This commitment was underscored during the Fintech Forward: Shaping Innovation and Investor Protection in the Digital Age forum held on Oct. 28 at the SEC Headquarters in Makati City.

The event gathered regulators, financial technology advocates, and cryptocurrency industry leaders to deepen awareness of market dynamics and regulatory expectations.

The forum formed part of the SEC’s celebration of World Investor Week, a global initiative led by the International Organization of Securities Commissions.

The 2024 campaign highlighted the global shift toward technology-driven finance, the rise of artificial intelligence (AI) in markets, and the growing sophistication of fraud and financial scams.

Bridging gaps in a fast-moving fintech ecosystem

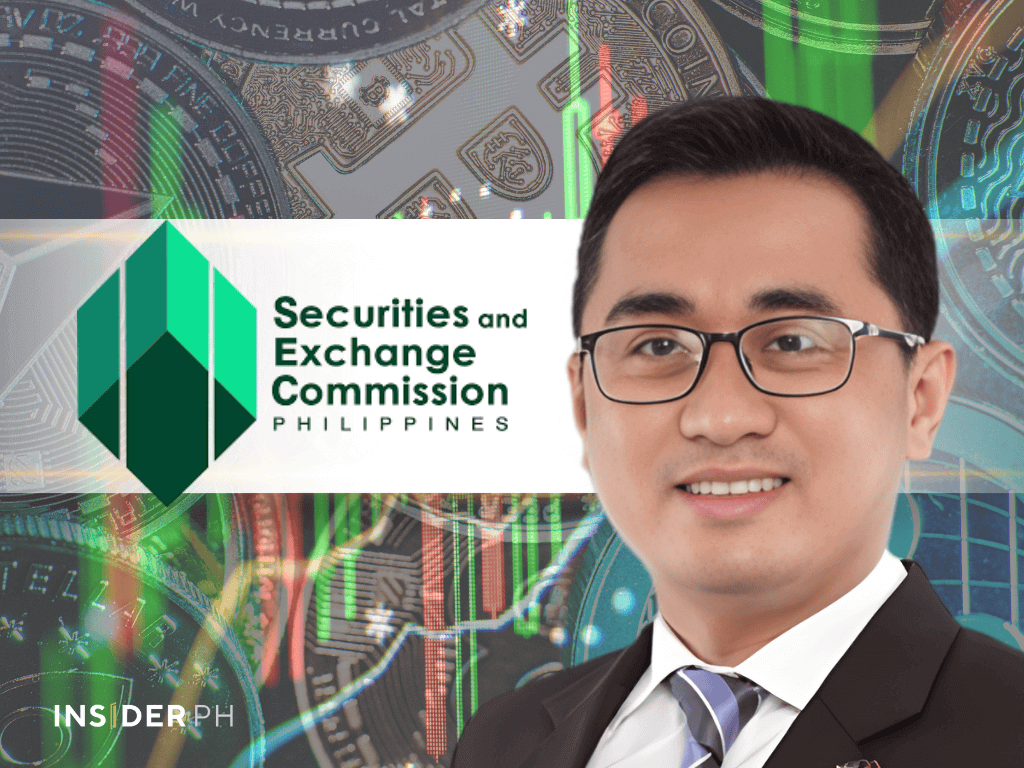

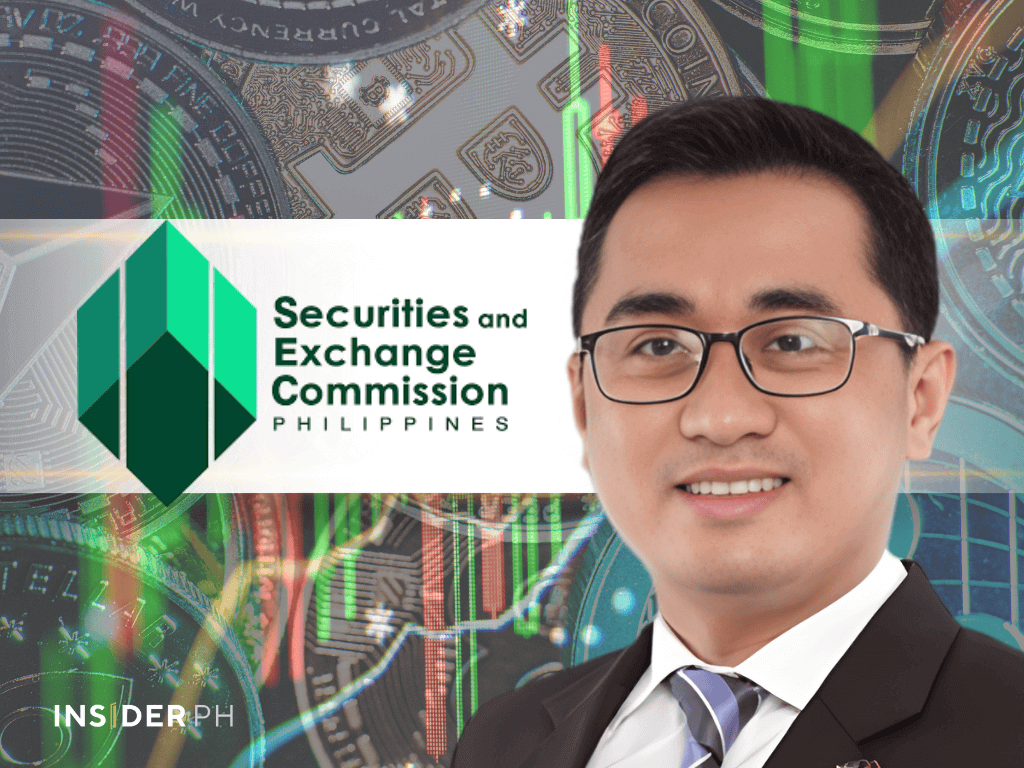

In his opening remarks, SEC Commissioner McJill Bryant Fernandez emphasized the importance of collaboration between regulators and industry players.

“This event serves as an important bridge between the regulatory community and the broader capital market,” he said.

“By encouraging open and transparent communication, we can close gaps within the fintech ecosystem and promote responsible innovation while safeguarding investors.”

Panel discussions explored the evolving regulatory framework for digital assets, the role of AI in investor protection, and strategies to prevent fraud in the digital finance ecosystem.

Speakers included SEC PhilFintech Innovation Office assistant director Paolo Montano M. Ong, SEC Innovation counsel Justine Stefan M. Gaverza, GCrypto head Luis Buenaventura, BitPinas editor-in-chief Michael Mislos, and ZFT CEO George Asibal.

Stronger rules for crypto operations

The SEC highlighted its proactive stance with the issuance of SEC Memorandum Circular Nos. 4 and 5, Series of 2025, which set operational and compliance rules for crypto-asset service providers. These measures aim to nurture innovative securities while maintaining market integrity and investor trust.

With fintech adoption accelerating nationwide, the SEC reiterated its goal of ensuring that innovation moves forward—safely, sustainably, and with investors at the core. —Ed: Corrie S. Narisma