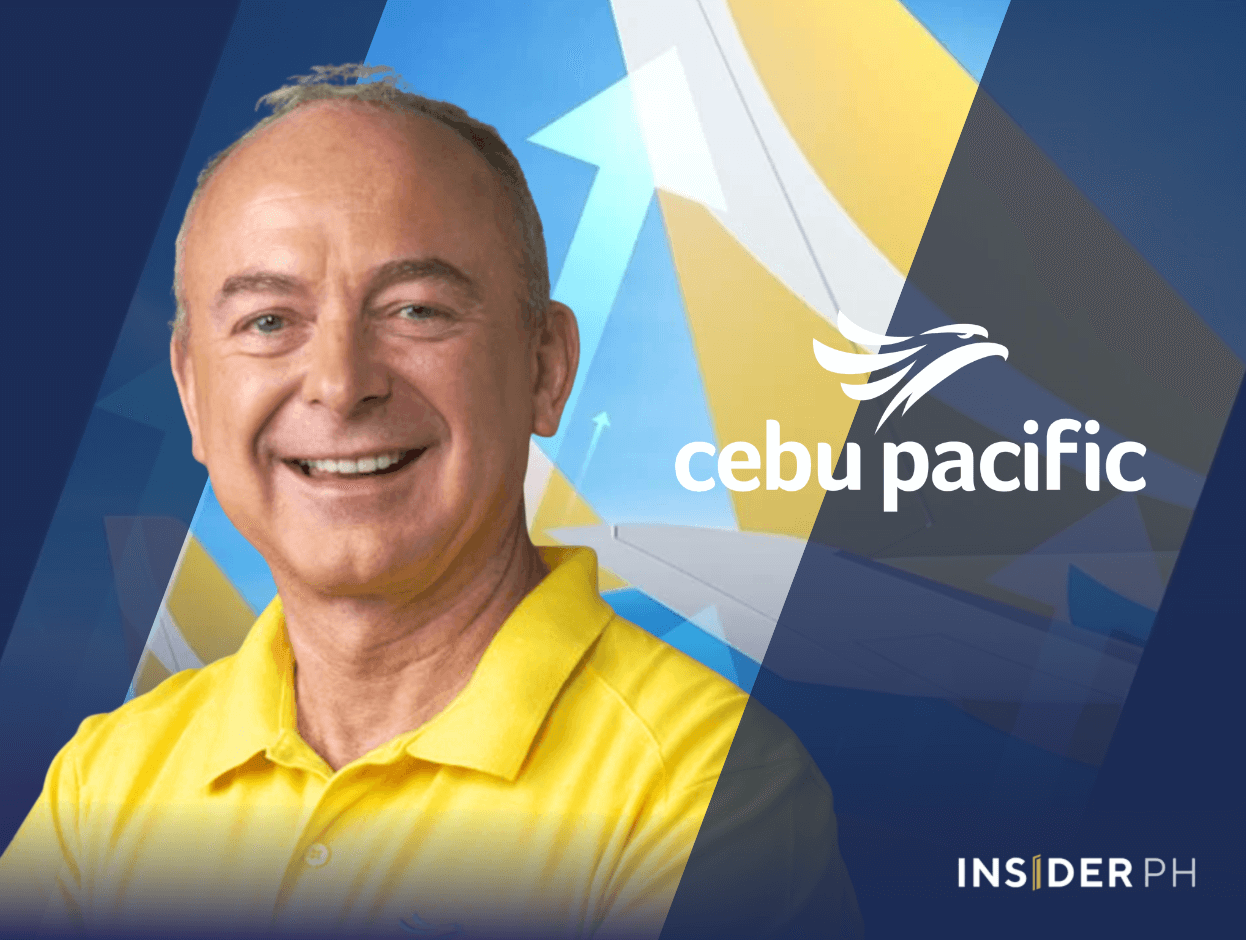

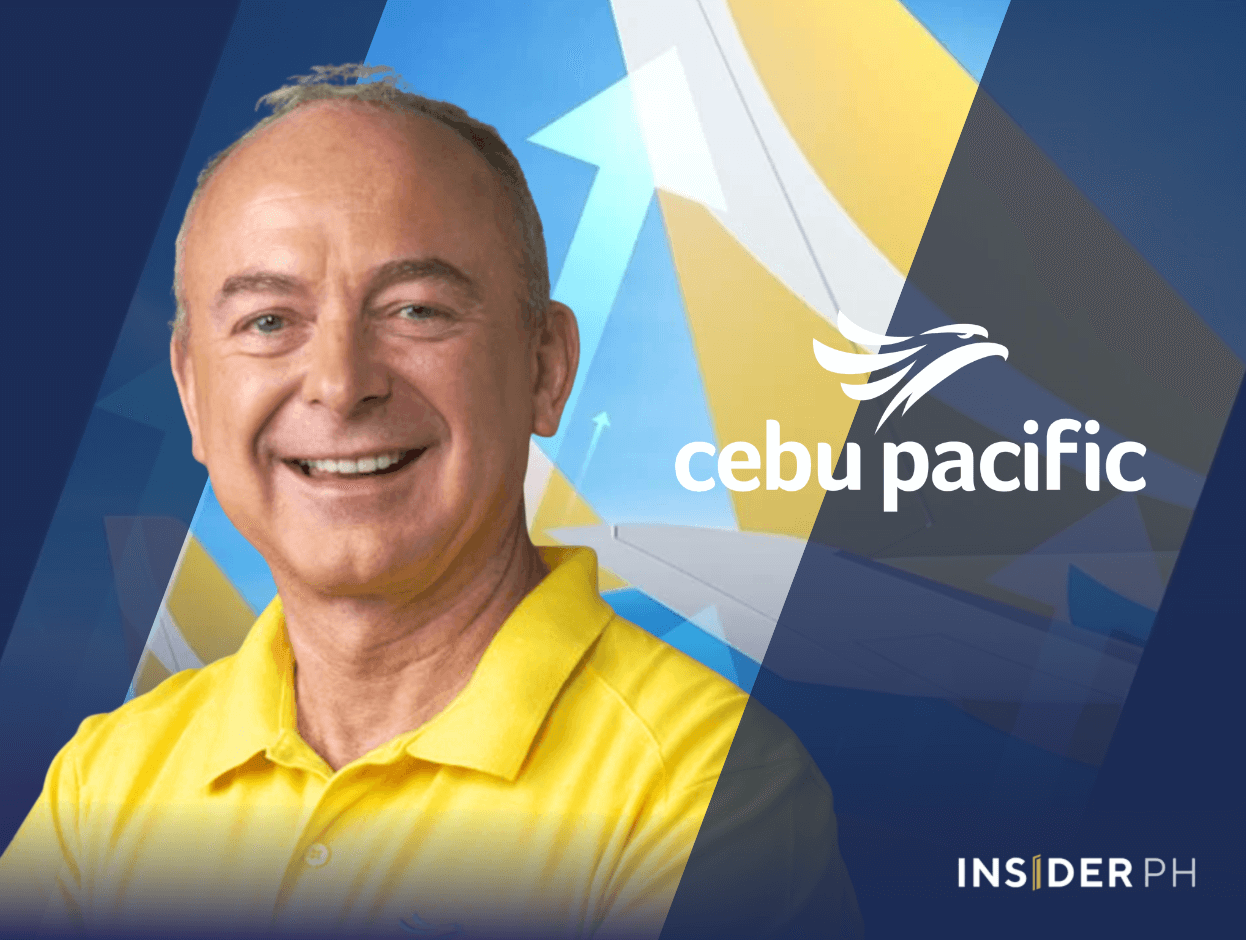

“It’s something very much on the cards and in discussion at the moment,” Cebu Pacific CEO Michael Szucs told InsiderPH in a recent interview.

Szucs said the Gokongwei family-controlled airline continues to navigate a tough business environment, but earnings have been picking up in the wake of the carrier’s decision to keep flying and honor its obligations during the global pandemic.

Dividends or paying down debt?

“The balance sheet is fine, but we used to have a balance sheet that was the envy of everyone,” he explained.

Bloomberg data showed that Cebu Air last paid out dividends to common shareholders on July 10, 2019. Cebu Air restarted payouts to holders of preferred shares on Oct. 1 last year.

“We’ve got all the options open to us, so we’ve got plenty of cash liquidity — it’s just a question of do we pay down debt or do we pay dividends,” Szucs said.

Cebu Air had retained earnings of about P12 billion and cash and cash equivalents of roughly P15.8 billion as of Sept. 2025. Any payout will still have to be balanced against its P36.4 billion in long-term borrowings.

Strong earnings and cash reserves point to a possible first dividend, but Cebu Pacific’s debt-heavy fleet makes the decision far from automatic.

Miguel R. Camus has been a reporter covering various domestic business topics since 2009.