Wednesday, 4 March 2026

11 Aug 2025

5:19PM

PSBank first half profit hits P2.16B, loan portfolio surges 16%

Philippine Savings Bank (PSBank), the thrift banking arm of the Metrobank Group, reported a net income of ₱2.16 billion in the first half of 2025, driven by steady expansion in its core businesses and ongoing operational cost reductions.

4 Aug 2025

8:37AM

PSBank returns to debt market with 2-year bonds at 5.875% rate

Philippine Savings Bank (PSBank) is raising at least P2 billion through peso-denominated fixed-rate bonds, marking its return to the local debt market after a five-year pause.

2 Jul 2025

10:32AM

Metrobank’s PSBank keeps top rating on strong auto loans, stable capital

Philippine Savings Bank (PSBank), the retail banking arm of the Metrobank Group, has once again earned the highest Issuer Credit Rating of PRS Aaa (corp.) with a stable outlook from Philippine Rating Services Corp.

11 Jun 2025

12:09PM

PSBank Flexi Personal Loan: Smart borrowing made simple

When life throws unexpected challenges—be it sudden home repairs, tuition deadlines, or emergency medical expenses—PSBank provides a practical solution through its Flexi Personal Loan.

3 Mar 2025

4:43PM

PSBank posted record 2024 earnings as loans surged… all while cutting bad loans

The growth was driven by a 15-percent expansion in total loans to P144 billion, supported by strong demand across consumer and commercial lending segments.

4 Nov 2024

2:57PM

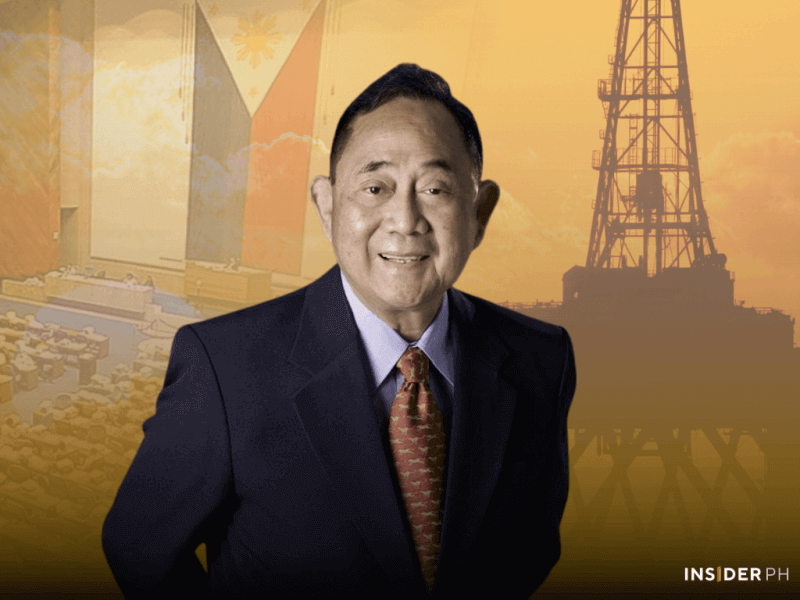

Ty's Philippine Savings Bank posts 19% profit growth, hits P4B in 1st 9 months of 2024

Philippine Savings Bank, the thrift bank of the Metrobank Group, reported a net income of P4 billion for the first nine months of 2024, a 19-percent increase from last year. This growth came from higher income and improved asset quality.

5 Aug 2024

10:22AM

Metrobank’s PSBank achieves record profit in the first half of 2024

Philippine Savings Bank increased its net income by 18 percent to P2.56 billion in the first half of the year.

6 May 2024

1:44PM

Ty family’s PSBank soars on strong auto loans, Q1 2024 net income jumps 23%

By: Miguel R. Camus

Philippine Savings Bank (PSBank), part of the billionaire Ty family’s Metrobank Group, recorded a net income of P1.2 billion in the first quarter of 2024, marking a 23 percent increase from the previous year.