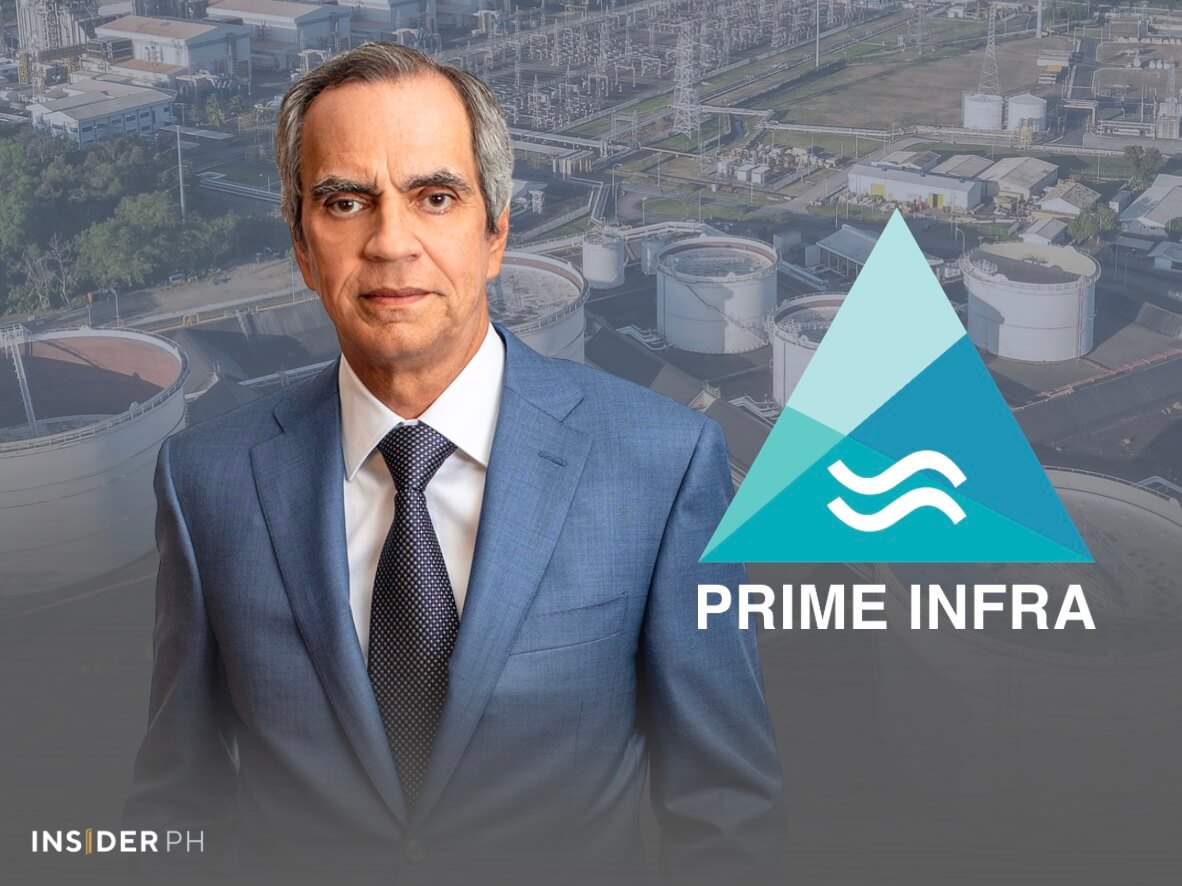

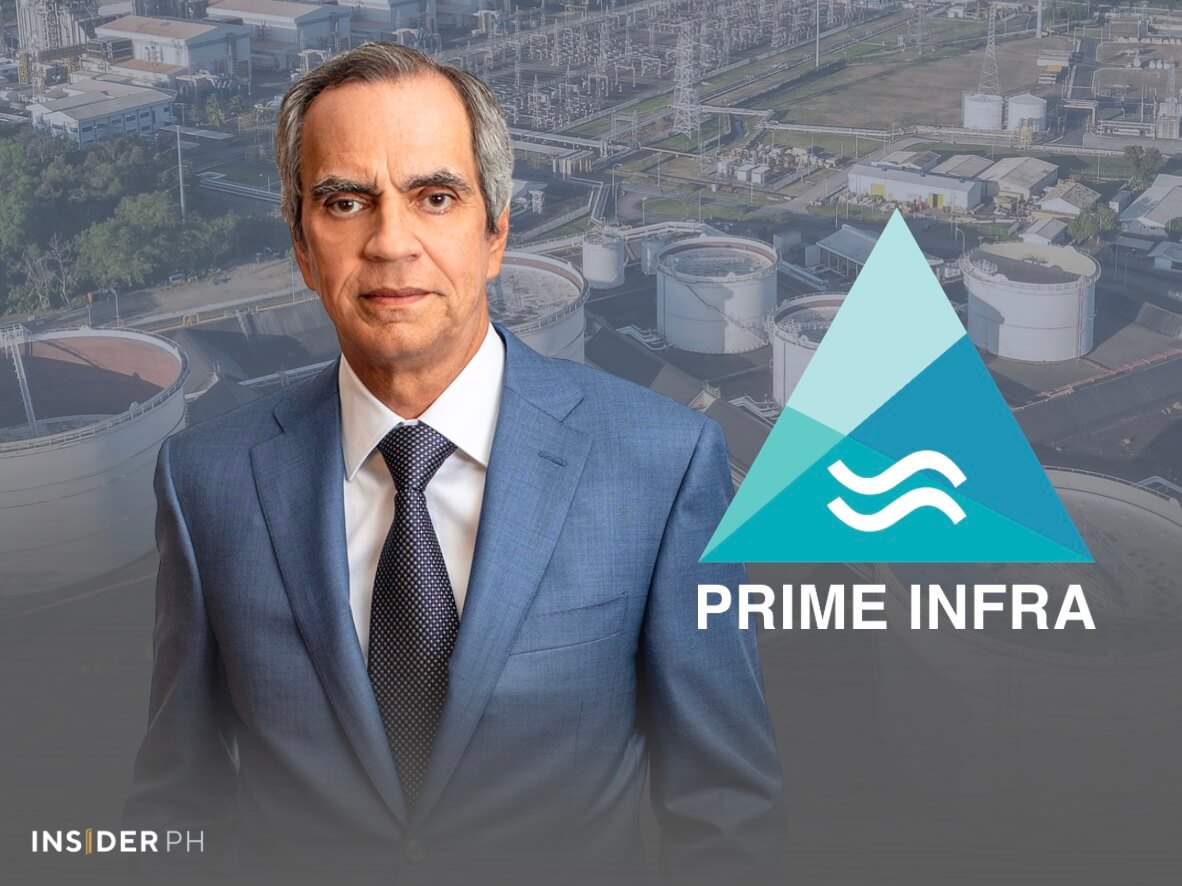

The transaction anchored investor appetite for renewable and grid-critical infrastructure and set the tone for a year dominated by energy-related deals.

Energy leads domestic deal activity

The Razon deal was followed by Meralco’s $127.6-million investment in SP New Energy Corp. and SembCorp Industries’ $77.4-million purchase of the Puente Al Sol solar farm in Negros Occidental, according to PwC Philippines, which used data provided by Mergermarket.

Together, these transactions reinforced energy and natural resources as the most active M&A sector in the Philippines.

Property and industrial deals follow

Outside power, real estate also remained on investors’ radar, with Ayala Land’s AREIT continuing to pursue selective asset infusions as part of its long-term expansion strategy.

Meanwhile, the industrial sector logged nine announced deals worth $180 million, largely centered on construction and metal-related activities.

What’s next?

Data from Isla Lipana & Co./PwC Philippines showed 74 announced deals worth $4.6 billion as of December 4, 2025, with energy and natural resources accounting for 29.7 percent of total deal volume.

With the government targeting renewables to supply 35 percent of power generation by 2030, dealmakers expect energy-led M&A momentum to extend into 2026.

“Even as investors have been strategically selective in 2025, we anticipate sustained interest in various sectors,” said PwC Philippines chair and senior partner Roderick Danao said.

“For energy, deals on renewables drove the sector last year. Clearly, investors are aligning with the government’s long-range campaign for clean energy. With this, we can hope to see a new wave of M&A activity this year, especially in the energy sector,” he added.

—Edited by Miguel R. Camus