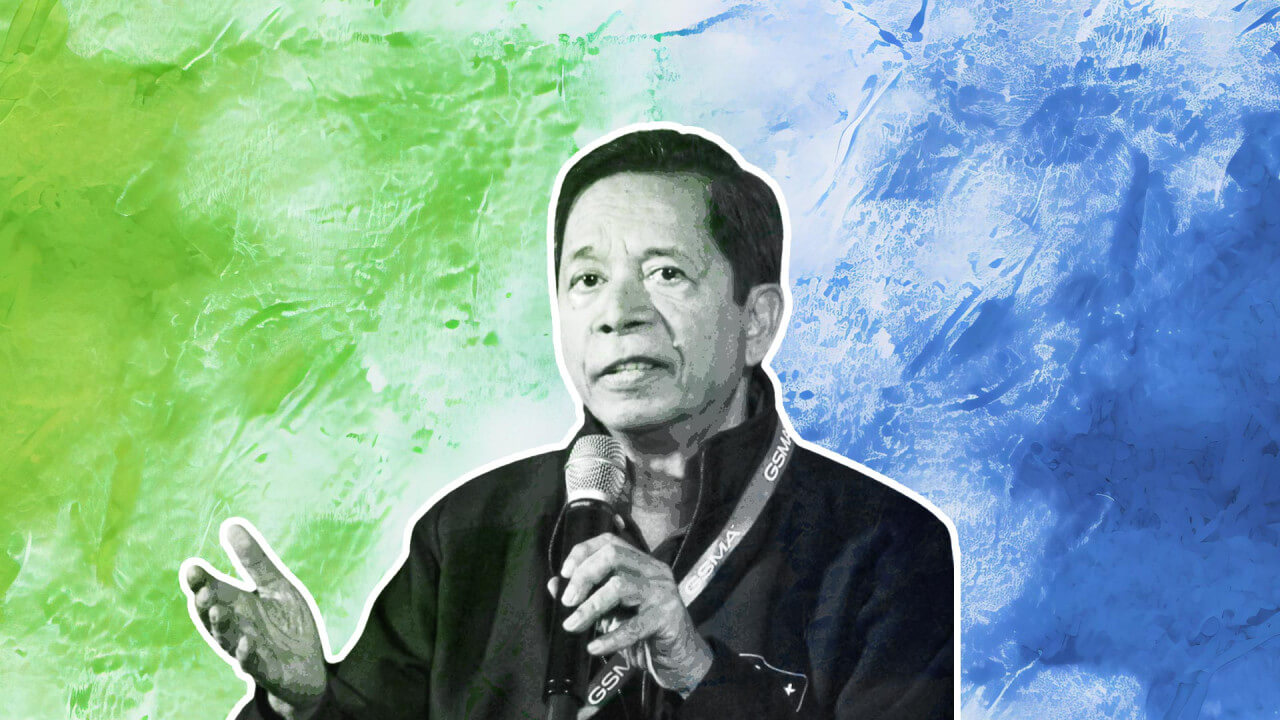

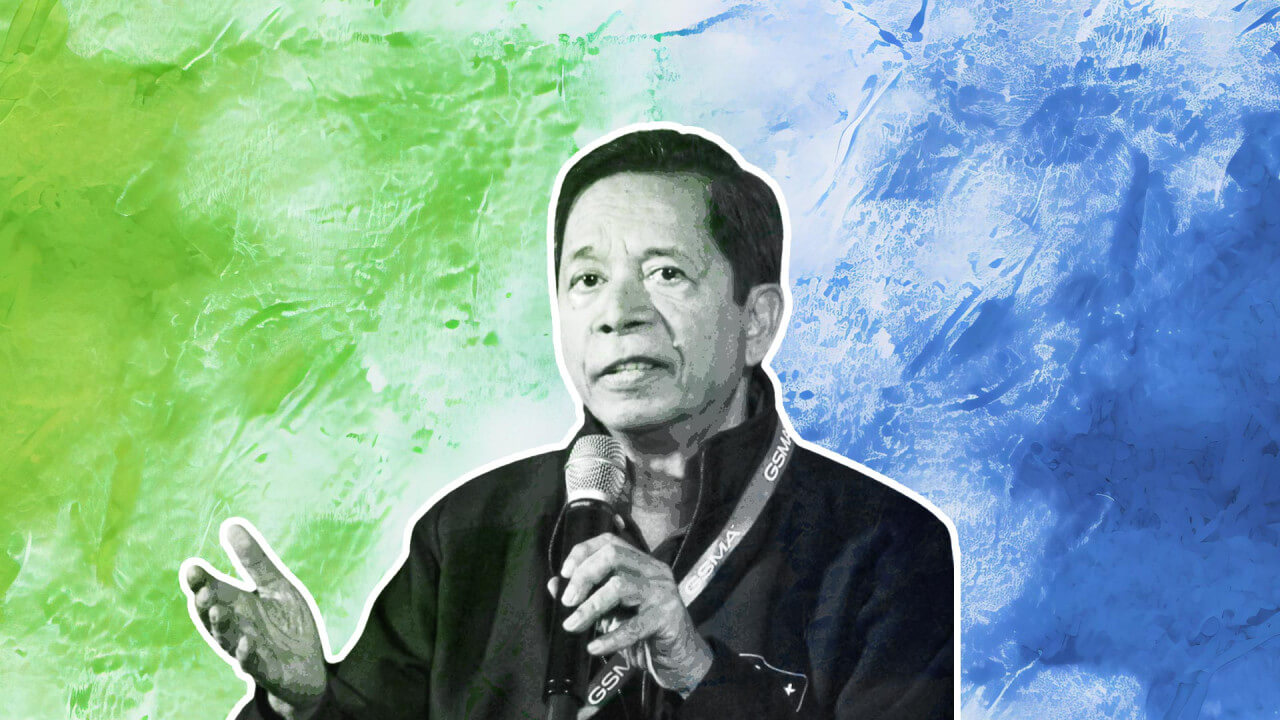

Martirez, who left Smart over two decades ago, returns at a time when the company is striving to regain its footing after losing market leadership to Globe, the country’s biggest mobile telecommunications provider and the largest shareholder of GCash.

He issued the bold challenge during the GSMA Digital Nation Summit on Tuesday in the presence of global telecommunications executives, including those from Globe.

“We were the first in the industry to introduce Smart Money, ahead of GCash,” he said.

“And at the time, we held 75 percent market share. Somewhere along the way, something happened, but that’s not a problem,” Martirez said.

“I’m back. I want to bring it back. I want to rebuild, and I hope I can retake,” he said.

Big picture

Martirez, whose return to Smart was first reported by InsiderPH, was personally chosen by PLDT chair and CEO Manuel V. Pangilinan to help the mobile services giant reclaim its No. 1 status.

Smart held the top spot when he left, but the company later ceded market leadership in mobile services to Globe, which is led by CEO Ernest Cu.

It seems Martirez is also set on aggressively challenging the highly lucrative mobile wallet space, currently dominated by GCash.

Martirez eyes new payments platform

