Monday, 2 March 2026

22 Jan 2026

11:16AM

Ayala seeks P30-B shelf registration for future peso bond issues

Ayala Corp., the country’s oldest listed conglomerate, said its board approved the filing of a five-year shelf registration of up to P30 billion for potential peso bond issuances.

22 Oct 2025

9:39AM

GT Capital’s Toyota Financial Services raises P5B from maiden bond sale

Toyota Financial Services Philippines Corp. (TFSPH), the financing arm of GT Capital Holdings, successfully raised P5 billion from its maiden fixed-rate bond issuance, following strong investor demand that reached 3.5 times the initial P2-billion offer.

6 Oct 2025

2:08PM

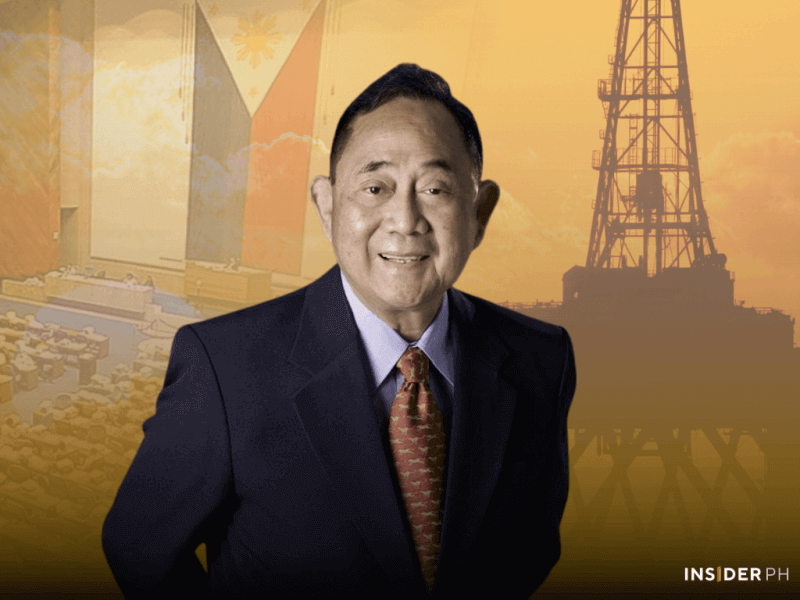

MVP-backed Metro Pacific Tollways shifts gears with P20-B bond sale amid delayed investor entry

Tycoon Manuel V. Pangilinan-led Metro Pacific Tollways Corp. (MPTC) is kicking off a massive fundraising drive, starting with a P20-billion bond sale after deferring plans to sell a significant minority stake to investors to help pare debts.

29 Jul 2025

11:27AM

Security Bank marks 74th year with fun fundraiser to build classrooms

In celebration of its 74th anniversary, Security Bank Corp. rallied more than 1,000 employees and their families in a purpose-driven campaign to support public school education through the Security Bank Foundation Inc. (SBFI).

4 Jun 2025

9:30AM

UnionBank launches P10-B bonds after redeeming debt ahead of costly reset

By: Miguel R. Camus

The Aboitiz family-led Union Bank of the Philippines is raising at least P10 billion, tapping the debt market anew with a fresh offering of 1.5-year and 3-year peso bonds, priced at 5.88 percent and 6.02 percent per annum, respectively.

24 Apr 2025

9:50PM

Ayala Land plans to raise P55B in debt, aims to grow 2x faster than the economy

By: Miguel R. Camus

Property giant Ayala Land Inc. is borrowing P55 billion this year to pay off old debts and bankroll new projects as it pushes to grow faster than the economy.

17 Mar 2025

1:18AM

Globe taps BDO, Metrobank for P20-B loan deal, bolstering network upgrade plans

The Ayala Group’s Globe Telecom secured P10 billion each from BDO Unibank and Metropolitan Bank & Trust Co. to fund network expansion, debt refinancing, and corporate needs.

4 Dec 2024

10:46PM

Dennis Uy's DITO CME secures P2.1B in sold-out offer as institutional buyers dominate

By: Miguel R. Camus

Davao tycoon Dennis A. Uy’s DITO CME Holdings raised P2.1 billion through a fully subscribed share sale at the discounted price of P1.05 per share.

24 Oct 2024

10:02AM

SM loyalty program raises P30M, helps 100,000 families fight hunger

SMAC, the loyalty program of SM, raised nearly P30 million in just about two months, from December 2023 to January 2024, to help fight involuntary hunger and improve access to quality education across the Philippines.