PLDT Inc.’s looming sale of half its data center business to a strategic partner could generate sufficient cash to cover debt payments for two years, freeing up resources to support expansion into new segments, including the competitive prepaid fiber market.

Tycoon Manuel V. Pangilinan-led PLDT confirmed news reports that it is in talks to sell 49 percent of $1 billion data centers business.

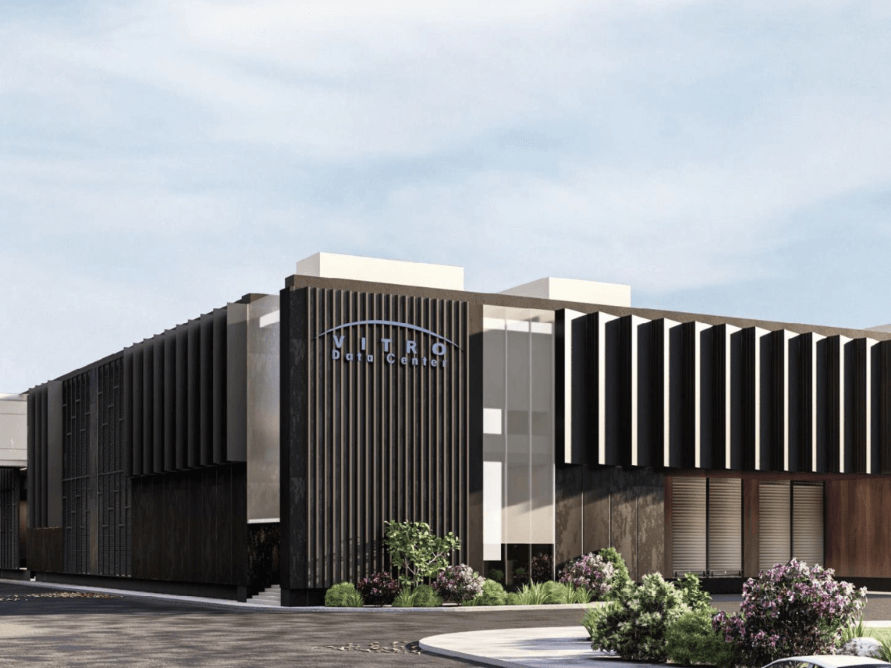

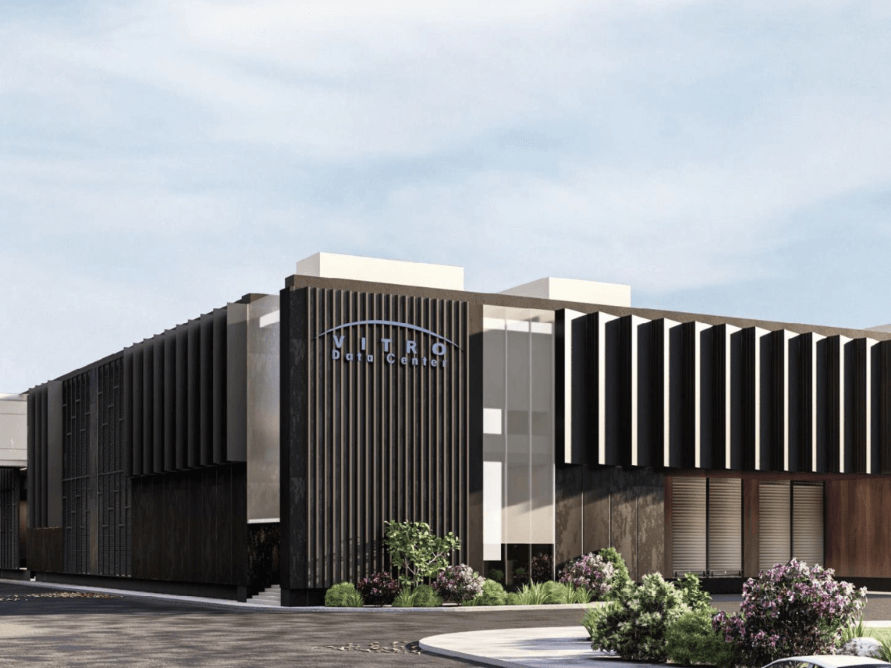

Data centers provide critical storage and network services needed by enterprises and tech giants, allowing faster speeds and a smoother user experience when accessing their apps and websites.

Paying down loans

Alfred Benjamin R. Garcia, head of research at stockbrokerage house AP Securities Inc., said this could raise around P28.2 billion in proceeds—nearly enough to cover debt maturities of P30.5 billion until 2025.

“This is roughly one-tenth of PLDT’s P257 billion gross debt (as of the first quarter of 2024) and would almost be enough to pay down the P7.3 billion of loans coming due this year and P23.2 billion coming due next year,” Garcia said in a note to investors.

Moreover, paying down debts would strengthen PLDT’s balance sheet versus close competitor Globe Telecom, he said.

Buy rating

This gives PLDT an important edge, justifying AP Securities’ buy rating with a consensus target price of P1,689.69 per sharer, implying a 17.4 percent upside from its present level.

Meanwhile, PLDT sees opportunities to expand further into the prepaid fiber market, competing directly with aggressive rivals like Converge ICT Solutions and Globe Telecom.

Miguel R. Camus has been a reporter covering various domestic business topics since 2009.