Thursday, 5 March 2026

2 days ago

Why the SM Group is considering selling Atlas after 15 years

By: Miguel R. Camus

SM Investments Corp. is finally unwinding its oldest diversification bet, underscoring the Sy family conglomerate's sharper focus on core sectors as economic uncertainty deepens in 2026.

5 days ago

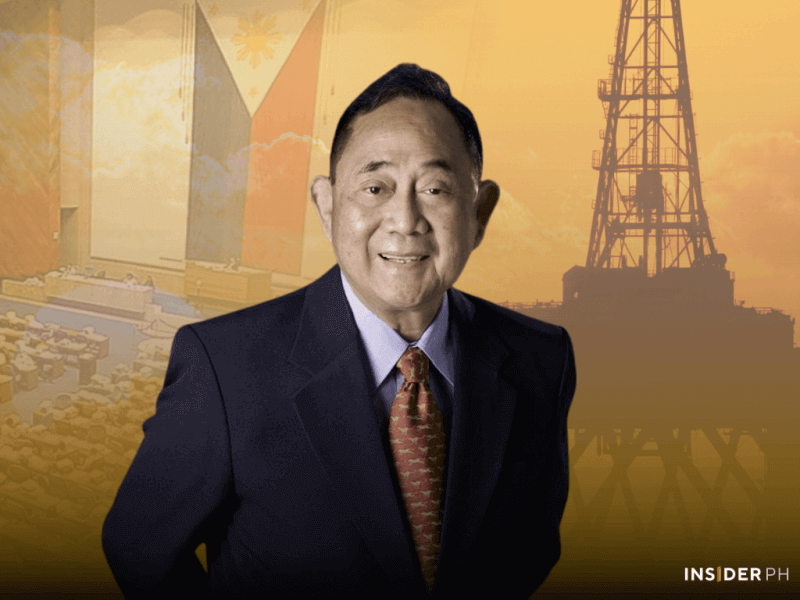

Lucio Tan’s LT Group delivers fourth year of record profits at nearly P31B in 2025

LT Group, Inc. booked P30.98 billion in consolidated attributable net income in 2025, beating P28.92 billion in 2024 and extending its record streak to four years.

5 days ago

SM Investments 2025 profit breaches P90B, grows 2 times faster than PH economy

Sy family-backed conglomerateSM Investments Corp. pushed consolidated net income past the P90 billion mark for the first time, underscoring the growing weight of its banking arm and the resilience of its property portfolio.

6 Feb 2026

7:02PM

WINNING | How Filinvest builds advantage across sectors

Filinvest Group’s competitive edge isn’t just its reach across industries, it’s how the organization aligns people, governance and long-term thinking across everything it builds and operates.

3 Feb 2026

1:31PM

Villar denies insider trading rap: ‘I have never engaged in illegal practices’

Manny Villar on Tuesday forcefully rejected allegations surrounding Villar Land Holdings Corp., stressing that he has never engaged in illegal practices meant to defraud customers or investors, as a complaint filed by the Securities and Exchange Commission moves to the Department of Justice for review.

1 Dec 2025

2:54PM

WINNING | SM boosts regional stature with stricter ESG reporting

SM Investments Corp. is sharpening its regional competitiveness by intensifying its sustainability reporting practices, aligning more closely with emerging global disclosure rules that investors and regulators are rapidly adopting.

19 Nov 2025

4:44PM

San Miguel Corp. grows nine-month core profit as revenues hit P1.1 trillion

Conglomerate San Miguel Corp. lifted nine-month core net income by 54 percent to P60.30 billion as efficiency improvements across food, beverages, power, and infrastructure offset pressure in fuel and oil.

17 Nov 2025

4:00PM

SMC nine-month 2025 profits surge on valuation gains, core strength

San Miguel Corp., led by tycoon Ramon S. Ang, delivered a strong profit rebound in the first nine months of 2025, with consolidated net income increasing P41.55 billion.

17 Nov 2025

3:17PM

Ayala Corp deepens CP AXTRA alliance as it targets Thailand diversification

Ayala Corp., the Philippines’ oldest conglomerate, is widening its regional footprint as it moves to diversify into Thailand.