The Philippine Stock Exchange ordered a trading suspension on Thursday since this would trigger its rules on backdoor listing, a process that allows a private entity to become publicly listed without going through an initial public offering.

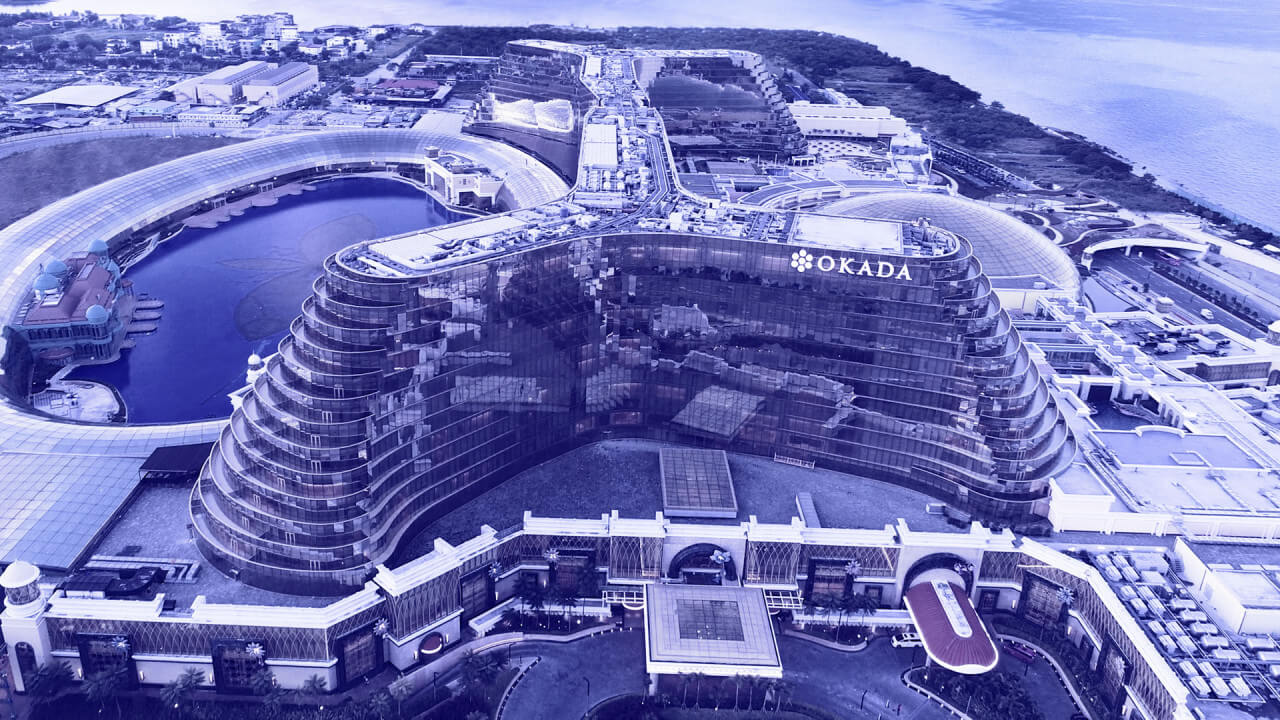

The deal involves issuing 918 million shares at P4.70 each in exchange for 94,144 square meters of land owned by Eagle 1 Landholdings Inc., which is partly owned by the Okada Group.

“The real properties are adjacent to the Okada Integrated Casino Resort,” Ferronoux said in a stock exchange filing on Thursday.

Talks over a possible property backdoor listing were first reported by InsiderPH.

“Currently, a portion of the property is being used to house the support facilities of the Okada casino complex, which will eventually be vacated once construction of the master-planned development commences,” it added.

The PSE said the trading suspension will remain in place until the company complies with the applicable requirements under its revised backdoor listing rules.

Other transactions

Ferronoux also approved a P240 million private placement with Themis Group Corp. by issuing 240 million common shares at P1 per share, payable in cash or property.

To meet the minimum public ownership requirement of the PSE, it plans to issue 300 million additional common shares through private placement although the final terms are still under review.

Finally, the board approved an amendment to increase Ferronoux’s authorized capital stock from P550 million to P2.5 billion. The company also plans to list 1.46 billion new shares on the Philippine Stock Exchange.

Leadership changes

Ferronoux disclosed the appointment of Atty. Omar Taccad as independent director and chairman of the corporate governance committee, replacing Alfred Jacinto.

Lawyer Rex Peter Raz was named director, succeeding Irving Cosiquien, while Atty. Phil Ivan Chan took over as corporate secretary from lawyer Manuel Gonzalez. Lawyer Gwyneth Ong also resigned as assistant corporate secretary.

Hot stock

Ferronoux, trading under the stock symbol FERRO, is among the top gainers with a year-to-date price surge of about 95 percent.

It last traded at P5.35 per share, valuing the company at approximately P2.7 billion.

The lingering question

For investors closely following movements, this latest development sparks curiosity about the 2019 acquisition of Asiabest Group, a shell company widely speculated to be a backdoor listing vehicle for its casino business.

The strategy was suddenly abandoned when Asiabest was sold to businessman Francis Chua’s PremiumLands earlier this month.

Why wasn’t Asiabest used as the listed vehicle for Okada’s land assets? Chalk it up to one of the market’s little enigmas.

Miguel R. Camus has been a reporter covering various domestic business topics since 2009.