Tuesday, 3 March 2026

9 Feb 2026

12:18PM

GCash operator keeps IPO option open, timing still undecided

GCash operator Mynt remains open to an initial public offering that could rank among the country’s largest listings, but a decision on timing has not been made.

22 Jan 2026

5:15PM

SEC to revisit ‘small IPO’ definition to boost SME listings

By: Miguel R. Camus

The Securities and Exchange Commission is raising the bar for what counts as a “small IPO” in a bid to bring more companies back to the market.

21 Jan 2026

11:19AM

Wildflour eyes IPO beyond 2026 as it gears up for biggest store rollout yet

By: Miguel R. Camus

The Wildflour Group is embarking on its most aggressive store rollout since its founding over a decade ago with plans to open up to 20 new branches this year as it works toward a potential public debut on the Philippine Stock Exchange beyond 2026.

6 Jan 2026

3:40PM

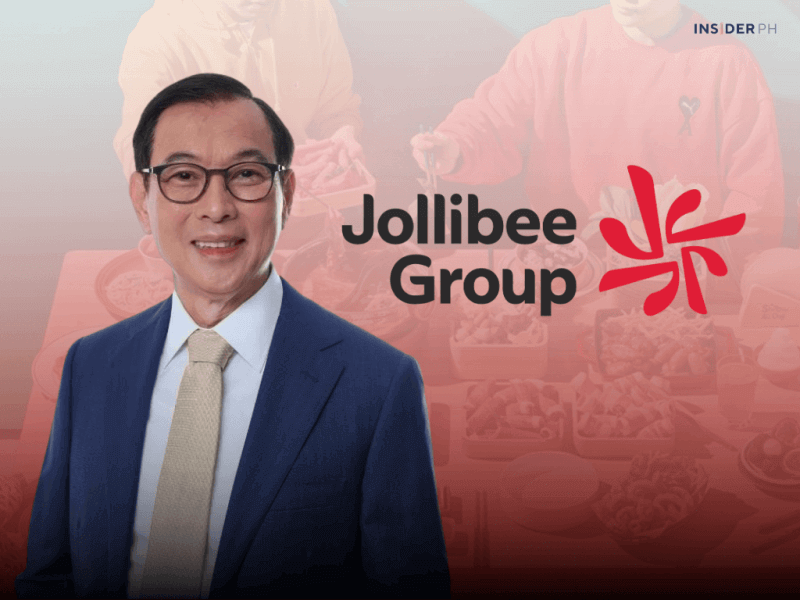

From Manila to Wall Street: Jollibee eyes the world’s biggest stock market

By: Miguel R. Camus

Two decades after its first overseas acquisition, the Jollibee Group is getting ready to realize the value of its fast-growing international business.

7 Nov 2025

11:55AM

‘We made the right decision’: Maynilad’s P34-B IPO oversubscribed 2.7 times

Amidst a sluggish market and investor wariness, Maynilad Water Services Inc. (MYNLD) surged to one of the year’s most sought-after listings, with its landmark initial public offering oversubscribed 2.7 times.

President Marcos Jr. to ring PSE bell for Maynilad’s landmark P34-B IPO

6 Nov 2025

9:51PM

Maynilad IPO shares on sale from Oct. 23–29 with IFC, ADB, and top local banks backing P34-B deal

23 Oct 2025

6:23PM

New IPO to make waves: Maynilad eyes P34-B debut, second-biggest in Philippine history

21 Oct 2025

1:14PM

29 Oct 2025

12:04PM

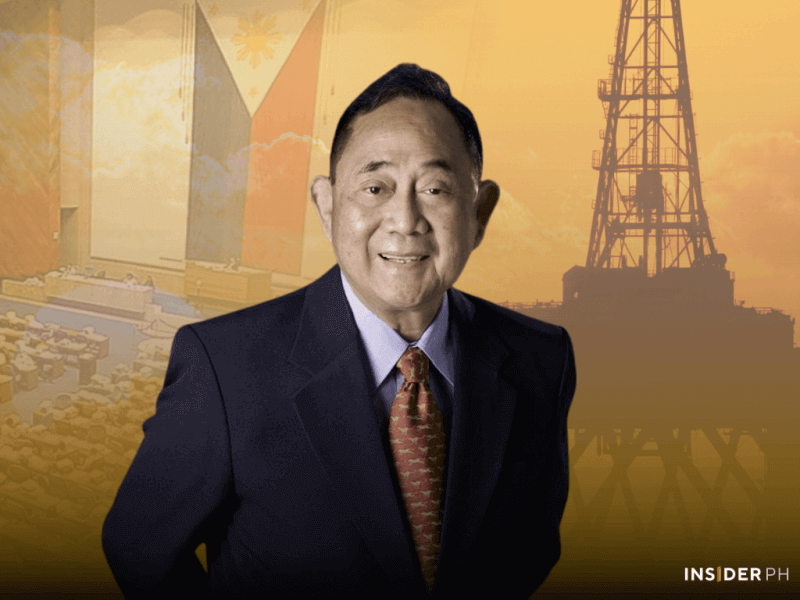

Leviste sells P13.8-B SPNEC stake to MVP-led Meralco’s renewable unit MGreen

Billionaire congressman Leandro Leviste has completed the sale of P13.76 billion worth of shares in SP New Energy Corp. (SPNEC) to the group of tycoon Manuel V. Pangilinan, cementing the latter’s control of one of the country’s largest solar operators.

28 Oct 2025

8:57AM

IPO ready: GCash parent Mynt secures SEC nod for stock split

GCash operator Globe Fintech Innovations Inc. (Mynt) has secured final approval from the Securities and Exchange Commission for its stock split, a key structural move seen as laying the groundwork for one of the country’s most anticipated initial public offerings.

23 Oct 2025

5:41PM

Maya Stocks makes IPO investing simple for first-time users

Maya Philippines Inc. is simplifying access to initial public offerings (IPOs) through Maya Stocks, a feature within its finance app that allows first-time investors to participate in the stock market digitally and securely.

22 Oct 2025

3:39PM

GCash adds IPO feature on GStocks PH for retail investors

As more Filipinos explore ways to grow their money, GCash is expanding its investment offerings with a new IPO subscription feature on GStocks PH, operated by AB Capital Securities Inc.