Martirez acknowledged the challenge of taking on GCash but remained adamant about doing so through a potential new platform, opting not to rely on Maya, which is backed by PLDT and other shareholders, such as China’s Tencent.

Maya, which offers payments and digital banking services through Maya Bank, is on track to achieve its first profitable year in 2025.

When asked which platform, he said, “my platform.”

“I’m not going to tell; there’s a plan,” he added.

Analysts’ view

Adrian Yu, head of institutional sales at stockbrokerage house COL Financial Group, said Smart faces an uphill climb in taking on GCash.

“I think this might be difficult considering the scale of GCash and the disparity in active users,” he said.

Referring to Maya, Yu said the company looking to achieve breakeven is a “good target first, before effectively challenging GCash.”

Maya continues to grow

Earlier this month, InsiderPH reported PLDT and its major shareholder, the First Pacific Group, were open to taking an even larger stake in Maya as the company nears profitability.

As of Sept. 30, 2024, Maya Bank’s deposits reached P36 billion while its customer base expanded to 4.5 million.

Loan disbursements hit P67 billion, with strong demand for consumer and small business credit offerings.

“With First Pacific, we own about 40 percent [of Maya]. We don’t mind going up, raising our stake,” Pangilinan had said.

Miguel R. Camus has been a reporter covering various domestic business topics since 2009.