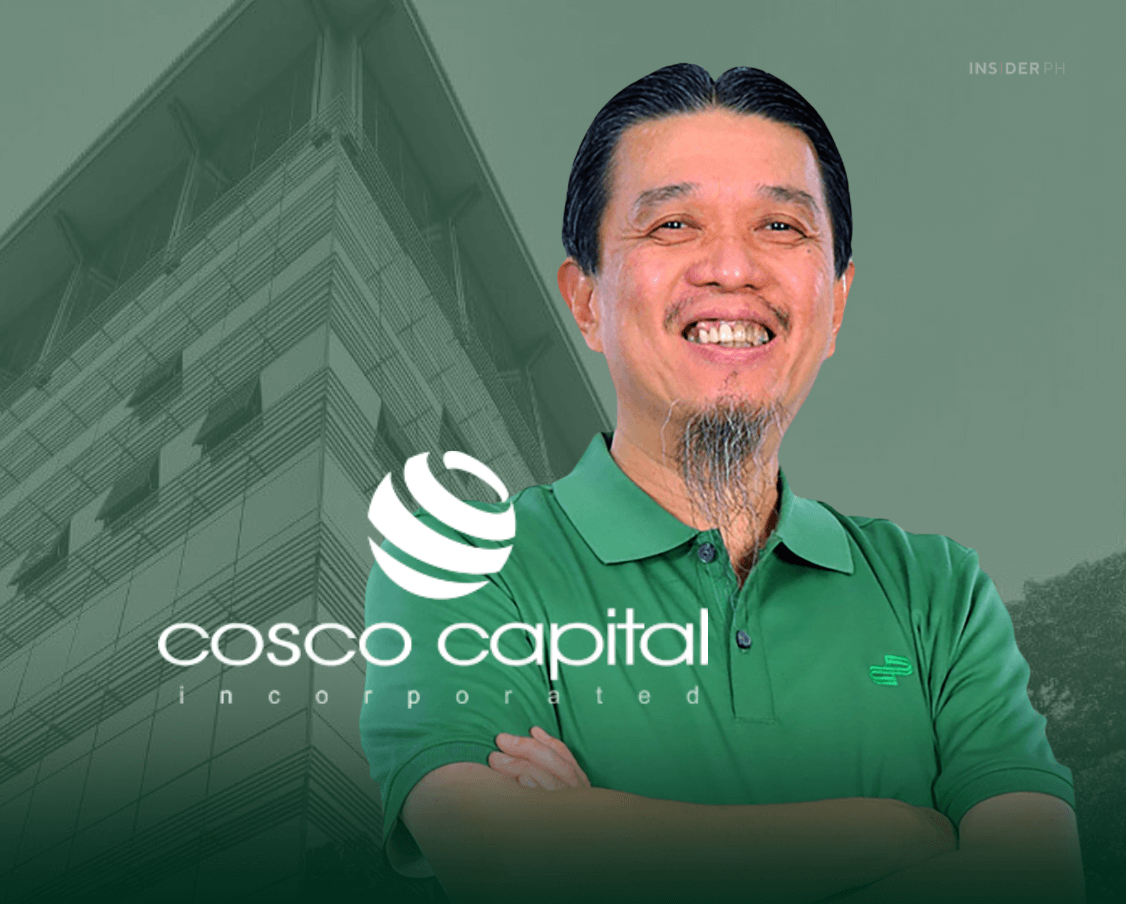

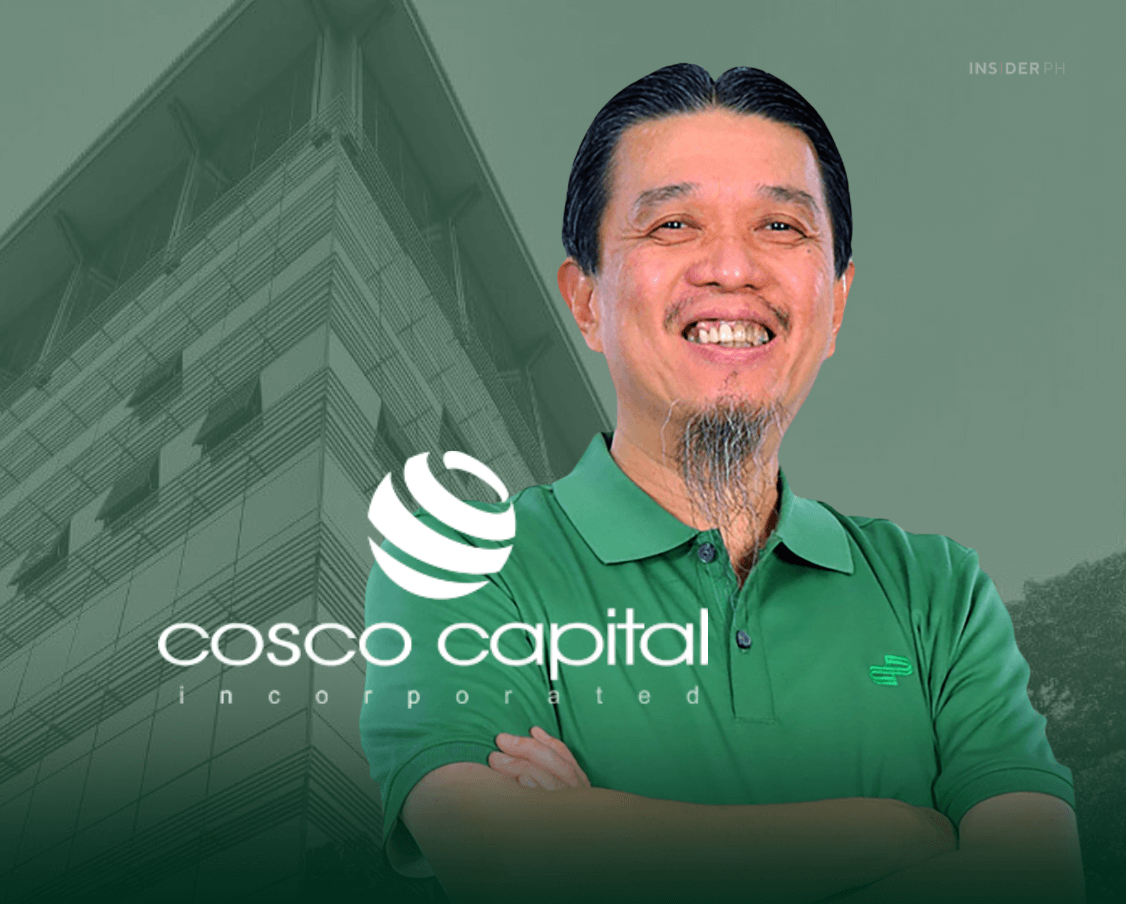

Consolidated revenues climbed 11.5 percent to P182.9 billion, lifted by its grocery, liquor, and property businesses.

“The croup continued to benefit from the economic recovery amidst the prevailing macroeconomic challenges by way of sustained and stronger revenue growth across all its business segments which indicates the recovering consumer demand,” Cosco said in a statement on Wednesday.

Growth sluggish vs 2024

While performance remained solid across its portfolio, profit growth slowed from nearly 10 percent last year as third-quarter results reflected softer domestic spending and a more tempered retail environment following the post-pandemic surge.

The company, which owns Puregold Price Club, S&R Membership Shopping Club, and Liquor Distribution Group, continued to post stable earnings across business lines.

Diversified operations

Grocery retailing contributed 68 percent of total net income, followed by liquor distribution at 22 percent, commercial real estate at 8 percent, and energy and specialty retail at 2 percent.

Grocery revenues rose 10.6 percent to P168 billion, driven by higher store traffic, larger basket sizes, and same-store sales growth of 4.8 percent for Puregold and 5.4 percent for S&R. Grocery net income increased 5.6 percent to P7.3 billion, supported by topline growth and better margins.

—Edited by Miguel R. Camus