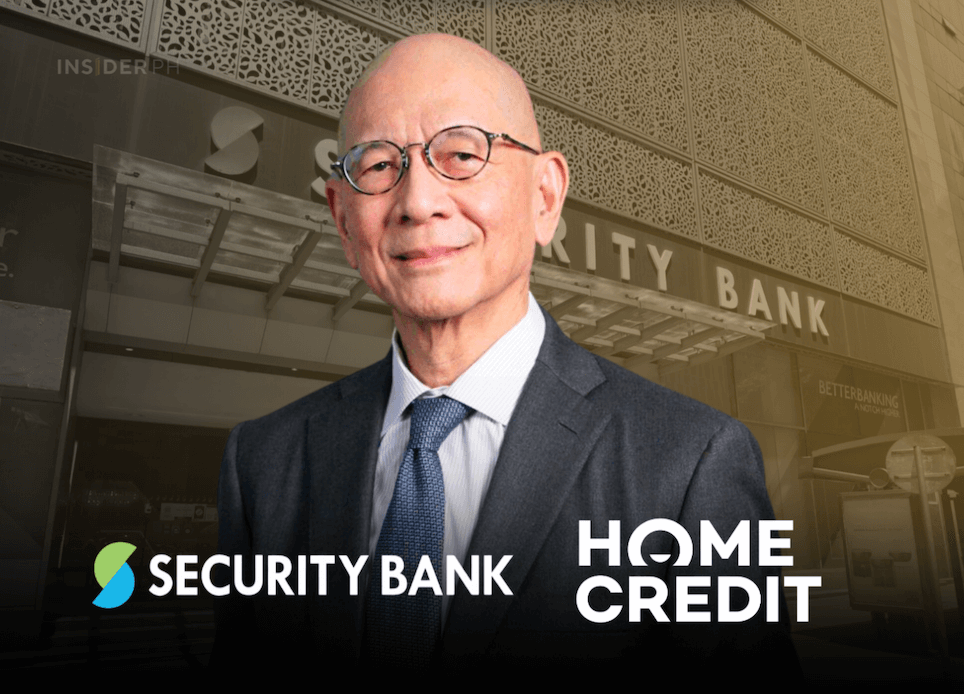

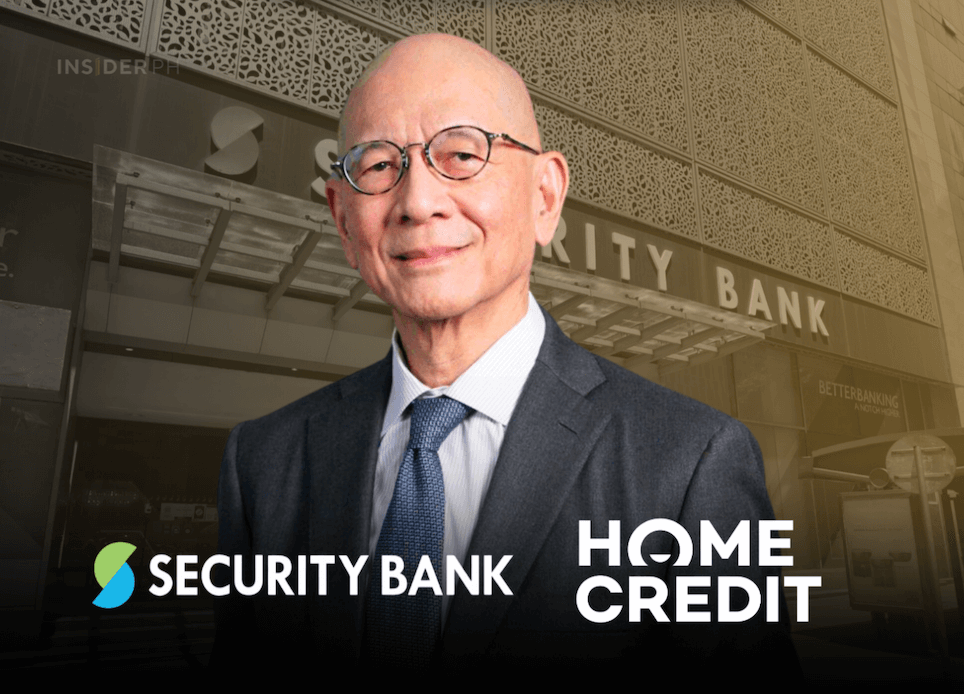

The final settlement came with a P1.23-billion top-up payment on August 28, closing a deal first announced in late 2024 and cementing its partnership with MUFG Bank Ltd., its 20 percent shareholder and seller of the HCPH shares.

Major lending portfolio

The additional payment reflects adjustments made after reviewing HCPH’s updated financial position, ensuring the purchase price accurately represents its value at closing.

HCPH, one of the country’s largest non-bank lenders, serves over 11 million customers with point-of-sale financing, cash loans, and revolving credit, giving Security Bank a strong foothold in retail lending.

The bank said the acquisition is income-accretive, meaning it will lift earnings and support its long-term growth strategy.

Major push into consumer market

It also strengthens Security Bank’s balance sheet diversification by leveraging HCPH’s vast reach and credit expertise.

Management said the move aligns with its push to provide customer-focused, accessible financing while advancing financial inclusion nationwide.

—Edited by Miguel R. Camus