Net interest income surged 33 percent, with net interest margin climbing to 4.57 percent from 3.71 percent, showing improved profitability on its core banking business.

The bank’s customer loans grew 14 percent, led by a 38 percent jump in consumer lending, as credit card and personal loan volumes rose by 47 percent, auto loans by 46 percent, and housing loans by 24 percent.

Digital, data focus

RCBC said its digital platforms like RCBC Online and Pulz helped expand its customer base, with digital transactions rising 28 percent.

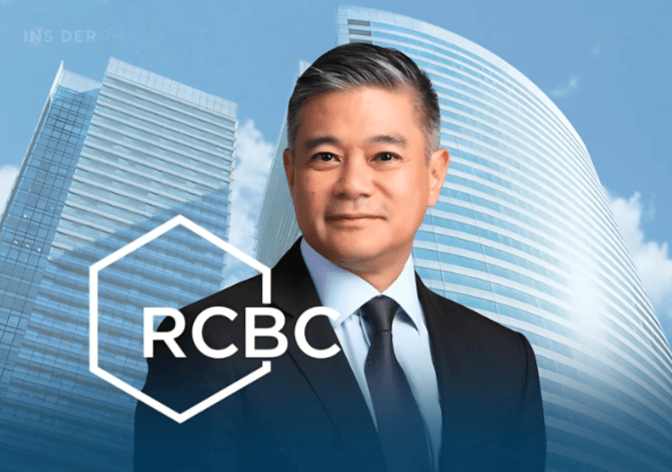

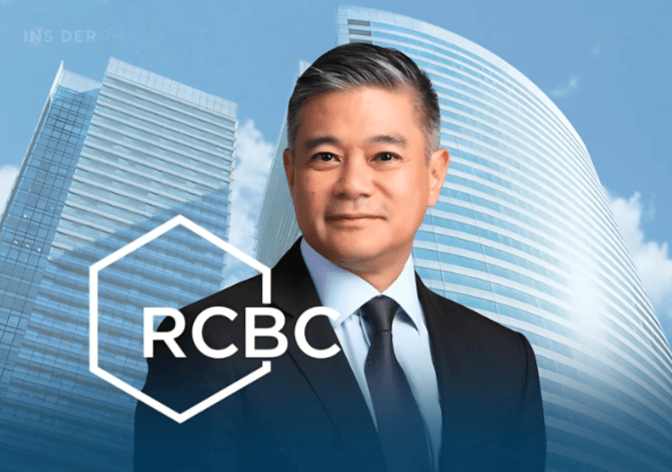

“We’re going to make data-driven decision making a core part of our way of doing things, so that we can make intelligent and resourceful decisions when we engage our clients,” said RCBC president and CEO Reggie Cariaso.

“We’re investing in ways that we can understand our clients and get all their financial needs met through RCBC,” he added.

Capital and reach

Capital rose 7 percent to P163 billion, with strong buffers of 16.21 percent for capital adequacy and 13.71 percent for core equity.

RCBC now operates 470 branches, 1,488 ATMs, and 6,549 ATM Go terminals nationwide, while also earning 24 awards this year, including Euromoney’s “Best Bank for Digital” in Asia for a sixth straight year.