In a complaint filed Jan. 30, the SEC charged Villar Land, formerly Golden MV Holdings Inc., with alleged violations of the Securities Regulation Code involving inflation statements, fraud, insider trading, and price manipulation.

Named as respondents are tycoon and former Senate president, Manuel B. Villar Jr., former Sen. Cynthia A. Villar, Cynthia J. Javarez, Manuel Paolo A. Villar, Sen. Camille A. Villar, Sen. Mark A. Villar, Ana Marie V. Pagsibigan, and Garth F. Castañeda.

The SEC also charged related firms Infra Holdings Corp. and MGS Construction, together with their officers and authorized signatories Virgilio B. Villar—Villar Jr.’s brother—Josephine R. Bartolome, Jerry M. Navarrete, and Joy J. Fernandez.

At its peak, Villar Land was valued at P1.6 trillion, larger than the SM Group and property giant Ayala Land. It's now trading at less than half that value with a market capitalization of about P600 billion, still one of the largest companies listed on the Philippine Stock Exchange.

The SEC complaint was first reported by the news site Rappler.

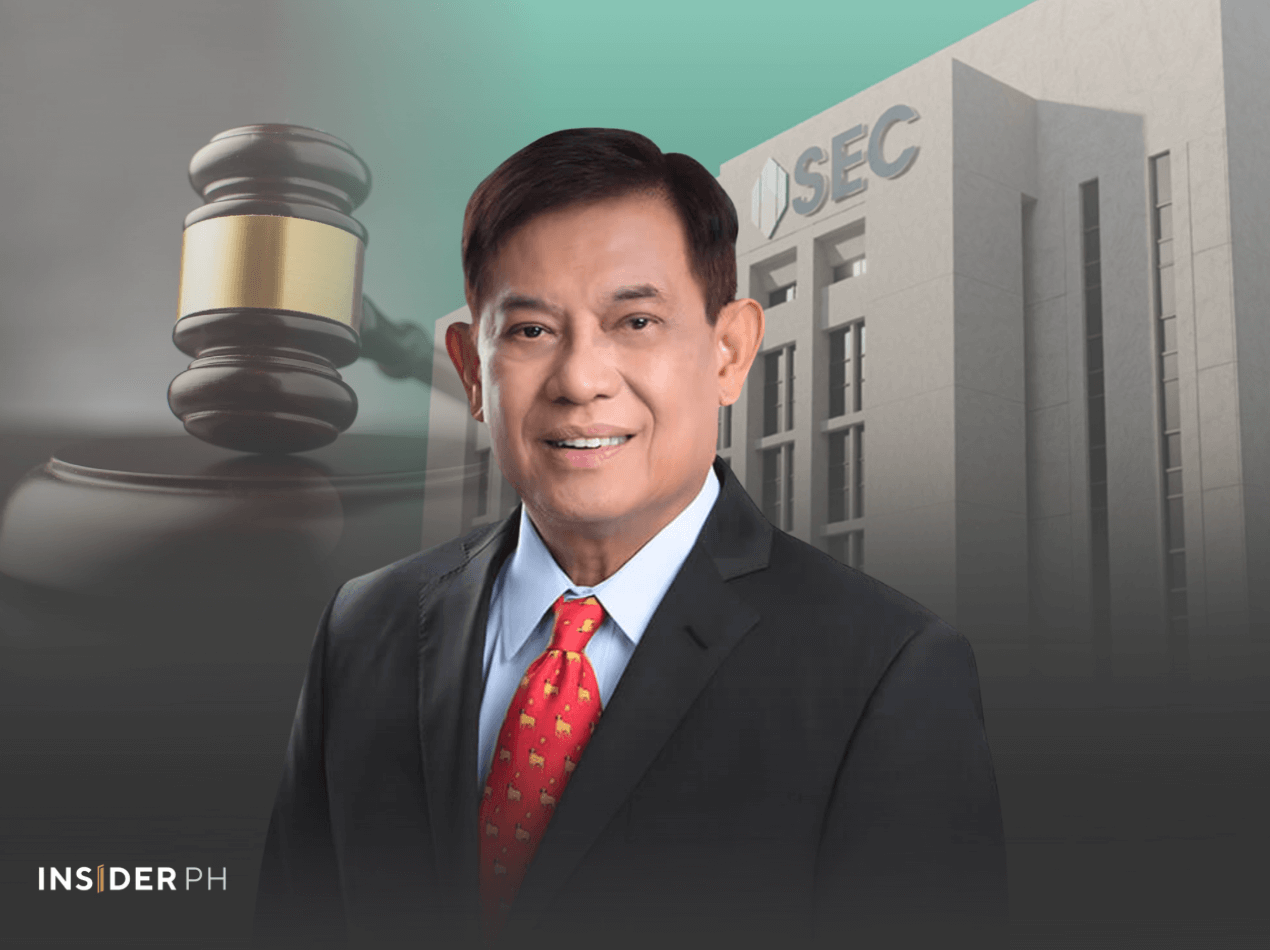

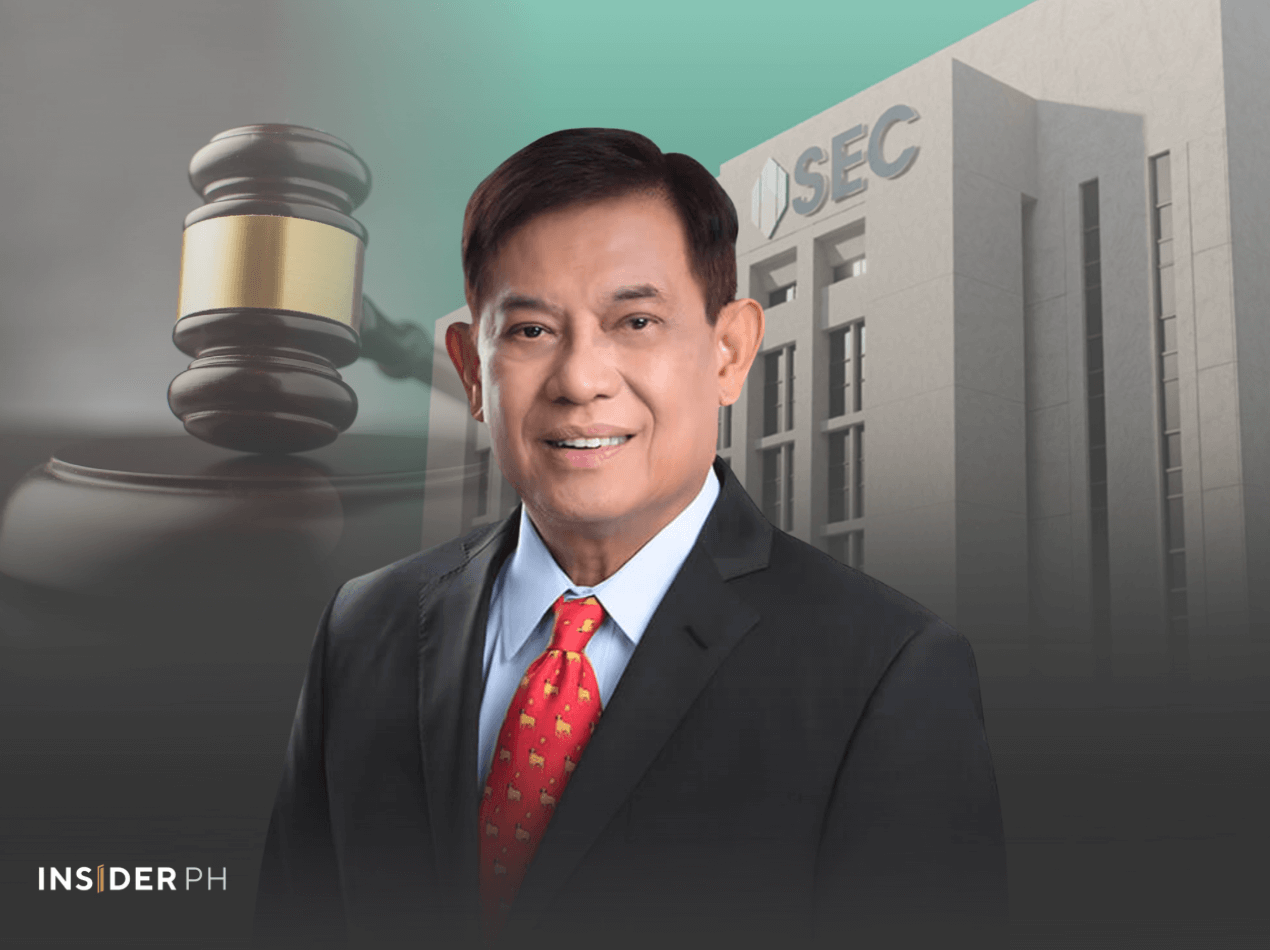

SEC’s Lim cracks down on market manipulation

“Building investor confidence in the Philippines is crucial in driving the inclusive and sustainable growth of our capital market and business sector for national development,” SEC chair Francis Ed. Lim said in a statement on Saturday.

“In this light, the SEC is firm in addressing fraudulent and manipulative acts that mislead the investing public and distort our capital markets. The Commission likewise enjoins publicly listed companies to uphold the highest standards of good corporate governance to help strengthen and sustain investor confidence badly needed by our capital markets,” he added

What happened?

Regulators said Villar Land publicly disclosed unaudited 2024 financial statements showing total assets of P1.33 trillion and net income of P999.72 billion, figures driven mainly by a revaluation of its real estate holdings.

The SEC alleged these figures were released before the completion of an external audit and later proved materially inaccurate.

When the audited statements were eventually submitted, Villar Land reported total assets of only P35.7 billion, far below what investors had earlier been told.

The SEC said this gap misled investors and distorted trading in the company’s shares.

Trading and insider allegations

The complaint further alleged that Infra Holdings Corp. and MGS Construction engaged in trades that created artificial demand and supported Villar Land’s share price.

Infra Holdings Corp. is owned by Virgilio B. Villar, the brother of Manuel B. Villar Jr., according to the SEC.

Regulators also accused Camille A. Villar of insider trading after allegedly buying 73,600 shares in December 2017 shortly before a disclosure that lifted the stock price.

—Edited by Miguel R. Camus