The draft amendments to the 2020 implementing rules, released for public comment on November 18, propose wider asset eligibility, longer reinvestment timelines, and controlled flexibility in public float requirements to make REIT listings easier and more attractive.

A REIT manages properties like buildings, malls, or warehouses and pays most of that income back to investors as dividends.

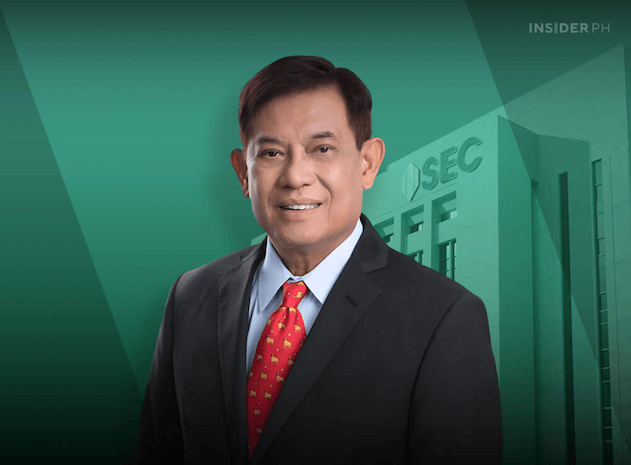

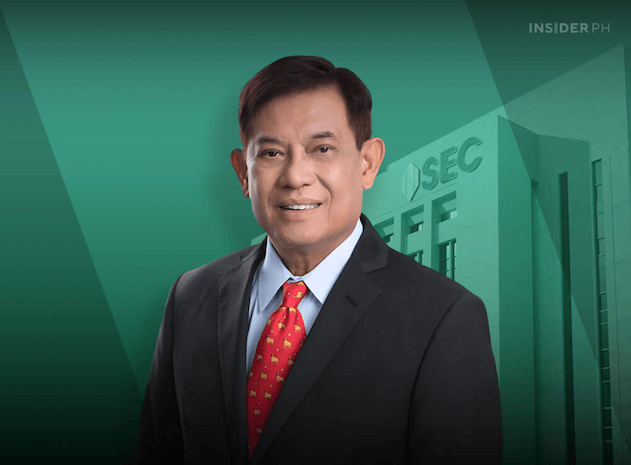

SEC chair Francis Ed. Lim said the reforms are designed to keep the REIT system “robust and responsive to evolving market needs,” helping the sector raise more funds and deepen its role in the economy.

Proposed updates

• The revised rules will allow REITs to own income-generating properties through wholly owned unlisted special purpose vehicles and include a wider range of cash-flowing assets such as information and communications technology, transport, and energy infrastructure, plus warehouses, buildings, parking areas, and registered leases.

• The SEC aims to broaden what counts as income-generating real estate so more companies can qualify as REITs.

• The reinvestment period will be extended to two years from one, covering equity investments, loan transactions, and debt repayments for real estate or infrastructure projects in the Philippines.

• REITs may temporarily fall below the minimum public ownership requirement when sponsors inject new income-producing assets in exchange for shares, subject to SEC and Philippine Stock Exchange approval.

• Any temporary dip must be disclosed, and the REIT must submit a timetable showing how it will restore the required public float.

—Edited by Miguel R. Camus