Friday, 27 February 2026

14 Feb 2026

2:08PM

Metrobank sees 25-bp BSP rate cut on Feb. 19

Slowing economic momentum is expected to take center stage at the Bangko Sentral ng Pilipinas’ (BSP) monetary policy meeting on Feb. 19, with Metrobank projecting a 25-basis-point rate cut to support domestic growth.

8 Jan 2026

4:12PM

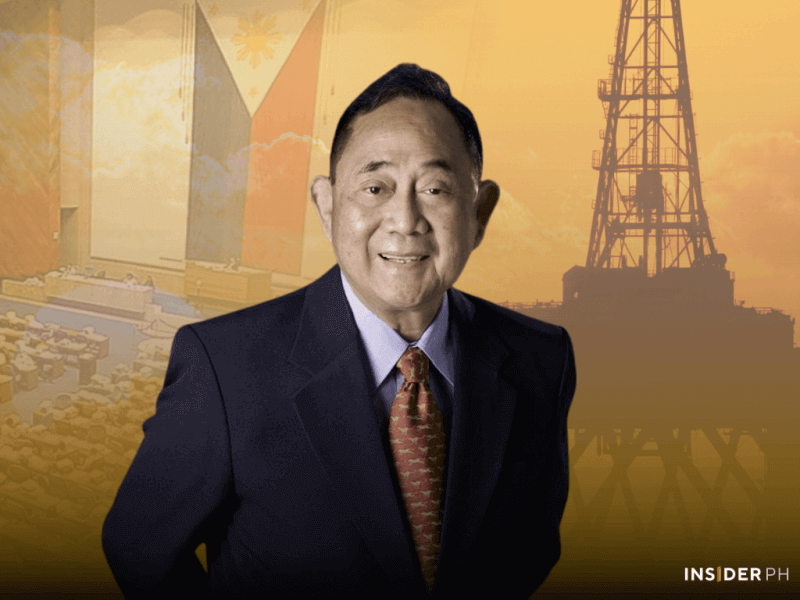

Why Finance Secretary Go’s Monetary Board role matters now

Finance Secretary Frederick Go’s entry into the Monetary Board of the Bangko Sentral ng Pilipinas is more than a routine leadership change. It strengthens the policy bridge between Malacañang’s fiscal agenda and the central bank’s monetary decisions at a time when alignment between the two has become increasingly critical.

6 Jan 2026

4:18PM

Waiting for cheaper loans? Don’t bet on big BSP rate cuts this year

By: Daxim L. Lucas

Bangko Sentral ng Pilipinas Governor Eli Remolona Jr. on Tuesday signaled limited room for further policy rate adjustments in 2026 despite a benign inflation rate environment, reiterating the regulator’s mantra that any adjustment will be data dependent.

10 Nov 2025

3:53PM

Foreign investment plunge continues: Philippines' eight-month FDI drops

The Philippines' net foreign direct investments (FDI) in August 2025 recorded a sharp decline, signaling persistent headwinds for capital inflows despite remaining positive. Data from the central bank show that net FDI inflows amounted to $494 million in August 2025 — a 40.5-percent drop from the $830 million recorded in August 2024.

29 Oct 2025

5:08PM

Peso rebounds after record low, seen stabilizing near P59 per USD

The local currency opened at P59.15 and touched a record intraday low of 59.26, but strengthened as market participants locked in profits from the peso’s historic fall.

14 Oct 2025

11:41AM

BSP warns demonetization won’t curb corruption, urges reforms instead

The BSP cited India’s 2016 demonetization as a cautionary tale. The move abruptly invalidated 86 percent of India’s cash, aiming to curb graft and fake currency. Instead, it caused widespread economic disruption—closing small businesses, cutting jobs, and shaving about two percentage points off GDP.

9 Oct 2025

3:47PM

Corruption-induced economic weakness prompts 4th straight BSP rate cut

The central bank chief cited a “benign” inflation outlook that remains well within its target range and said inflation expectations “remain well-anchored.” With price pressures easing, policymakers saw room to support economic activity without threatening price stability.

19 Sep 2025

4:13PM

BSP’s P500,000 daily withdrawal cap may disrupt cash-reliant firms

By: Daxim L. Lucas

While the BSP’s move would likely target anti-money laundering and fraud risk management, the unintended consequence is a liquidity squeeze on cash-reliant but legitimate businesses. Unless paired with robust digital payment alternatives and financial inclusion measures, the cap risks disrupting day-to-day commerce, particularly outside Metro Manila.

17 Sep 2025

9:22AM

BSP tests new anti-scam law in flood control corruption probe

The central bank said it is applying the Anti Financial Account Scamming Act (RA 12010), which took effect in June, to track potential “money muling” — the use of bank accounts to move or conceal criminal proceeds.