The offer covers 266.7 million Series 2 preferred shares at P75 each, with an oversubscription option of up to 133.3 million shares.

The offer period will run from Oc.t 13-17, 2025, with listing on the Philippine Stock Exchange to follow.

Assuming the oversubscription option is fully sold, SMC’s deal would top Ayala Corp.’s P20 billion preferred share sale in June and Filinvest Development Corp.’s P8 billion offer earlier this month.

Proceeds tied to debt, airport projects

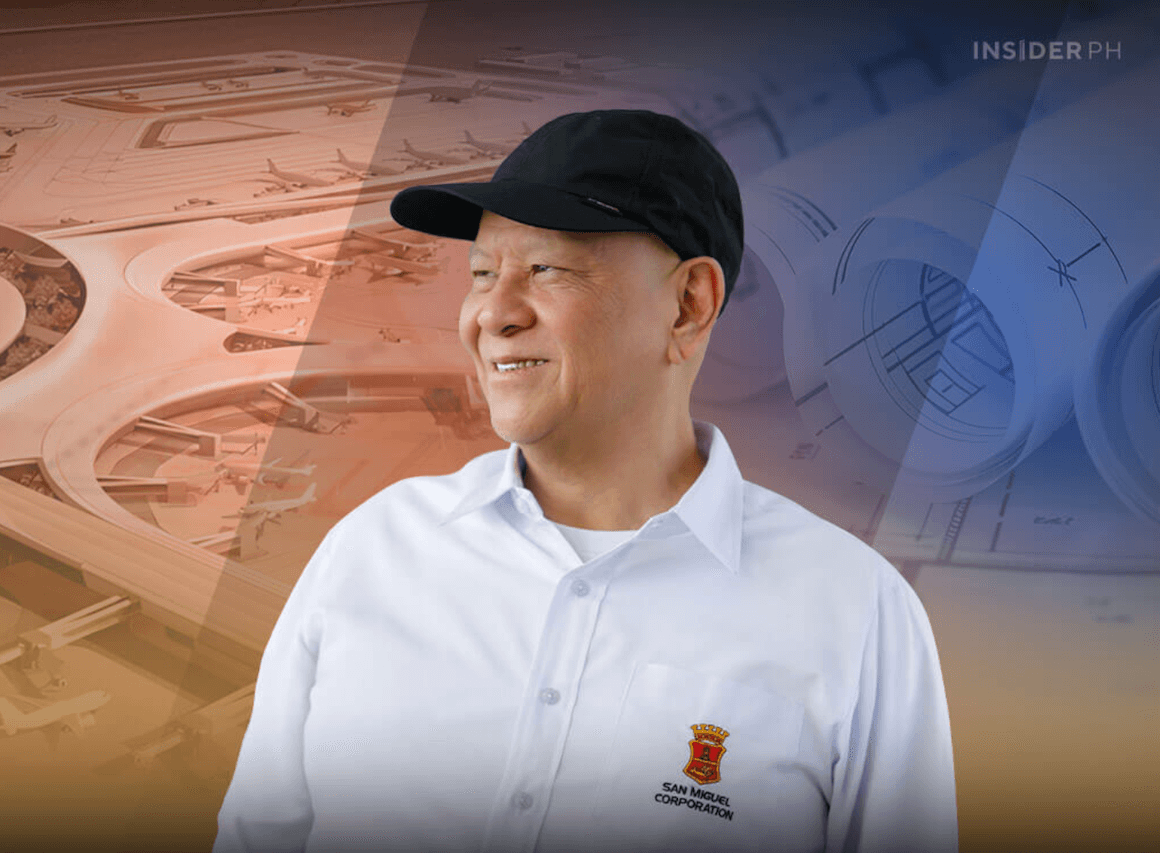

According to SMC, most of the proceeds will go to refinance P16.75 billion in Series 2-F preferred shares due on September 21, 2025, while part will fund the redemption of Series 2-J and 2-K shares and investments in the Bulacan airport and tollways.

SMC issued the Series 2-J and 2-K in 2020, and holders who do not join its voluntary exchange offer will see them redeemed on Oct. 29 and Dec. 10, 2025, respectively.

