Friday, 13 February 2026

7 Jan 2026

11:42AM

Debt, political noise may cap PH’s growth in 2026, Metrobank says

High household debt and lingering political noise are expected to blunt the Philippines’ economic rebound in 2026, even as interest rates fall and growth conditions gradually improve, according to Metrobank Research.

6 Jan 2026

4:18PM

Waiting for cheaper loans? Don’t bet on big BSP rate cuts this year

By: Daxim L. Lucas

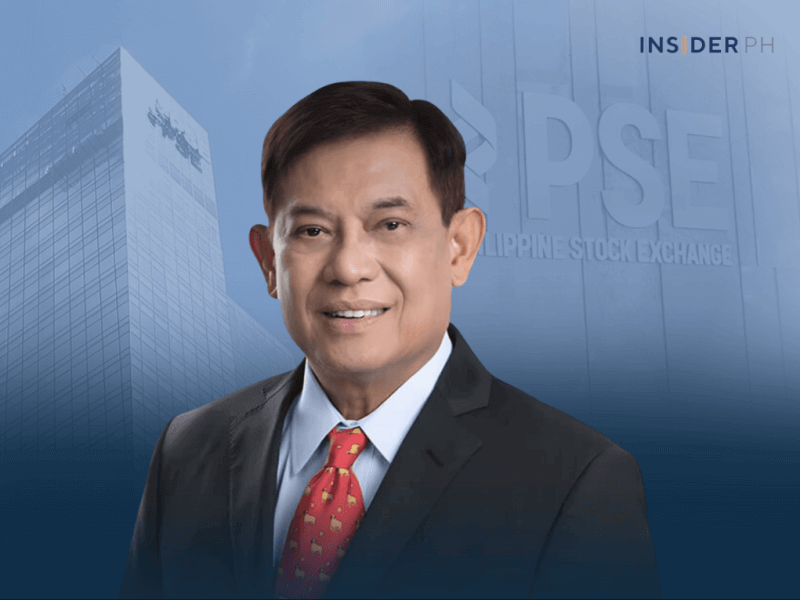

Bangko Sentral ng Pilipinas Governor Eli Remolona Jr. on Tuesday signaled limited room for further policy rate adjustments in 2026 despite a benign inflation rate environment, reiterating the regulator’s mantra that any adjustment will be data dependent.

9 Oct 2025

3:47PM

Corruption-induced economic weakness prompts 4th straight BSP rate cut

The central bank chief cited a “benign” inflation outlook that remains well within its target range and said inflation expectations “remain well-anchored.” With price pressures easing, policymakers saw room to support economic activity without threatening price stability.

28 Aug 2025

3:19PM

BSP delivers 3rd straight rate cut this year amid muted inflation

The Bangko Sentral ng Pilipinas (BSP) on Thursday reduced its policy rate by 25 basis points to 5.0 percent, maintaining its relaxed monetary stance amid stable inflation expectations.

10 Apr 2025

3:21PM

BSP cuts key interest rate by 25 bps to 5.5% as inflation outlook eases

BSP Governor Eli Remolona Jr. said the Monetary Board adjusted the overnight deposit and lending rates to 5 percent and 6 percent, respectively, reflecting the central bank’s shift toward a more accommodative stance, following months of stable price movements.

13 Feb 2025

4:36PM

Citing uncertain inflation, BSP defies dovish market bet by holding rates steady

The decision underscores the central bank’s cautious stance amid persistent inflation risks and global economic uncertainty.

16 Oct 2024

3:38PM

BSP trims key interest rate for second straight policy meeting amid muted inflation

The central bank chief said the Monetary Board’s decision reflects its assessment that inflation pressures remain under control.

2 Oct 2024

4:33PM

Fitch’s BMI: Big BSP cuts to bring rates down to pre-pandemic levels by 2025

By: Miguel R. Camus

Warning signs of a slowing Philippine economy may prompt the Bangko Sentral ng Pilipinas to implement “jumbo” cuts that would bring the policy rate back to the prepandemic level.

21 Aug 2024

8:39AM

VIEWS FROM THE PEAK: Much ado about cutting

The recent rate cut signals the end of tight monetary policy, driving the market up over 250 points in three days as investors return to equities.