Insider Spotlight

Why it matters

The Monetary Board sets the direction of monetary policy, including interest rates, liquidity conditions, and financial system oversight. Having the sitting finance secretary as the Cabinet representative ensures that fiscal realities such as government spending, revenue performance, and debt management are factored into central bank deliberations.

This coordination is especially important as policymakers seek to sustain economic growth while keeping inflation and financial risks in check.

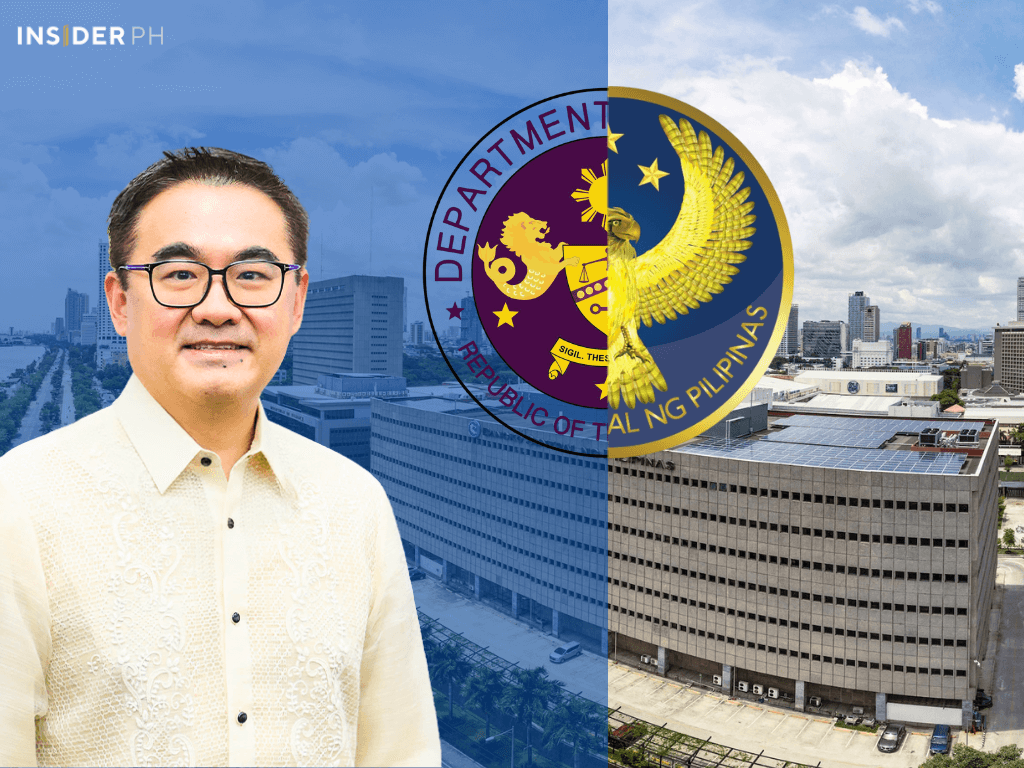

Go was designated by President Ferdinand Marcos Jr. to the BSP’s policy-making body, replacing former Finance Secretary and now Executive Secretary Ralph Recto.

His appointment comes as the government balances infrastructure spending, investment promotion, and social programs against tighter global financial conditions and shifting domestic demand.

The policy context

Monetary and fiscal authorities operate independently, but their actions are closely intertwined. Interest rate decisions affect borrowing costs for government and businesses, while fiscal policy influences inflation, liquidity, and overall economic momentum.

With Go sitting on the Monetary Board, the Department of Finance gains a direct voice in discussions that shape credit conditions and market expectations.

This matters for investors and businesses, who closely watch signals from both the BSP in terms of interest rate policy and the economic team.

Clearer alignment between fiscal priorities and monetary policy can help reduce uncertainty, support investor confidence, and improve the effectiveness of policy responses to economic shocks.

What Go brings

Before becoming finance secretary, Go served as Special Assistant to the President for Investment and Economic Affairs, where he coordinated the government’s economic and investment agenda and chaired the Economic Development Group.

That role required close collaboration with agencies responsible for planning, budgeting, trade, and investment promotion, experience that now feeds directly into Monetary Board discussions.

His extensive private-sector background, including as chief executive officer of Robinsons Land Corp. and leadership roles across banking, finance, aviation, and energy, adds a market-oriented perspective to the board’s policy debates. This can be valuable as the BSP weighs the real-world impact of policy decisions on businesses and capital flows.

The bottom line

Go’s presence on the Monetary Board reinforces the administration’s push for coherent economic policymaking. At a time when inflation risks, growth targets, and fiscal discipline must be carefully balanced, closer coordination between the finance department and the central bank could shape how effectively the Philippines navigates its economic challenges in 2026 and beyond. —Daxim L. Lucas | Ed: Corrie S. Narisma