Insider Spotlight

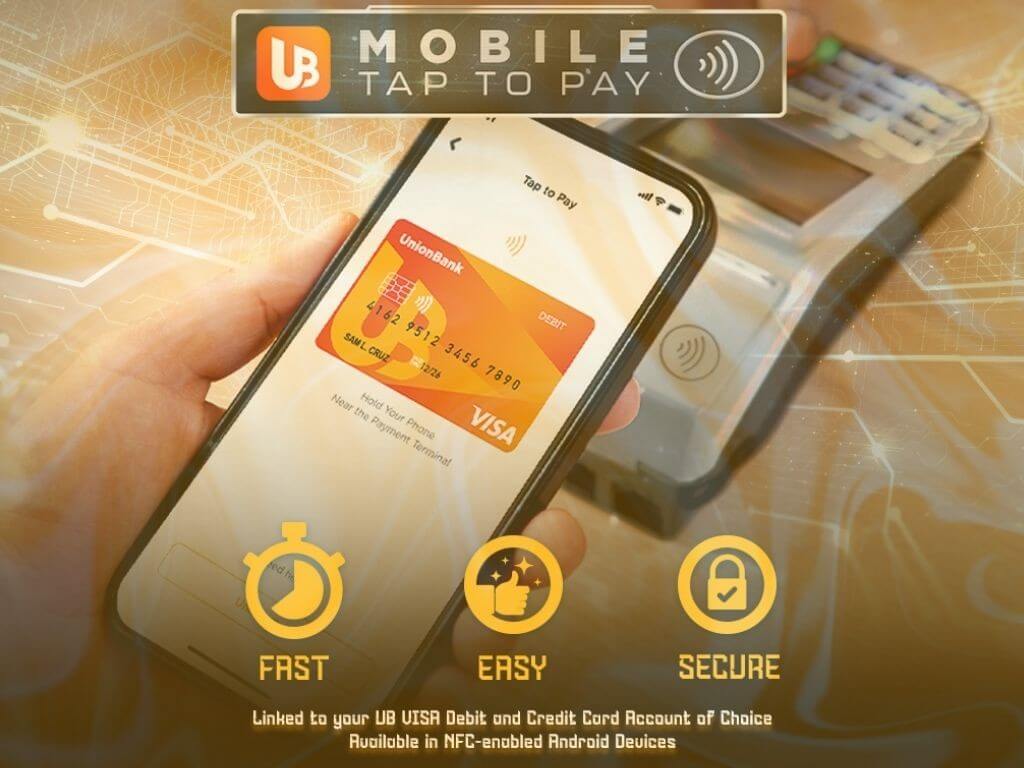

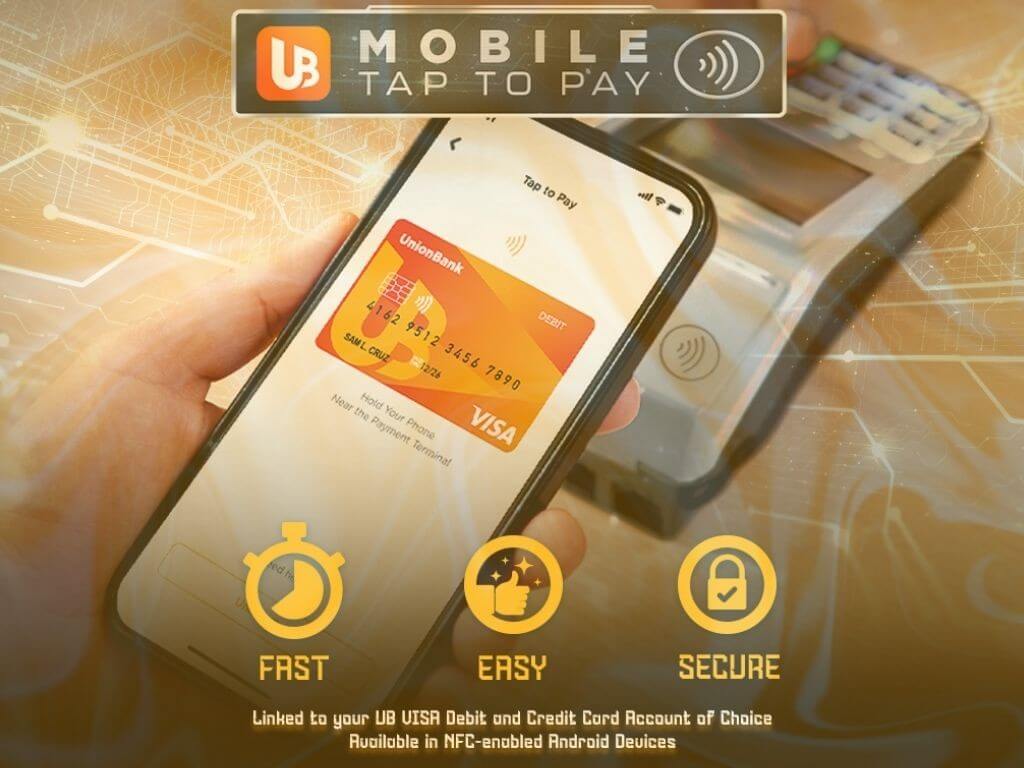

An NFC-enabled device is a smartphone equipped with Near Field Communication (NFC) technology, allowing it to exchange encrypted data with payment terminals at close range. By linking their UnionBank Visa debit or credit card, users can simply tap their phone on a Visa contactless terminal to complete purchases instantly.

Why it matters

The move positions UnionBank among the first Philippine banks to embed native tap-to-pay functionality directly within a mobile banking app. This leap reflects the country’s accelerating adoption of digital-first financial services.

“With Mobile Tap to Pay, UnionBank is elevating the everyday payment experience for Filipinos. This isn’t just a new feature—it’s a customer-first innovation that brings security, speed, and simplicity of making payments directly via our mobile app,” said Albert Cuadrante, UnionBank’s chief marketing & experience officer.

How it works

Once activated, the feature can be launched from the app’s login screen and accessed within seconds using biometric authentication. Customers can choose which debit or credit card to link, and swap preferences seamlessly.

Every transaction is secured with Visa’s tokenization technology, which replaces sensitive card data with a unique, encrypted code—ensuring card numbers are never shared with merchants.

The big picture

From coffee runs to overseas shopping, the feature works across millions of Visa contactless terminals worldwide. UnionBank says the goal is to deliver seamless, global convenience while maintaining the reliability Filipino customers expect.

“Whether it’s a quick coffee run, a spontaneous purchase, or a fast-paced commute, Mobile Tap to Pay is designed to keep up with our customers’ lives—making every transaction seamless and stress-free,” Cuadrante added. —Ed: Vanessa Hidalgo