It is currently finalizing the program guidelines, systems integration, and partnerships with participating banks.

Strategic policy guidance

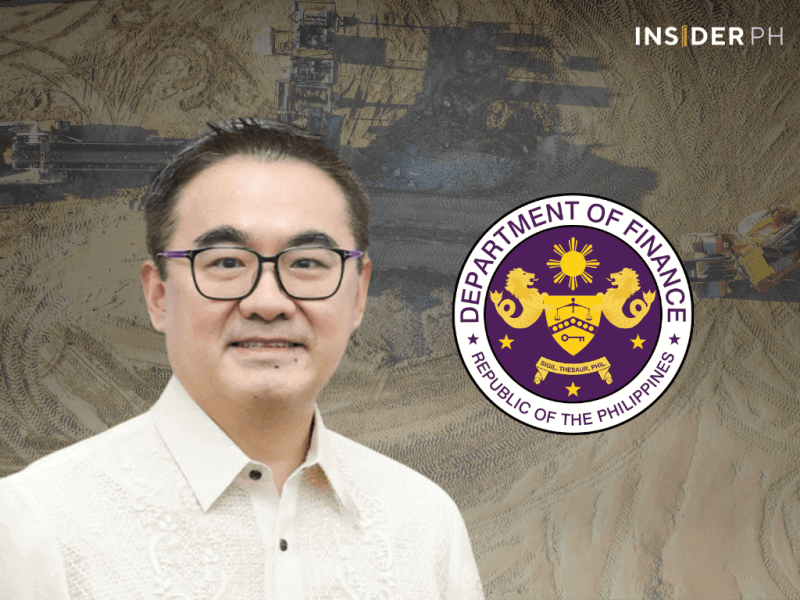

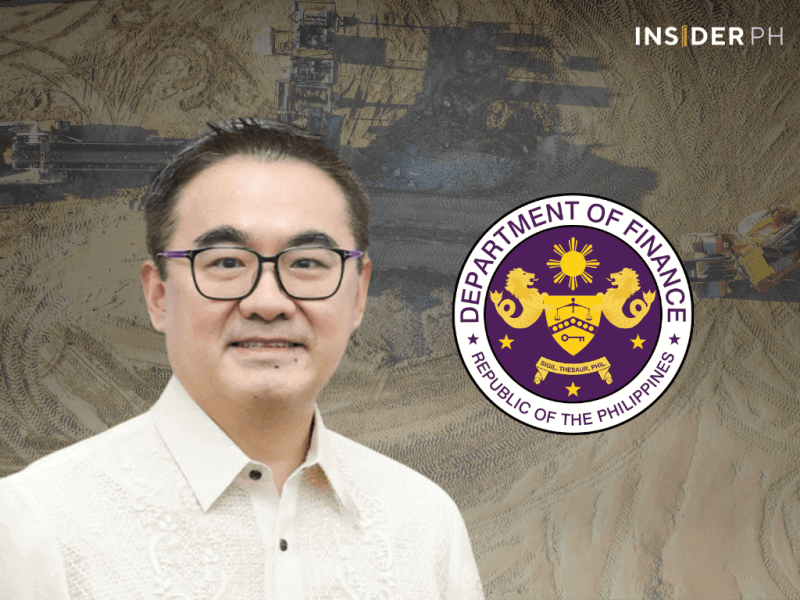

Finance Secretary and Social Security Commission Chair Frederick D. Go said in a press statement that the initiative reflects the Marcos administration’s push to strengthen social protection while shielding Filipinos from high-cost informal lending.

“Through the proposed SSS Micro-Loan Program, we are addressing the immediate cash needs of members by offering small, short-term loans at reasonable rates and with flexible repayment options,” Go said.

“This program will help steer members away from loan sharks and other high-cost, predatory lending schemes, while promoting responsible borrowing,” Go added.

Digital platform delivery

Under the proposed framework, the SSS will partner with participating banks and financial institutions to implement the program through their digital platforms, allowing members to access loans quickly and conveniently.

The digital-first approach is also expected to improve efficiency and reduce operational risks associated with traditional lending channels.

Loan program features

The proposed micro-loan facility will offer loan amounts ranging from P1,000 to P20,000, depending on a member’s average monthly salary credit.

Repayment terms will range from 15 to 90 days, with an interest rate set at 8 percent per annum, or about 0.67 percent per month, positioning the loans as a lower-cost alternative to informal credit.

Eligibility requirements set

The program will be open to eligible SSS members aged 18 to under 65 years old, with at least 12 paid monthly contributions and no pending or settled retirement, total disability, or death benefit claims.

Members with existing SSS loans may still qualify, subject to program limits.

“This micro-loan program reflects our continued commitment to strengthening social protection and advancing financial inclusion for all Filipinos,” Go said. —Ed: Corrie S. Narisma