The transaction, approved by AREIT’s board, marks the real estate trust’s biggest retail infusion yet and cements its growing footprint in Metro Manila and Cebu.

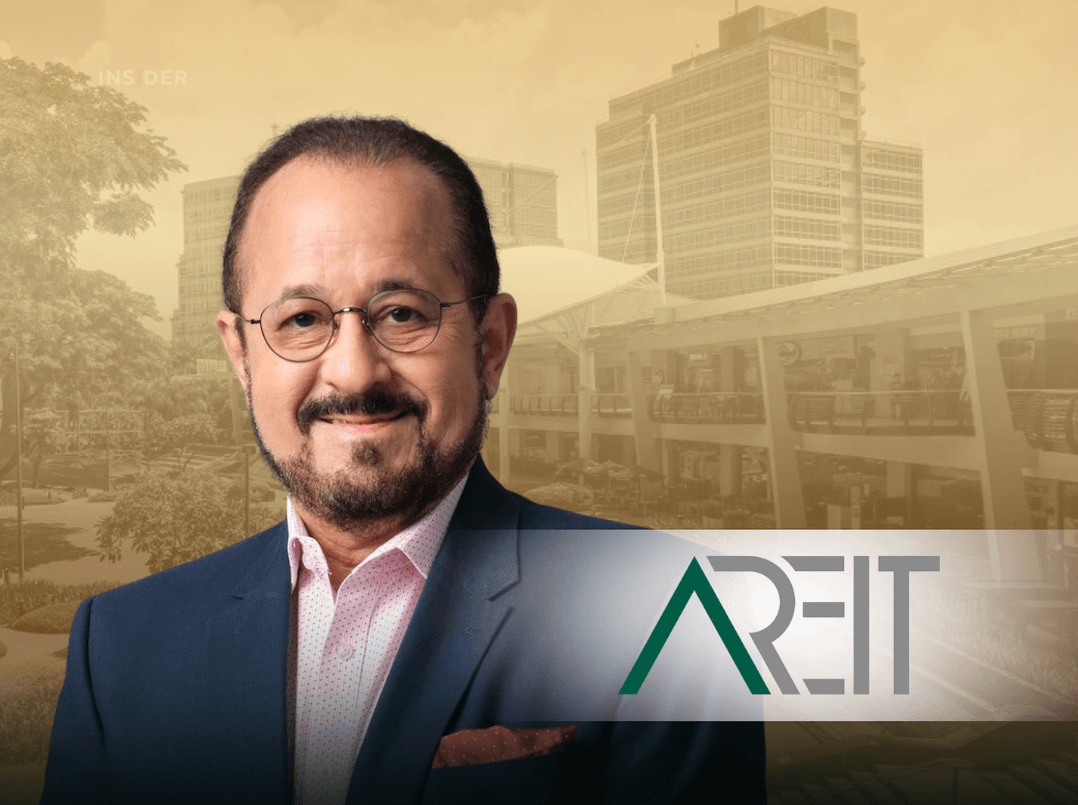

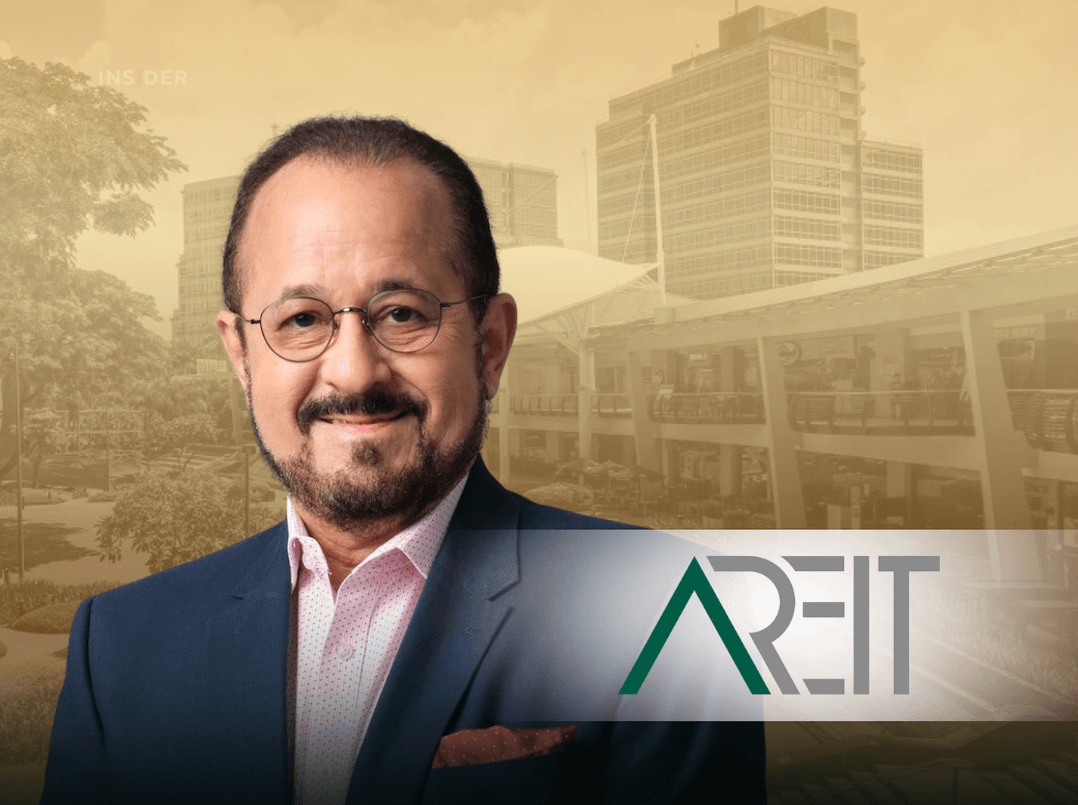

“This latest infusion strengthens AREIT’s portfolio with two dynamic retail destinations, enhancing both our geographic reach and asset mix. As we continue to build scale with quality, our shareholders will benefit from a larger and more diversified portfolio,” said AREIT president and CEO Alberto M. de Larrazabal.

Transaction details

The swap, priced at P44.15 per share, is subject to shareholder and regulatory approvals, with completion targeted in the second half of 2026.

This is a 2.6 percent premium from AREIT’s closing price the previous day.

Once finalized, total infusions for the year will hit P40.5 billion, underscoring AREIT’s largest expansion since listing in 2020.

The deal will push AREIT’s total assets under management to P158 billion, adding 375,000 square meters of leasable space and expanding its building GLA to 1.8 million square meters. Retail assets will now account for 54 percent of the portfolio, balancing offices and hotels to create a more resilient mix.

—Edited by Miguel R. Camus