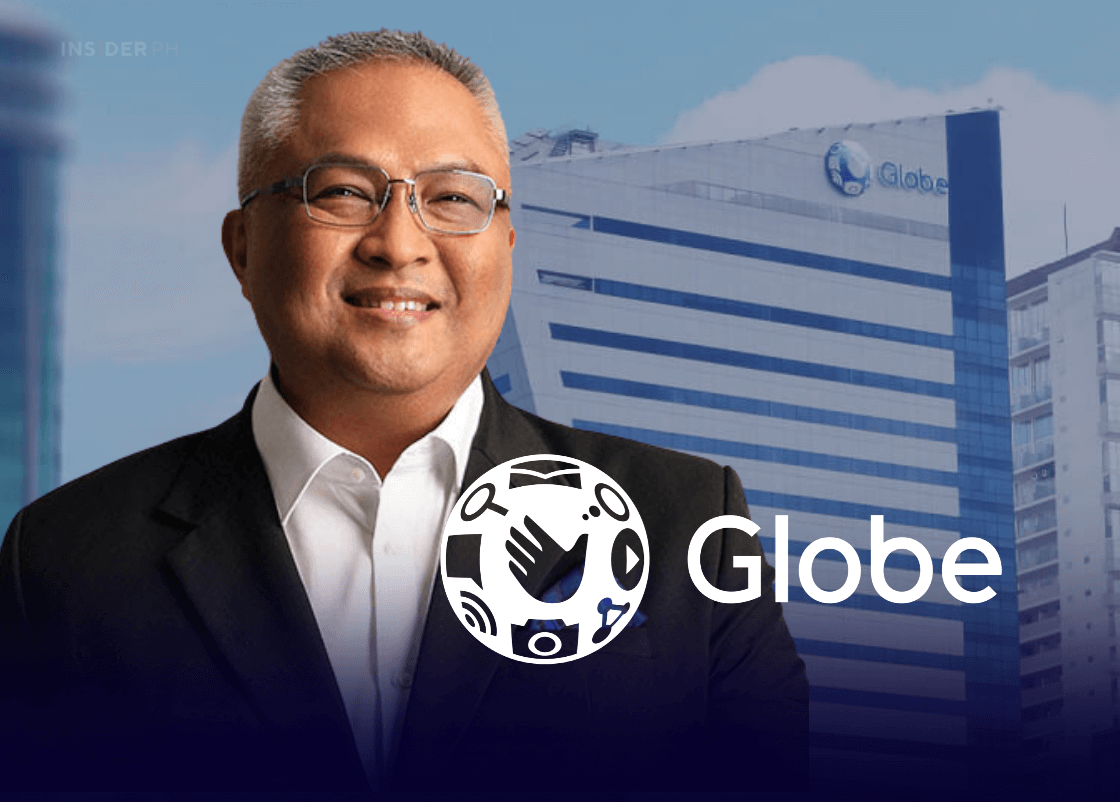

“Our third-quarter results underscore Globe’s consistent performance and our ability to create impact beyond connectivity for more Filipino families and businesses,” said president and CEO Carl Raymond R. Cruz.

“Looking ahead, our focus remains firmly on our customers… We remain steadfast in our vision of becoming the most valuable, trusted, and admired operator in the country,” he added.

Online gambling’s impact on GCash?

While the recent slowdown in online gambling and e-wallet delinking tested fintech activity, Mynt stayed firmly in growth mode.

It delivered a P5.3-billion equity share, up 52 percent year-on-year, now contributing 25 percent of Globe’s pre-tax income, up from 14 percent in 2024.

Analyst sees potential in GCash’s diversification moves

This was the slowest quarter for Mynt this year, with its contribution to Globe down 25 percent quarter-on-quarter to P1.5 billion from P2 billion in the second quarter.

For Nicky Franco, research head at Abacus Securities, Globe’s softer third-quarter numbers reflected temporary headwinds rather than weakening fundamentals.

“[T]he market might also be underpricing the growth from Mynt’s other revenue streams, both current (e.g., lending) and future. For example, GCash recently launched a service that allows small businesses to use smartphones as a point-of-sale (POS) device,” Franco said.

Called PocketPay, the service eliminates costly POS terminals and allows customers to simply tap their credit or debit cards on a phone. “We believe this has wide potential usage, especially now that Filipinos are shifting more and more toward cashless payment options,” he said.

“In short, the impact on GCash/Mynt from online gaming will likely be temporary,” he added.

Measured expansion moves

Globe trimmed capital spending (capex) by 23 percent to P31.4 billion as it focused on efficiency and data-driven investments.

About 89 percent of capex went to digital infrastructure, including 877 new 5G sites built nationwide. T

his expanded 5G coverage to nearly 99 percent of Metro Manila and key cities across Visayas and Mindanao.

—Edited by Miguel R. Camus