Why it matters:

This integration enables real-time identity verification through the PhilSys National ID system, helping MSMEs access government-backed loans more efficiently while reducing the risk of fraudulent applications.

The big picture:

The ceremonial signing, held on July 14, 2025, at the PSA Headquarters in Quezon City, formalized the partnership. Present were PSA Deputy National Statistician Minerva Eloisa P. Esquivias (on behalf of Usec. Claire Dennis S. Mapa) and Assistant Secretary Rosalinda P. Bautista, along with SBCorp president and CEO Robert C. Bastillo.

“The National ID system is always envisioned as a digitalization-enabling platform,” said Esquivias. “By integrating with SBCorp, we’re making government transactions faster and more secure.”

How it works:

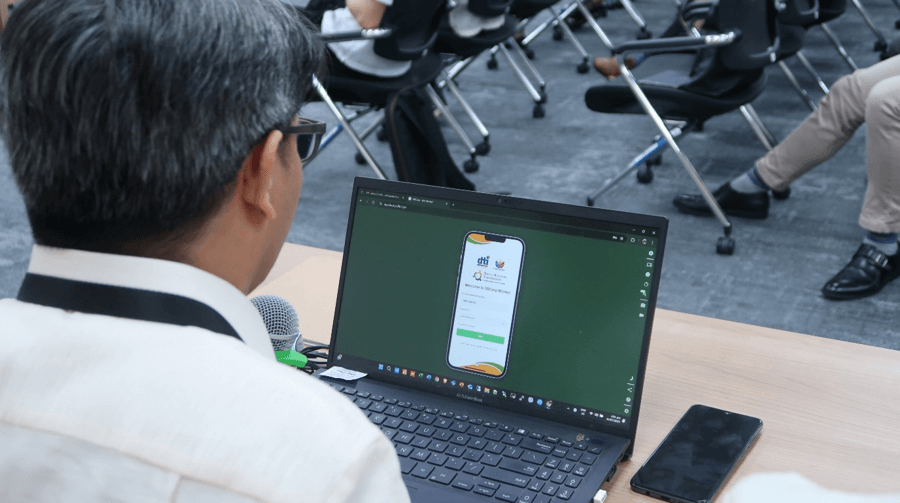

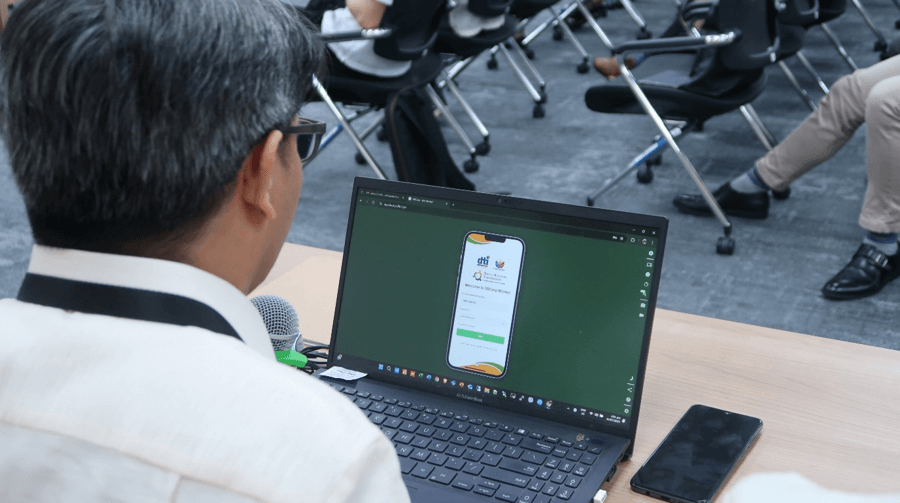

The integration includes liveness checks or real-time facial recognition for account creation and loan applications via SBCorp’s mobile Money app. This ensures only legitimate users gain access to funds.

What they’re saying:

“This gives us a means to clearly identify our clients and eliminate to a large extent identity theft and fraudulent applications,” said Bastillo, emphasizing the integration’s role in better targeting financial support for MSMEs.

Between the lines:

SBCorp, an attached agency of the Department of Trade and Industry (DTI), has been a key player in financing Filipino MSMEs since its establishment in 1991.

The partnership marks another step in the government’s push for cross-agency digital transformation and financial inclusion. —Ed: Corrie S. Narisma