The deals were structured under MUFG’s sustainable trade asset finance framework, which aligns with international sustainability principles and the bank’s Net Zero Commitment by 2050.

“We are proud to partner with industry leaders San Miguel Group and SN Aboitiz Power in driving the Philippines’ renewable energy agenda forward,” said Marie Diana Lynn Singson, Deputy country head and head of global corporate banking for MUFG Manila Branch.

“These transactions have further demonstrated their strong drive for positive climate action, while also reaffirming MUFG’s efforts in partnering clients to pursue their sustainability agendas,” she added.

What the deal does

MUFG issued standby letters of credit (SBLCs) in favor of the Department of Energy to secure the companies’ performance obligations, adding financial assurance that committed projects will be delivered.

For SMGP, the SBLC facilities support a combined 1 gigawatt of capacity tied to floating solar and hydropower commitments.

For SN Aboitiz Power, MUFG issued an SBLC for its 50-megawatt floating solar project, which MUFG said is the company’s first green trade facility.

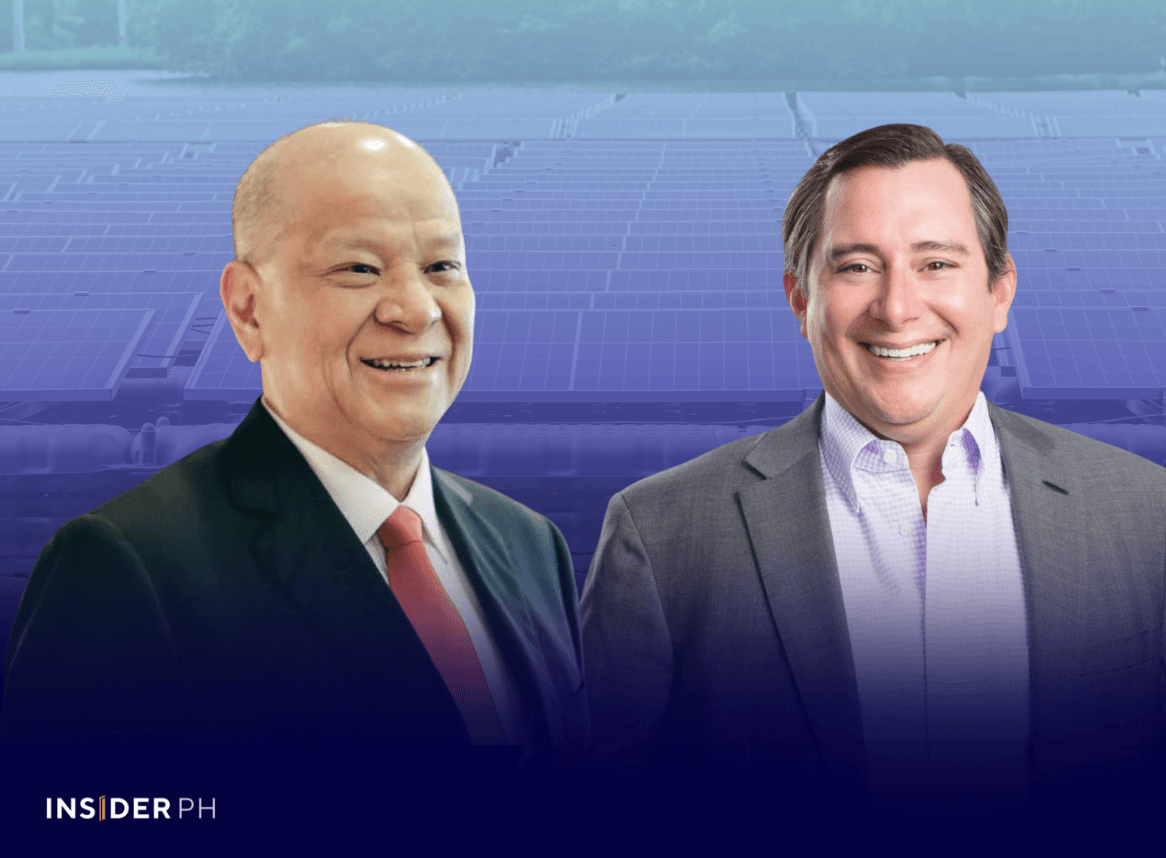

“As our nation pursues continued growth and development in the coming years and decades, our country’s energy requirements will also expectedly grow,” said Ramon S. Ang, chair and CEO of San Miguel Corp.

