Third-quarter earnings climbed 8 percent to P12.8 billion, underscoring the resilience of consumer spending and foot traffic across its retail portfolio.

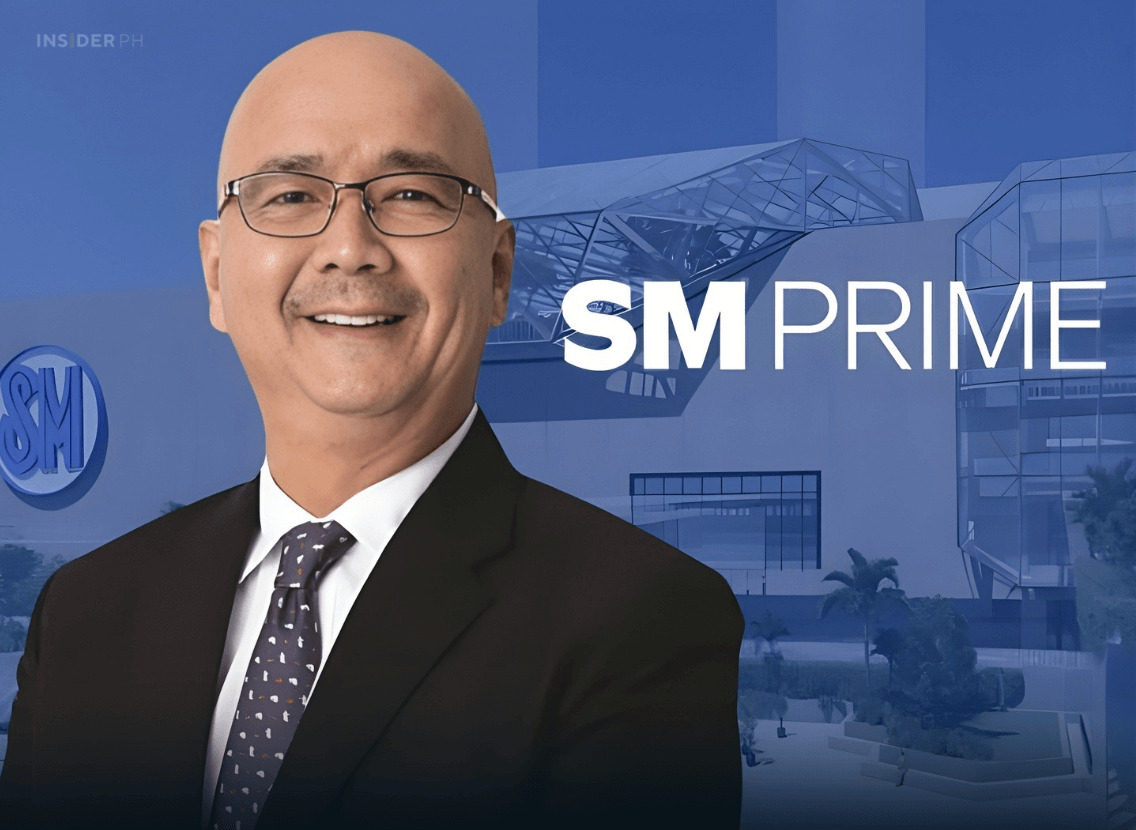

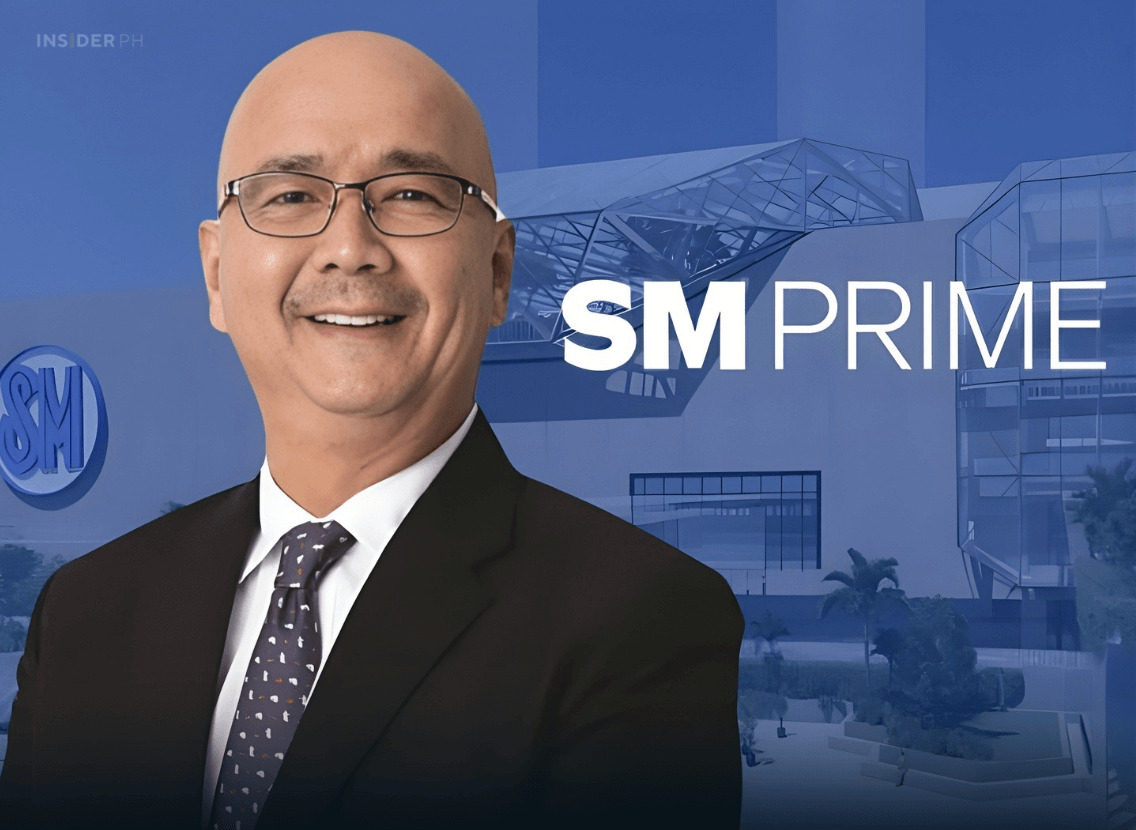

Management’s view

“Our malls remain strong anchors for growth,” said SM Prime president Jeffrey C. Lim.

“Their performance was driven by regional expansion, the upgrading of flagship malls, and the introduction of more experiential retail and dining concepts,” he added.

Malls contribute over half of revenue

Total revenues for the period rose 4 percent to P103.4 billion, with malls contributing 59 percent, or P61 billion, up 7 percent from last year.

The residential segment brought in P32.6 billion, down 2 percent due to slower recognition from mid-segment projects, while hotels and convention centers led growth with a 9-percent increase to P6 billion on the back of strong MICE bookings.

Offices and warehouses remained steady at P4 billion, affected by temporary tenant relocations during renovation works.

Tempered residential segment

“The residential and office segments were tempered by macroeconomic conditions, but recovery initiatives are underway,” Lim added.

Capital expenditures reached P59.3 billion, up 11 percent, as SM Prime pushed forward with new malls, housing projects, and estate developments.

The group maintained a net debt-to-equity ratio of 46:54 and an interest coverage ratio of 7.1 times, reflecting solid financial discipline.

—Edited by Miguel R. Camus