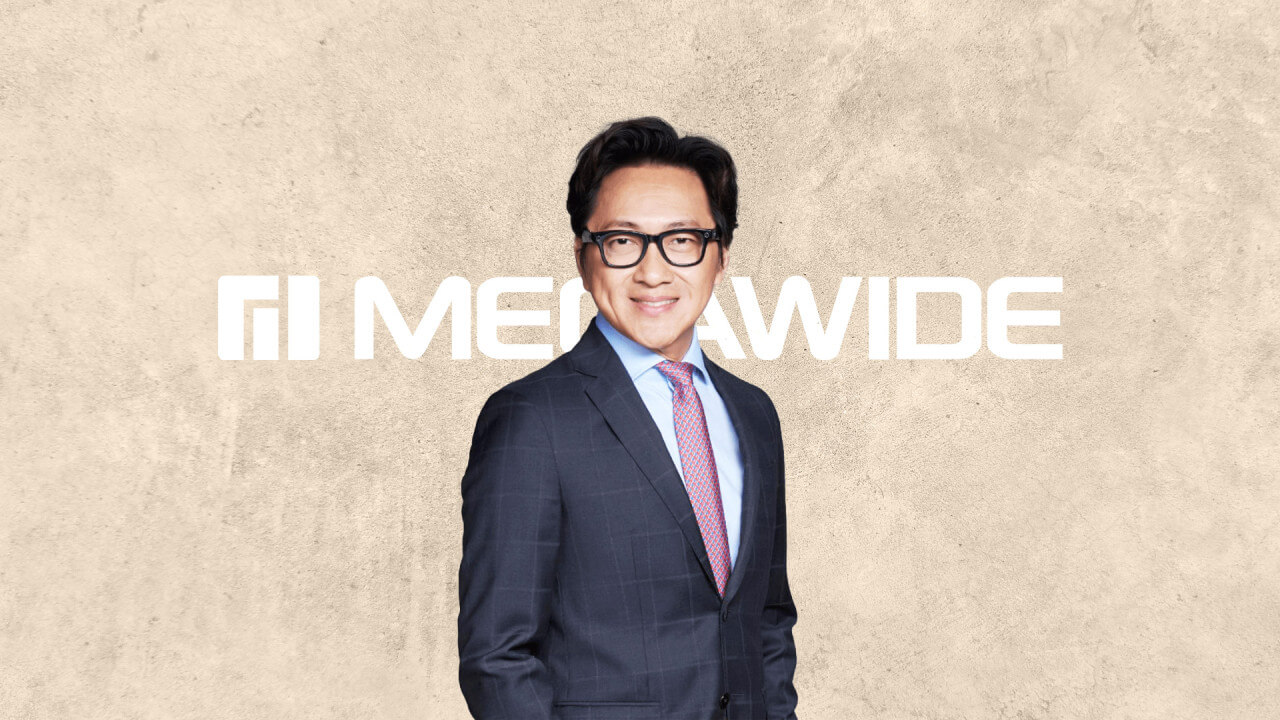

Tycoon Edgar Saavedra’s Megawide Construction Corp. is ramping up expansion efforts after successfully raising P5 billion from the sale of bonds.

“Our thrust to grow in more scalable platforms that offer synergies within our internal value chain pave the way for new opportunities,” Megawide chair and CEO Edgar Saavedra said in a statement.

A total of P5 billion was raised through Series C, D, and E bonds with maturities of 3, 5, and 7 years, respectively, and a weighted average rate of 7.86 percent across all maturities.

Megawide said the deal was oversubscribed 1.6 times as total demand reached P6.4 billion.

“We are very thankful for the unwavering support and confidence of our underwriters and investors, and we look forward to this same enthusiasm as we embark on more exciting projects towards engineering a first-world Philippines,” he added.

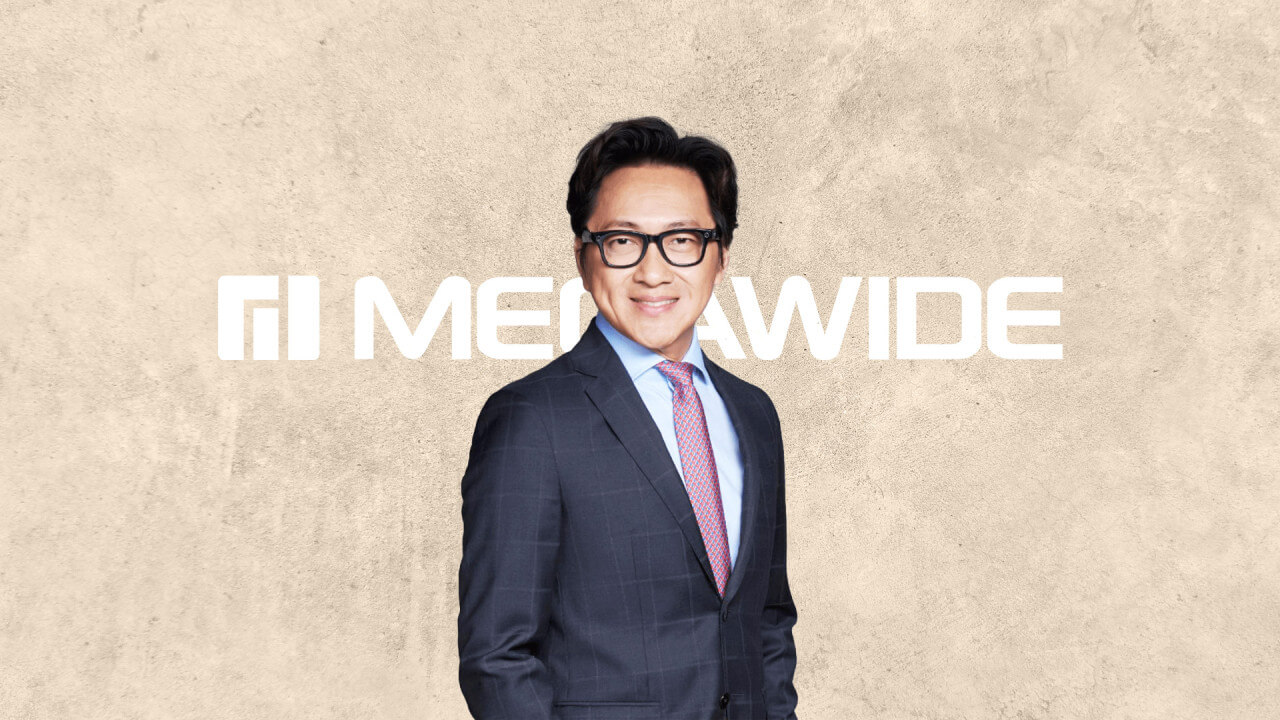

RCBC Capital Corp., SB Capital Investment Corp., and PNB Capital and Investment Corp. were tapped as joint issue managers, joint lead underwriters, and bookrunners with RCBC Trust and Investment Group acting as trustee.

“PNB Capital together with RCBC and SB Capital congratulate Saavedra and the Megawide team. They are able to demonstrate their agility to navigate through the challenges and take advantage of opportunities to come out stronger,” said Gerry Valenciano, president and CEO of PNB Capital Corp.

“These themes resonate well with investors, which we believe drove the healthy demand and oversubscription for the offer,” he added.

Miguel R. Camus has been a reporter covering various domestic business topics since 2009.