Big players, big renewables

“As we invest in and build infrastructure that will serve current and future generations, the need to balance our country’s energy needs, with the need to protect our environment, becomes even more critical. We are grateful to MUFG for supporting SMGP’s greater push for increased renewable capacities, to benefit Filipinos and economy,” Ang added.

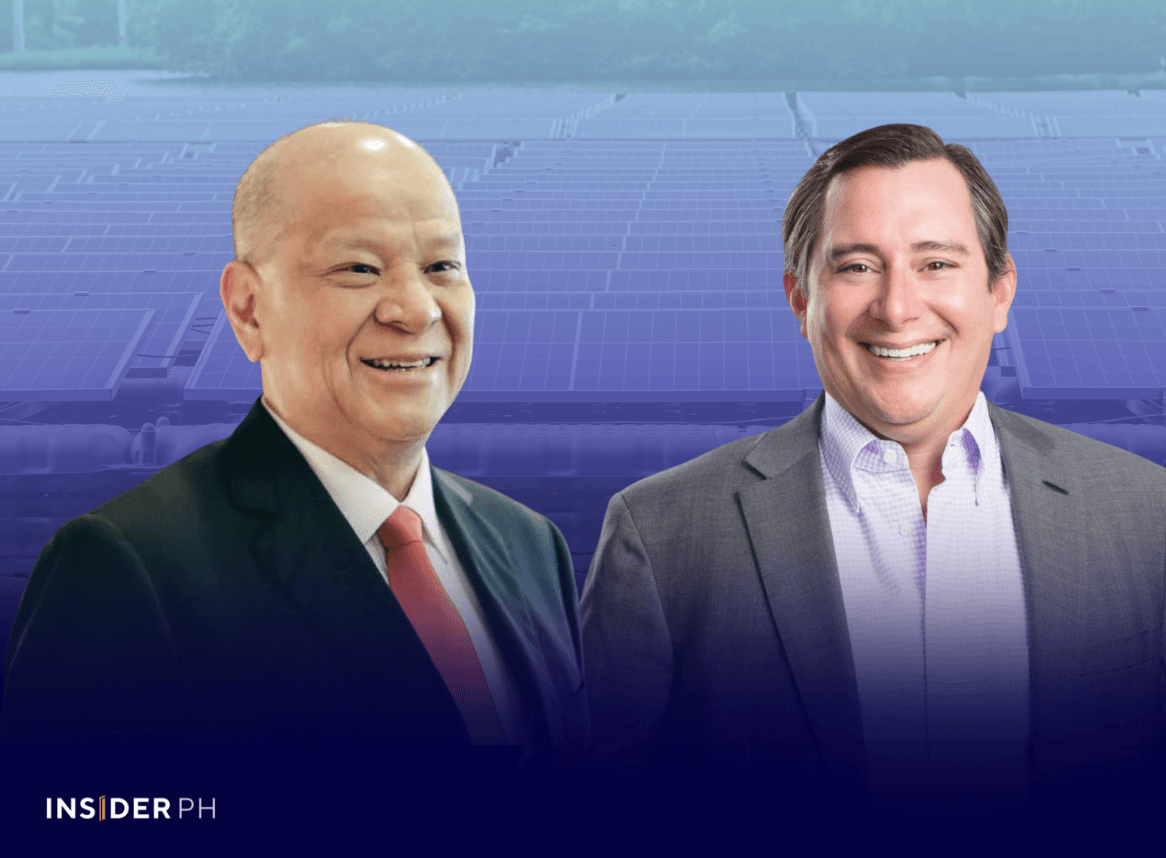

“We welcome MUFG’s partnership in supporting sustainable financing solutions that help advance our renewable energy projects in support of the Philippines’ energy transition,” said Joseph Yu, group president and CEO of SN Aboitiz Power.

—Edited by Miguel R. Camus