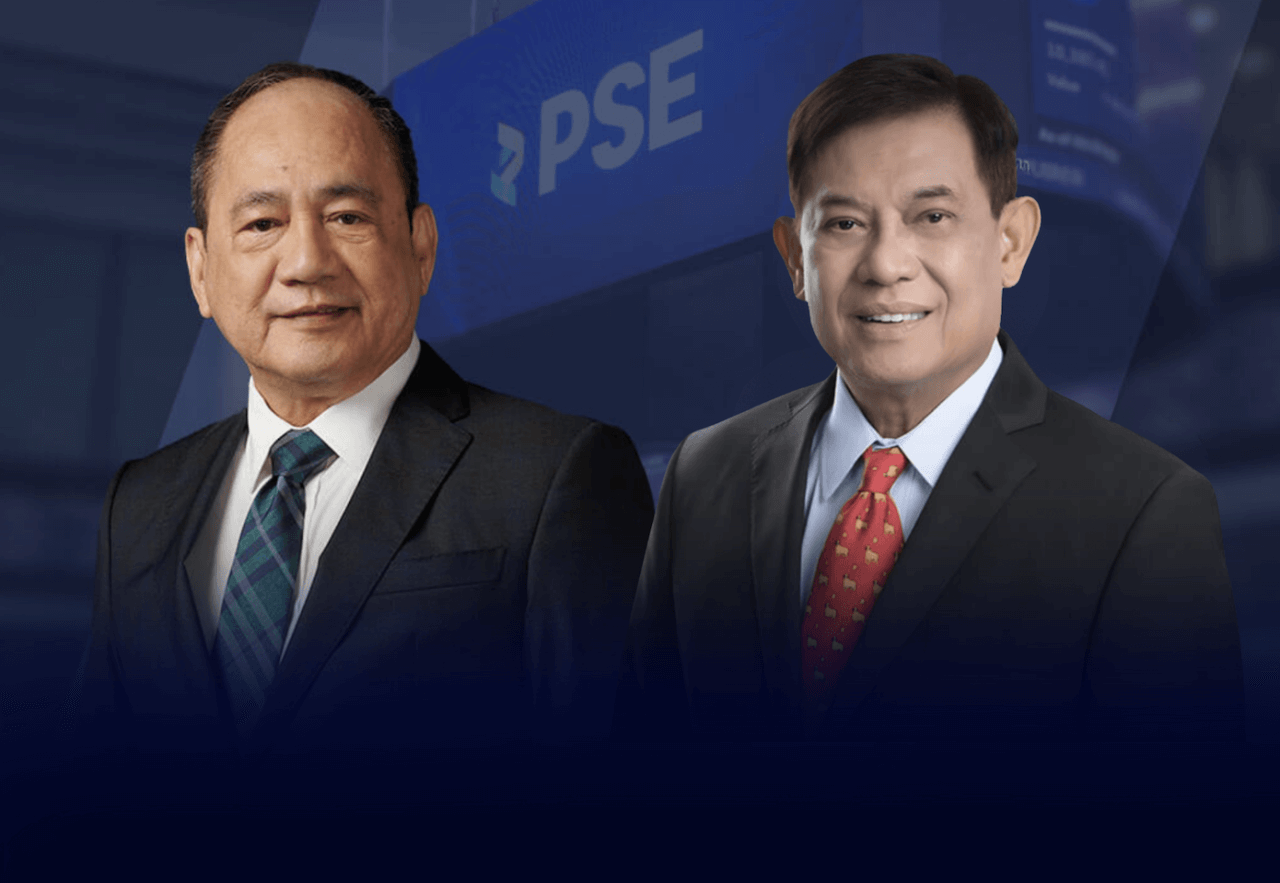

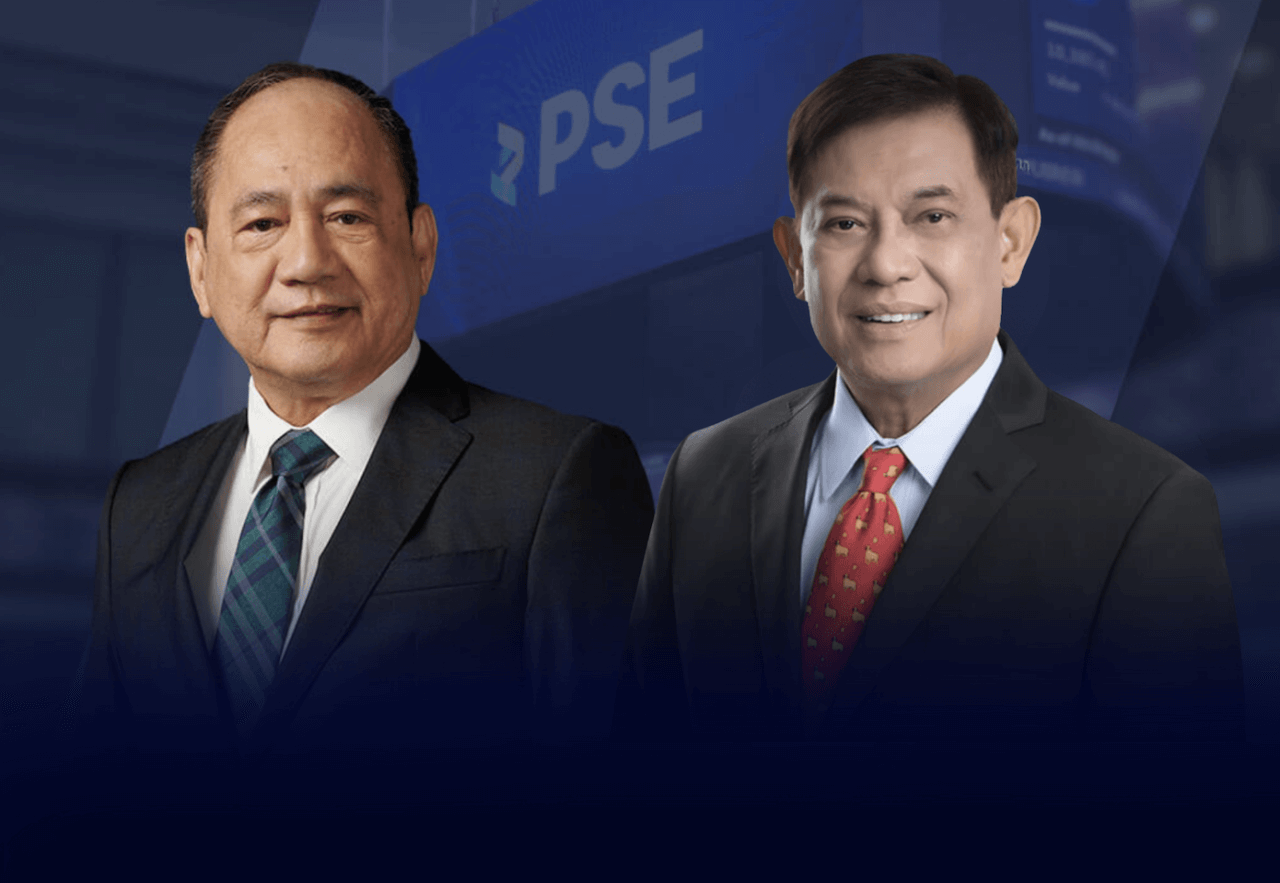

These were among the obstacles discouraging small to medium-sized enterprises (SMEs) from listing, PSE President Ramon Monzon said during a recent panel discussion with Bloomberg News.

“We are in the process of reviewing our disclosure rules,” Monzon said.

“I told my team we do have a responsibility to provide investment protection but disclosure violations really have no impact to investors, like disclosure of share transfers. I think we should lighten up on that,” he said.

“And perhaps, for SMEs, if they have some disclosure violations, don’t penalize them in the first or second instance, to give them chances,” he added.

SEC backs PSE move

SEC Chair Francis Ed. Lim said he supports easing rules, especially minor breaches.

“That’s a good move and we agree with it,” he told reporters on the sidelines of the panel discussion.

“I think what’s been happening is one size fits all. But as President Mon [Monzon] mentioned, these are disincentives for small companies to go public,” he said.

Lim also stressed that easing rules on minor disclosure lapses will not weaken safeguards, especially against firms that deliberately mislead investors or exploit loopholes.

He said this should be undertaken as part of a thorough review of all disclosure rules.

“Fortunately, we have some practices in other exchanges and other markets that we can study,” he said. “It can be done and it’s already being done elsewhere,” he added.

Less tax burden?

During the panel discussion, Monzon also talked about a joint initiative with the SEC to address listing issues and enlist the support of the Bureau of Internal Revenue.

He said small family-run firms often struggle with the weight of both accounting and tax requirements.

“We are going to be approaching our tax authorities if they can come up with a program for low priority audit for companies like this,” he said.

This will give small firms more breathing room while preparing for a public listing.

For Lim, this is also part of the SEC's role in promoting ease of doing business.

"Yesterday I received data of the trading value of the Asean Exchanges. Vietnam had had $34.1 billion, we have $3.2 billion," he said.

"It’s even overtaking Singapore, Thailand and Indonesia," he added.

IPO deferrals

IPOs have slowed for both large and small firms, even as the bourse had previously eased listing requirements for SMEs.

The move comes as the PSE is expecting just two IPOs this year (Top Line Business Development Corp. and Maynilad Water Services) against three to four delistings.

IPO candidate Hann Holdings announced the deferral of its P13-billion offer while GCash parent firm Mynt signaled delays in its proposed listing.

Miguel R. Camus has been a reporter covering various domestic business topics since 2009.