With its maiden preferred share exchange and follow-on offering now listed on the Philippine Stock Exchange, the company has opened a fresh way for Filipinos to take part in its growth story.

The nearly P49-billion offering marks a milestone for San Miguel and the local capital markets, as it combines flexibility for investors with a structure never before attempted by a private firm.

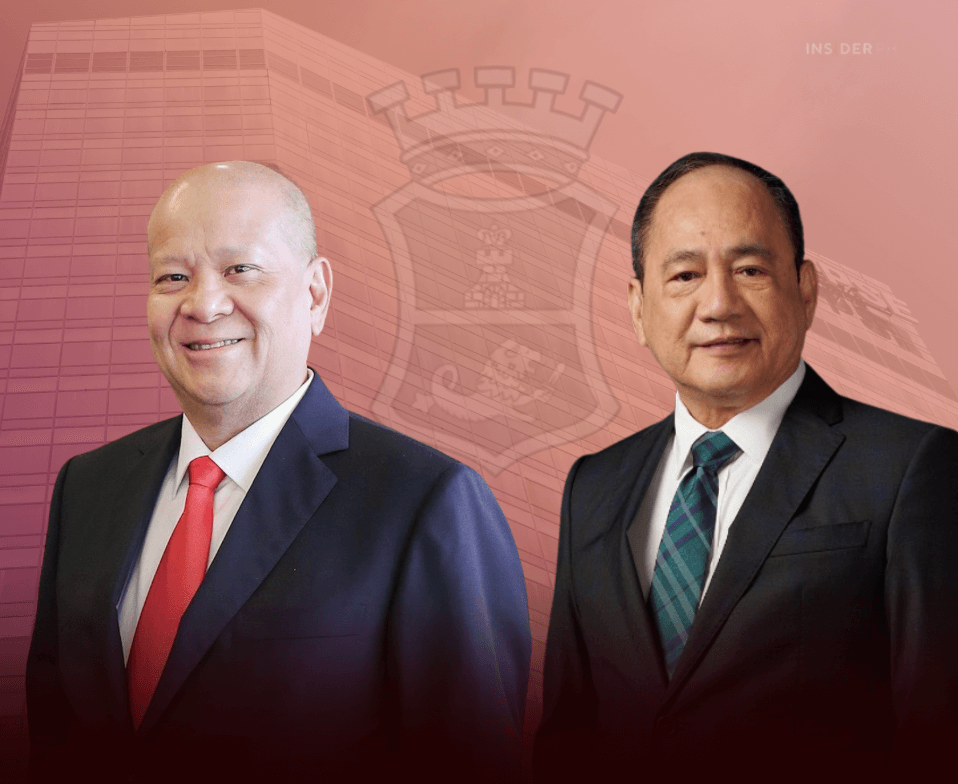

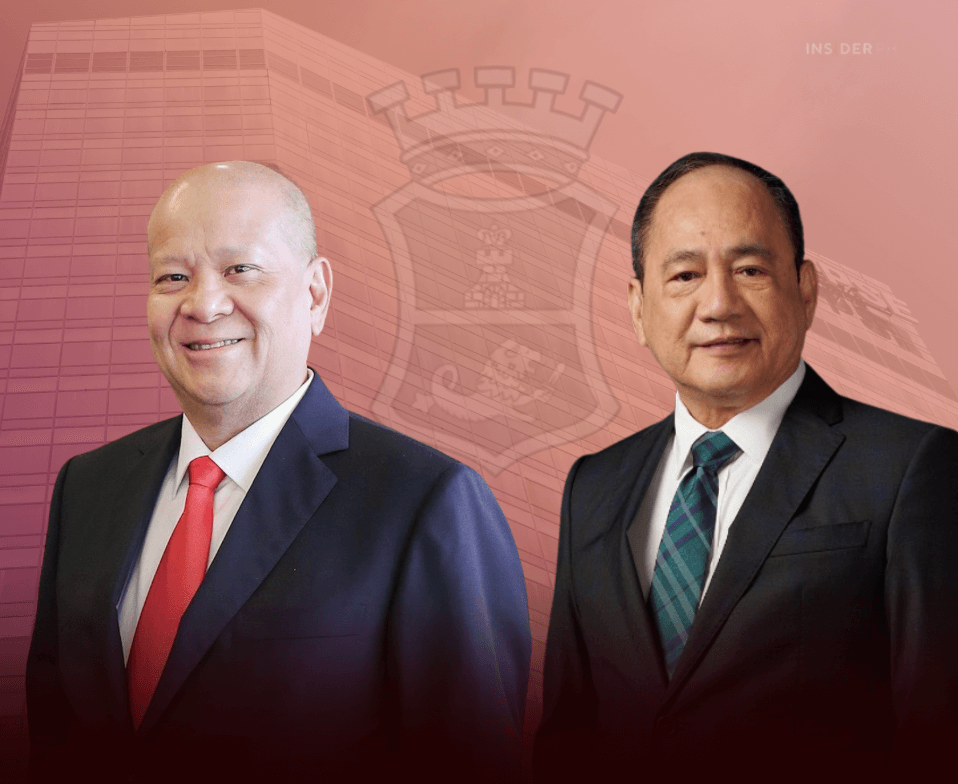

“For us, this is about giving investors more ways to take part in San Miguel’s growth and in the process, help make our capital markets more active and accessible to more Filipinos,” SMC chair and CEO Ramon S. Ang said in a post on Facebook.

“It’s one more way we are channeling investments toward industries that create more jobs, build infrastructure, and drive long-term growth for our country," he added.

The funds raised will help refinance short-term loans tied to previous preferred share redemptions and support major projects like the New Manila International Airport in Bulacan and tollway developments.

Offer was 1.5 times oversubscribed

Philippine Stock Exchange president and CEO Ramon Monzon said San Miguel’s follow-on offering was a standout in both scale and investor response.

“SMC proceeded with their FOO, raising P30 billion for its Series 2-S, 2-T, and 2-U preferred shares, one of the biggest amounts of capital raised via an FOO in PSE history,” Monzon said.

“Not surprisingly, this FOO, like all previous SMC issuances, was oversubscribed—this time by 1.5 times—again reflecting the investors’ trust and confidence in the company’s superior track record and in the transformative leadership and strategic mindset of SMC’s chairman and CEO, Mr. Ramon S. Ang, and his very capable management team,” he added.

—Edited by Miguel R. Camus