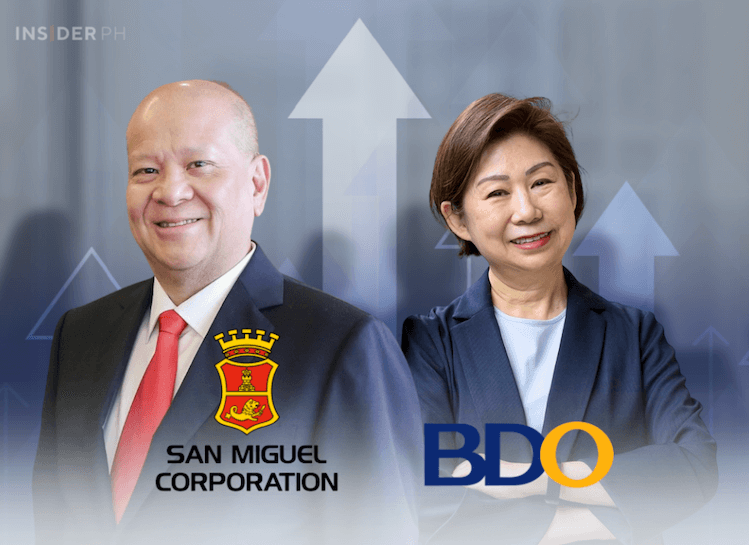

Bond buyers piled into BDO’s latest offer, which combined a robust yield of 5.875 percent, a relatively short 1.5-year tenor, and the security of backing from the country’s largest bank.

The deal was arranged by ING Bank N.V., Manila Branch, with BDO and ING acting as selling agents, while BDO Capital & Investment Corp. served as financial advisor.

“People want safe investments and the BDO bonds answered that,” Eduardo Francisco, president of BDO Capital, told InsiderPH.

“We had to cut short offer after four days as demand overwhelming across the whole country,” he added.

Big picture

Investors are flocking to fixed income investments like bonds over stocks as the benchmark Philippine Stock Exchange Index trades lower by 3 percent since the start of 2025.

The PSE, which now controls the fixed-income exchange after taking over a majority stake in PDS Holdings, is projecting about P186 billion in stock market fundraising this year, PSE president and CEO Ramon Monzon said last July 12.

This is already eclipsed by the bond market, with BDO’s historic high raise now bringing total bond listings and enrollments on the Philippine Dealing & Exchange Corp. to an estimated P327 billion.

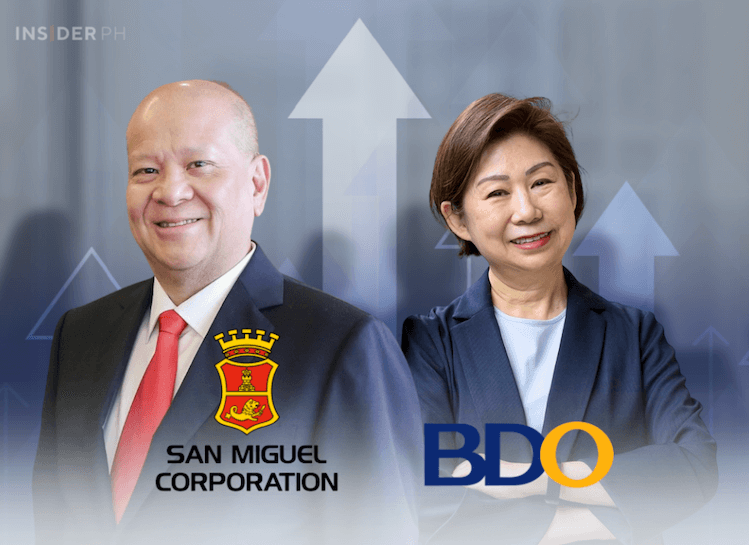

SMC remains the largest issuer of preferred shares, an equity instrument that pays fixed dividends and carries bond-like income features.

For common shares, the biggest sale remains Monde Nissin’s P48.6 billion initial public offering in 2021, according to Alfred Benjamin R. Garcia, research head at AP Securities.

SMC leads prefs, Monde holds IPO crown

SMC remains the largest issuer of preferred shares, an equity instrument that pays fixed dividends and carries bond-like income features.

For common shares, the biggest sale remains Monde Nissin’s P48.6 billion initial public offering in 2021, according to Alfred Benjamin R. Garcia, research head at AP Securities.

Bond market royalty

BDO’s offer topped its own bond record when it raised P63.3 billion at the start of 2024 and sold another P55.7 billion worth of bonds in July 2024.

The next-largest offer this year is Bank of the Philippine Islands’ Supporting Inclusion, Nature, and Growth (SINAG) Bonds, which raised P40 billion last June 10.

BDO’s latest bond issue, oversubscribed 23 times, will fund and refinance assets under its Sustainable Finance Framework while supporting lending growth and diversifying funding sources.

Miguel R. Camus has been a reporter covering various domestic business topics since 2009.