The PSEi slumped 1.78 percent to 6,000.32 on Monday, bringing losses since the start of the year to about 8 percent.

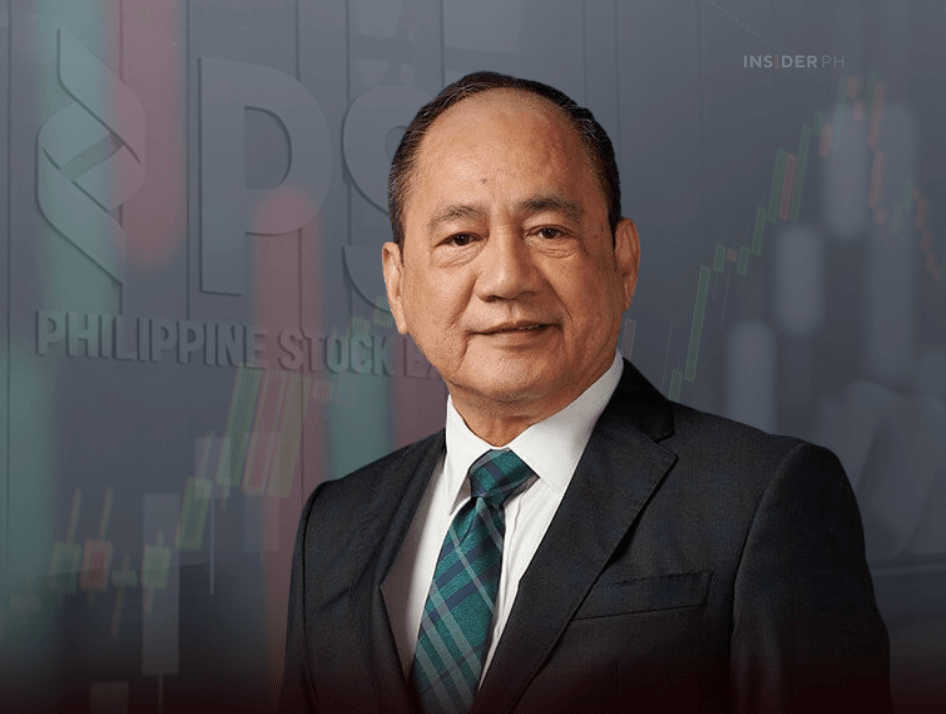

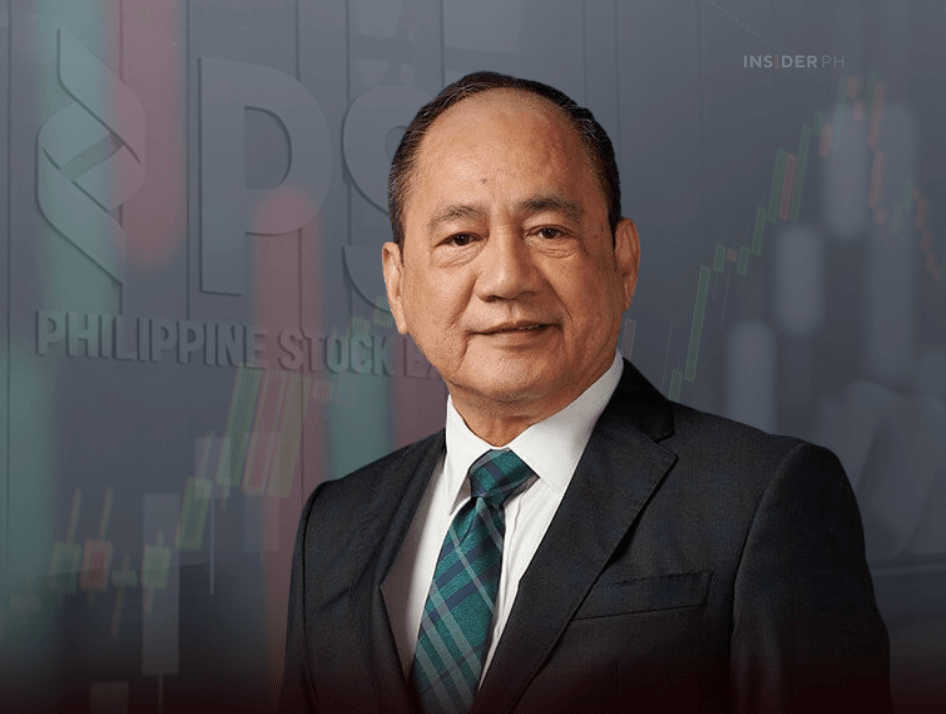

PSE president Ramon Monzon warned in an interview with Bloomberg News that the market’s retreat could accelerate if uncertainty lingers.

Monzon, who joined the large-scale anti-corruption rally at the People Power Monument last Sept. 21 with offices and employees of the Exchange, emphasized the need for a prompt and credible resolution to the investigations to restore investor confidence.

“Until foreign investors see clarity in the results of the investigation, they will continue to price in risks in our market,” Monzon said in an interview with Bloomberg.

“A swift, credible and all encompassing” investigation and prosecution are “very important,” he said.

AP Securities Inc. said on Monday the market slipped back to the 6,000 level in a broad-based decline, with nearly all index stocks in the red as risk-off sentiment persisted.

Chart-based traders will also be watching the PSEi’s recent low of 5,905.35 and whether this support zone will continue to hold.

The most actively traded stock was International Container Terminal Services Inc. (ICTSI), which slipped 0.78 percent to P508 on P904.4 million worth of trades.

Other heavyweights also fell, with BDO Unibank down 1.81 percent to P135.50, Ayala Land lower by 2.89 percent to P23.50, SM Investments easing 1.74 percent to P732, and Bank of the Philippine Islands dropping 3.89 percent to P108.60.