Through a series of share purchases, the state-run pension fund increased its stake in Emperador Inc., which owns Emperador Brandy, Fundador, and premium Scotch brands such as The Dalmore and Jura, from about 4.4 percent to 5.23 percent.

What’s going on behind the scenes?

An insider said the Government Service Insurance System is increasing exposure to Emperador Group as it factors in the long-term value of The Dalmore’s maturing whisky stocks, including barrels still developing into 18-year, 25-year, and older.

“The older the single malt becomes the higher the value. Fundador consumption in the north and south America continues to be strong. Emperador can dominate the Philippine market due to its cost advantage,” the insider said.

The source also pointed to Fundador inventories in Jerez and Emperador’s vineyards in Toledo, where output is “double that of regular vineyards.”

GSIS stake in Emperador now worth P13.1 billion

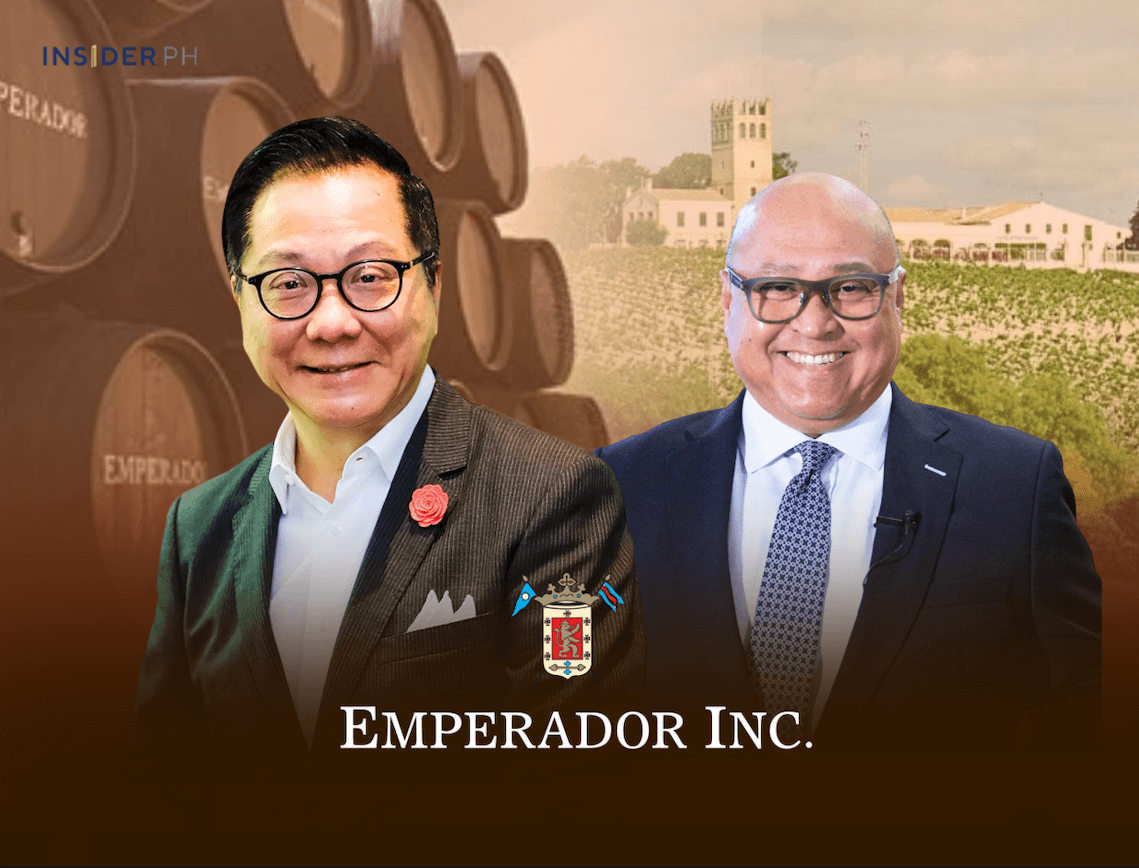

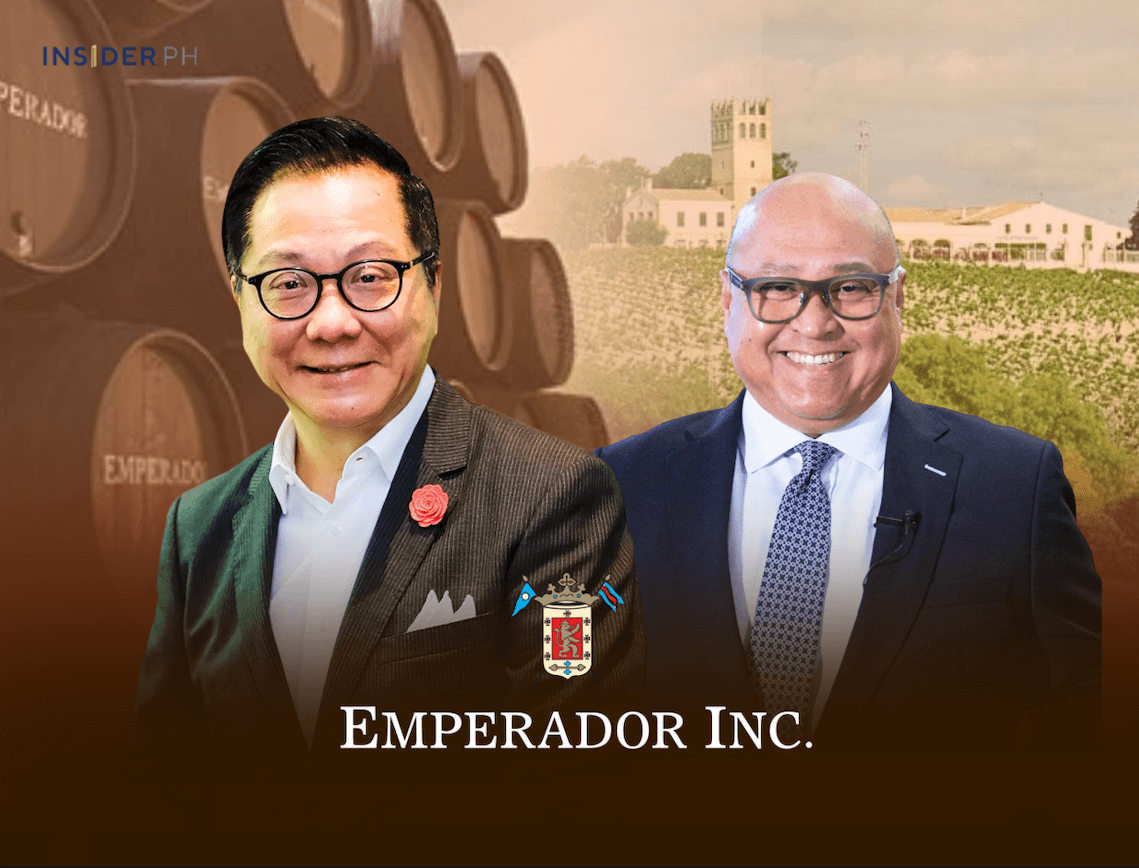

GSIS, led by president Jose Arnulfo “Wick” A. Veloso, is now the company’s biggest shareholder after the Tan family and No. 2 stockholder Singapore sovereign wealth fund GIC, via Arran Investment Pte. Ltd.

The pension fund bolstered its ownership after buying 131.3 million Emperador shares over the past 60 days. The transaction was first reported by the Manila Standard.

GSIS now owns 823.2 million Emperador shares worth around P13.1 billion.

As of Oct. 31, the Tan family-led conglomerate Alliance Global Group remained the largest shareholder of EMI with a 79.07 percent stake.

Listed on the PSE and Singapore

Emperador, which trades under the stock symbol EMI, has gained about 4.3 percent over the past month to P15.88 per share.

The company is one of only two Philippine firms dual-listed on the Singapore Exchange, alongside Campos-led food giant Del Monte Pacific Ltd.

Despite the recent share price gains, Emperador, which is now valued at around P250 billion, has lost about 12 percent of its market value since the start of 2025.

Solid profitability

Emperador Group booked P4.7 billion in net profit for the first nine months of 2025, flat year on year, on the back of P41.2 billion in revenues and other income.

The brandy business returned to growth during the period, while Scotch whisky remained under pressure globally but showed improvement in the third quarter.

Miguel R. Camus has been a reporter covering various domestic business topics since 2009.