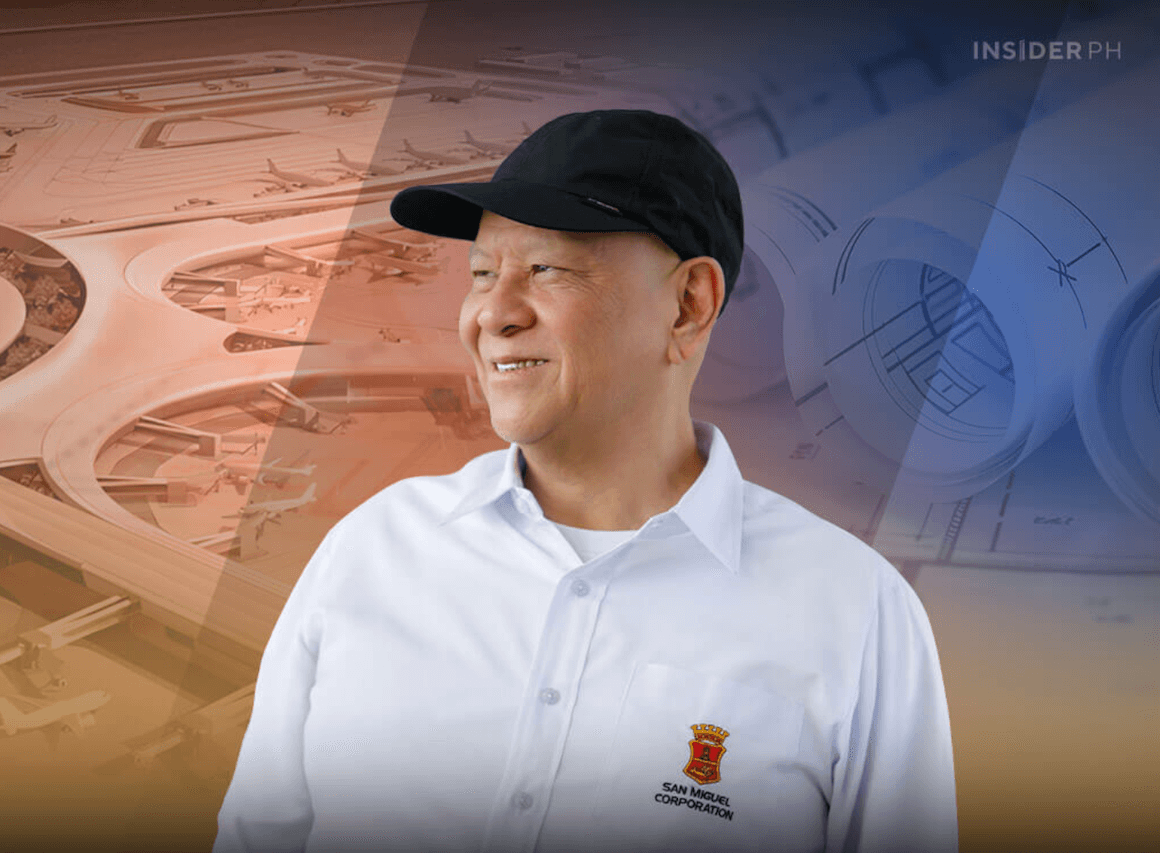

Largest issuer in diversified industries

The conglomerate runs one of Philippines’ biggest diversified groups, with operations in food, beverages, power, fuels, and infrastructure.

Dividend rates for the new Series 2-S, 2-T, and 2-U preferred shares are not yet finalized and will be set prior to the listing.

Supporting banks for the offer

Joint issue managers

• Bank of Commerce

• BDO Capital & Investment Corp.

• PNB Capital & Investment Corp.

Joint Lead underwriters and bookrunners

• BPI Capital Corp.

• China Bank Capital Corp.

• Land Bank of the Philippines

• Philippine Commercial Capital Inc.

• RCBC Capital Corp.

• Security Bank Capital Investment Corp.

• PNB Capital & Investment Corp.

—Edited by Miguel R. Camus