The group’s strong performance was anchored by banking, automotive, real estate, and utilities—all of which held firm even as headwinds began to weigh on broader activity.

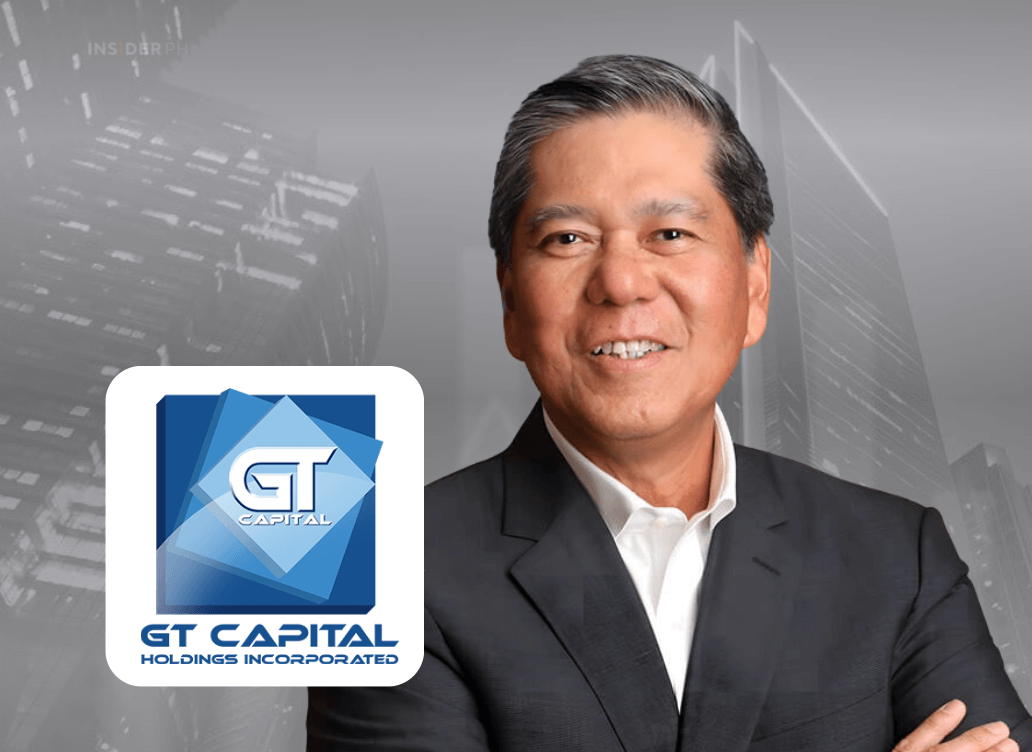

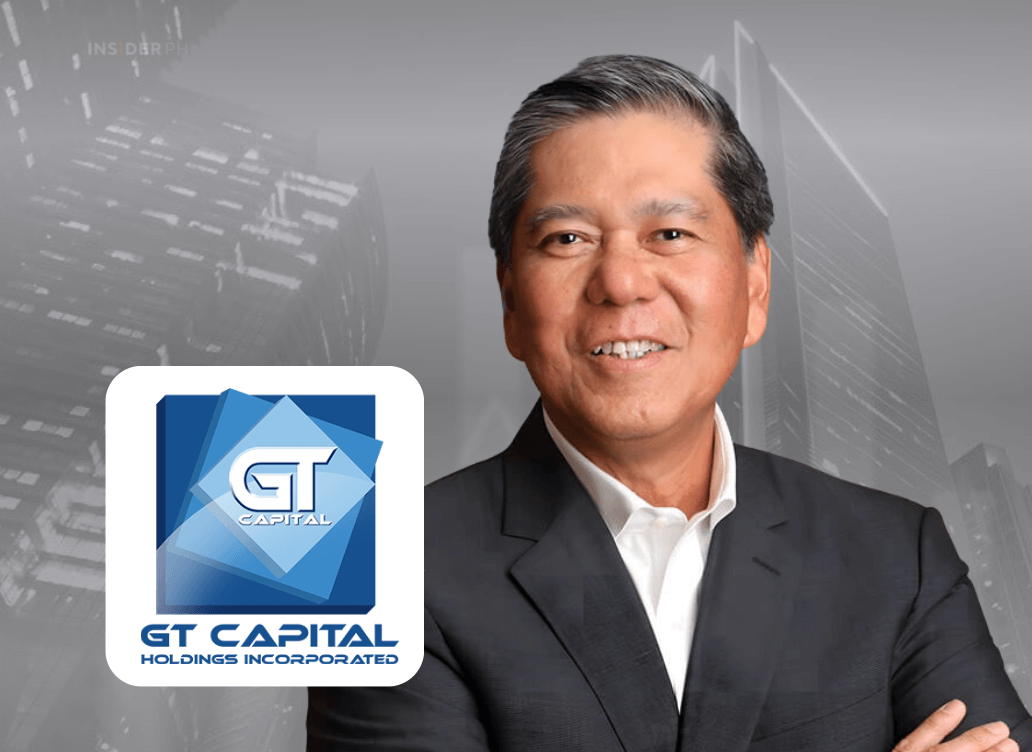

Management’s view

“GT Capital’s performance was supported by the Philippine economy, which grew by 4% in the third quarter of 2025. Loan growth and continued motorization drove the businesses of our main operating companies. As we enter the last quarter of the year, global and domestic headwinds are beginning to slow economic activity,” GT Capital president Carmelo Maria Luza Bautista said.

“Nonetheless, our growth momentum should allow us to post record earnings for 2025, backed by strong fundamentals — healthy consumer demand from seasonal spending, manageable inflation, lower interest rates, and steady Overseas Filipino Worker (OFW) remittances. These factors position us well to sustain our momentum for long-term growth,” he added.

Banking, cars

Metrobank led the charge with P37.3 billion in net income as loans expanded 10.8 percent, deposits rose 7.6 percent, and operating costs grew just 1.7 percent, improving bank efficiency.

Toyota Motor Philippines delivered its own record with P16.8 billion in earnings on 11.6 percent revenue growth, backed by stronger unit sales, a favorable peso, and rising demand for electrified vehicles.

Real estate, infrastructure & insurance

Real estate arm Federal Land and its joint venture with Nomura logged 6 percent higher reservation sales, supported by fast-selling projects like The Observatory and the full sell-out of Riverpark North.

Metro Pacific Investments Corp., which has stakes in Maynilad Water Services, Manila Electric Co., toll roads and hospitals, added P23.6 billion in core income as power, water, and hospital volumes improved across its portfolio.

AXA Philippines rounded out contributions with a 3.5 percent profit increase and 19.8 percent growth in premium revenue driven by stronger life margins and a turnaround in general insurance.

—Edited by Miguel R. Camus